You buy a stock, and it immediately tanks. You believe in the stock, and it's a long term hold. You know you can make money in this position while you hold it?

I find myself in this position a lot, and by utilizing covered calls I am able to still profit while holding on to my position. I'm also able to use this strategy to squeeze additional profit from well performing positions.

What is a covered call?

A covered call is a contract (aka option) that you can use while holding on to at least 100 shares of a stock. The contract is an agreement between you and a third party that allows them the option to buy your shares at a set price known as the strike price.

Buying & selling option contracts is very complicated, and can be very profitable. Option trading is a lot more risky than buying shares as you can't always just sit on an option and wait forever for the price to come back.

A covered call is an option contract where you already own a stock and you want to sell the right to buy it off you at a future date. When you sell the option contract you immediately collect a premium that is yours to keep regardless of the outcome of the contract. You are however bound to sell the stock if the third party decides to execute the option. These shares are effectively locked by your broke until the contract expires, is executed, or you buy yourself out of it.

Of all the ways to buy/sell options, I believe covered calls are the easiest to take advantage of with less direct risk.

Take Intel for example, right now Intel has dropped significantly in the last month, as a result of many factors. China announced they don't want to do business with AMD or Intel anymore and only want to use locally created chips. This severely hurt Intel even after it was announced they would get $8,000,000 from the US government. Of course it didn't help they also announced a $7,000,000 loss shortly after. Add in the empty promises of rate cuts, and you a recipe for disaster, resulting in Intel dropping around 25% in the last month.

If you purchased Intel, but you still believe in Intel you are likely still going to hold on to it. You believe it will come back, or you don't want to realize the 25% loss, or you are just looking at holding it long term.

This is a perfect scenario to consider a covered call on your position. In my case, I am looking to hold Intel for at least a year to only have capital gains tax rather than the larger short term taxes. Since I plan on holding the stock anyway, I can collect some cash in the process. A covered call does minimizes my upside on the stock. In other words, if Intel takes off, I won't see those profits as my shares will likely be assigned when the third party decides to execute.

You can use this premium you earned on the contract to purchase more of this stock to lower your cost basis. Technically, this premium you earned has already lowered your cost basis. You can use this to purchase more of this stock to lower your cost basis, purchase another stock, or just cash it out. Just keep in mind this is considered income, and you will need to pay taxes on it. Depending on your situation, you may need to pay an estimated tax early before your yearly tax time.

Knowing this though, you can choose a strike price that puts you in an acceptable profitable position. If the stock continues to do poorly, you will likely never need to sell the stock. If it does well, you make a profit based on your strike price in addition to the premium you collected on the option.

Let's use an example.

You purchased Intel last month, the stock is down 25%. A month ago Intel was trading for around $40 to $45. Let's say you bought it at $45, worst case scenario. It is now trading for $34.46, a 25% loss.

With such a loss, you won't be able to buy a short term option contract that doesn't have a high risk of the shares being assigned. This is because you won't be able to pick a strike price that is profitable for your original purchase price and still yields a premium.

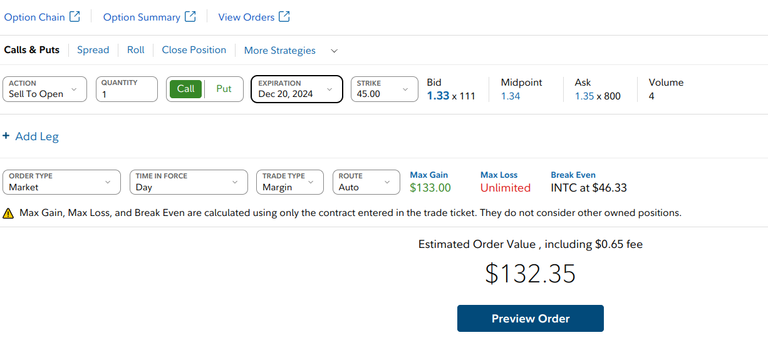

As you can see here, buying an option for this week at $45 only yields $1 premium. This is one contract for 100 shares of Intel (roughly $3,500 currently, but $4,500 at your original purchase price). Not really worth purchasing.

Let's be aggressive though, and get an option for as far out as we can.

This same contract is now worth $132.35. As I said before, you can do this with no risk as you set the price you will sell at, but you do expose yourself to a new risk. You are now forced to hold these stocks until the contract expires. 2.5 years is a long time to be held in a position by force. If you really believe in the company, and feel it will come back and if not, you would be holding it anyway, this might not be a bad idea. You may however be stuck in this contract while the stock goes down further and the only way you can sell this stock is by closing the option. This means you are forced to pay whatever premium that is left on the contract. Only then are you able to sell your shares.

With a blue chip like Intel, this may be an acceptable risk. Keep in mind, even blue chip stocks can crash heavily or even go out of business. There are so many unseen forces that can affect every company so nothing is a sure bet.

This example is quite extreme, most options are either for the week or a month. Going further out has so many unknown variables it is more akin to gambling than investing.

I wouldn't generally recommend jumping into option trading unless you are really comfortable with the risk and understand how they work. Covered calls however are really easy to use and can provide income on a position you are holding long term anyway. In the best case scenario, your stock goes up but not enough that the covered call is executed, and you do it again for additional premium. Setting the strike price and expiration date is an art form. If you chose them well, you can make income on a regular basis.

In the less than best case scenario, you stock goes up and the third party executes the contract and buys the stock from you at the strike price. If the strike price is high enough that it is still a profitable trade, you then made some profit as well as additional profit from the premium. You do however miss out on any upside above your strike price. Let's say your strike price was $47, and you bought at $45 and the stock goes to $50. While you have made $2 per share plus whatever premium from your option, you lost out in $3 of profit. While this sucks, you are still have a profitable outcome.

In the worst case scenario, your stock goes down even more, potentially more than you are comfortable. Let's say it goes from $34.50 down to $30 and it feels like it might even hit $25. Now you are locked in this contract and you cannot sell your shares until you then buy the option contract out. Depending on how much time has passed, there may or may not be a lot of premium left on the contract and this may be an additional expense just to be able to sell out of a losing position. In this case you may put yourself into a Ride or Die situation.

One last thing I want to say before I wrap this up. The premium on an option contract decays over time. Let's say you went with my above extreme example and you got a 2.5 year contract for Intel at $132 premium. At year down the road it may only cost you $30 to buy out your contract and release you from the obligation. This may be a good move if you want to buy another contract under new conditions. You made $100 premium after buying out the contract, and instead of waiting for the last $30, you can sign another contract for another $130. This is a strategy I use a lot, I frequently sell a 1 week/month option contracts only to buy them back when I have received most of the premium. This allows me to put up another contract instead of waiting out until the last day. On a weekly contract I might do this on the last day, or the day before. I generally want to get ~90% of the premium before closing a contract, unless I feel the risk of it being executed is higher than I like but there isn't a lot of premium left. I generally want to continue to hold my stocks, rather than have them purchased through an option.

As always, this isn't financial advice, if you want that go talk to your mom.

This is not what I typically talk about here, but I thought some might find it interesting. Always do your own research and fully understand how this strategy works before using real money.