ChatGPT still sucks with faces and words

Clickbait Title - please let me explain

You probably heard about @blocktrades voting for the return proposal and the drama involved. So here is my take.

For many years now I have heard about an argument against the DHF that while having perhaps some merit in the few instances when Hive's volume was low it should be dismissed based on the following fact. But first the argument:

- The DHF is putting constant sell pressure on Hive (my bag is not pumping, please stop!)

While of course true, this argument is meaningless when we don't look at the ratio of that sell pressure against market activity. In other words, what is the precentage of DHF's sell pressure against Hive's volume?

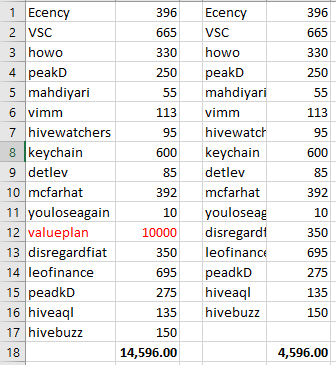

First, the DHF. Currently there are only 17 active proposals (which all have been defunded except for @ecency) with @blocktrades' support of the return proposal.

So how much daily selling pressure are we talking about?

$14,596!

Granted, the majority is from @valueplan and I see no justification of it being worth a $10k daily pay. So if we remove that proposal it wouldn't even be $5,000!

THIS IS NOTHING (or is it?)

(The other argument to look at, of course, is of the relevance and impact of these proposals which I do not want to get into here - I simply want to show the ridiculousness of the argument that this number is at all relevant).

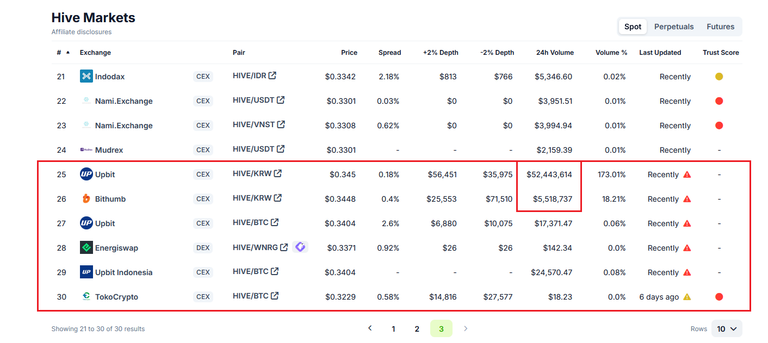

Now, what again is Hive's daily volume?

Today we have seen a more active market than usually, but it's still a far cry from the volume we spikes we are now occasionally getting from the mega pumps which are at almost 1 Billion $!

Coingecko states that Hive'v volume today is around $30M. But this is actually quite wrong.

It excludes the majority of volume due to a missing trust score! At the bottom of the list we see that - oh yeah, we have the biggest exchange: Upbit with a staggering $52M and Bithumb with $5M.

So we have to add another $57M to the $30M.

Today's daily volume is $87M (and we still have half of the day)

Let's put it all together:

- Selling pressure from the DHF: $15k (hell I even rounded up)

- Trading volume $87M (not even counting internal volume)

====> 15 000 / 87 000 000 = 0.0001724... <====

... 0.0172%

Ouch that must hurt!

Everybody, stop the DHF, it is destroying Hive's price (not!)

Please do not use this argument again (unless this percentage goes above 1% which would mean a daily spending of DHF of almost $1M (lol) or a significant drop of volume...)

Check out the Love The Clouds Community if you share the love for clouds!