The tokenization of debt instruments is not a new idea, but it is still a confusing concept for many, especially those new to crypto or finance in general.

This article is a brief overview of debt instruments, tokenization and why it's a good idea to combine both.

Debt instruments

Debt often carries a bad connotation. People usually want to avoid debt and those who are in debt plan to get out of it as soon as possible. It's understandable why most people would prefer to avoid debt but in reality, debt is an important part of the financial system as we know it today.

Debt, or more specifically, debt instruments, are financial tools that governments and businesses can use to raise money to fund their operations and develop new services or products, among other things.

If the idea is still fuzzy in your head, perhaps looking at some examples of debt instruments will help you understand it. You may have seen at least one of these, especially if you dabble in traditional investments.

Some standard debt instruments are:

Bonds: A debt instrument issued by a corporation, state, or union of states to raise money for projects. The issuer pays the investor a fixed rate of interest, known as a coupon.

Mortgages: A debt instrument used to purchase a home, commercial property, or vacant land. The property being purchased is used as collateral for the loan.

Debentures: A debt instrument issued by a company to raise money from the public. The company promises to pay the investors a fixed rate of interest.

Treasury bills: A short-term debt instrument that matures within 12 months. Treasury bills are issued at a premium and redeemed at par value.

Tokenized debt

Simply put, the idea behind tokenized debt is the digital representation of a traditional debt instrument with the aid of blockchain technology.

So, instead of traditional documentation, your investment is represented by a digital token, which can be safely stored in a digital wallet, just like any blockchain asset.

But, if debt instruments have existed in traditional finance for a long time, why tokenize them?

Why tokenize debt instruments?

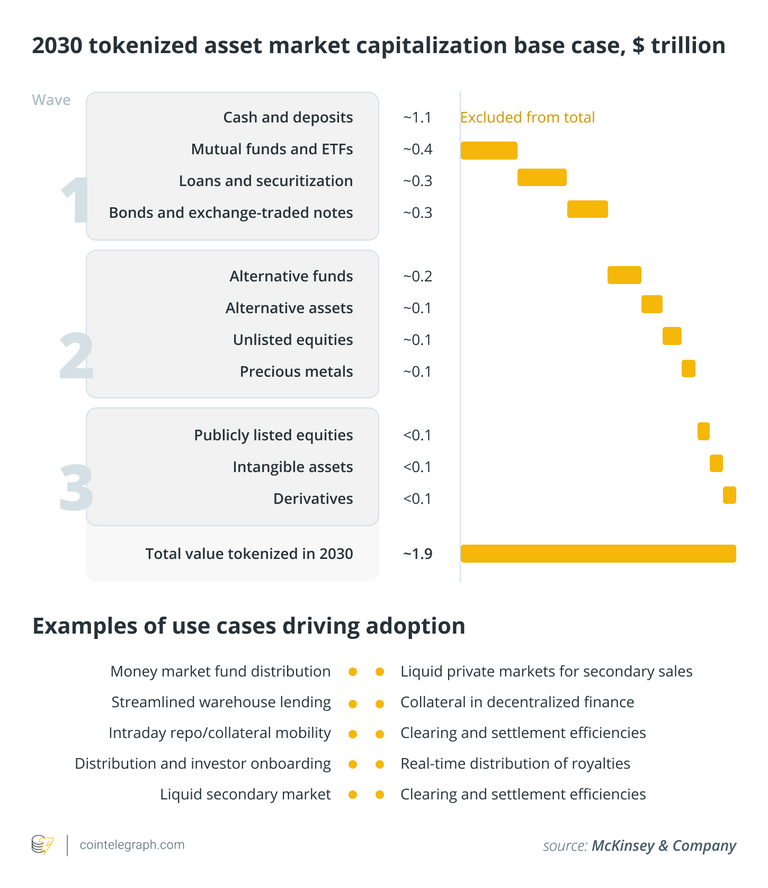

The asset tokenization market is on an uptrend. McKinsey & Company predicts it will be worth between 1 and 4 trillion dollars by 2030 and other firms believe this figure will be even higher. Bernstein, for example, projects a value of 5 trillion by 2028.

Tokenized debt is a major part of that market because of the benefits due to the underlying blockchain technology: transactions are safe and unchangeable, and the possibility of automation using smart contracts and fractional ownership, to name a few.

The tokenization of debt instruments adds a lot of value to the economy. For example, fractional ownership enables debt to be broken into smaller units, which can potentially attract a wider range of investors since they can dilute risk by diversifying their investment into small fractions of different assets.

The 24/7 nature of blockchain networks also allows investors to trade around the clock, increasing market liquidity and accessibility.

And finally, there is the transparency factor. Blockchain offers a public, unchangeable, and easily accessible transaction log, allowing investors to keep track of their operations in real-time, making audits easier, and ensuring regulatory compliance.

Challenges for debt tokenization

Although tokenized debt adds tremendous value and innovation for financial markets, some challenges must be addressed before they can be widely adopted.

One challenge that's common for everything involving cryptocurrency and blockchain is investor awareness and education. Most investors still don't understand this technology and avoid its complexity.

Another big problem is regulatory uncertainty. This is still uncharted territory in many jurisdictions, which hinders adoption as the effort and cost to navigate the complexity of this environment are still too high.

Finally, there is a lack of standardization among the different platforms and protocols, which makes it difficult for institutions to work across all the different systems that are involved in the ecosystem.

Final thoughts

The tokenization of debt instruments can potentially add a lot of value to financial markets.

There are still many challenges that need to be addressed before tokenized debt can be widely adopted, such as increasing investor awareness and education on blockchain, cryptocurrency, and related concepts, as well as facilitating cross-chain compatibility among the many existing platforms and protocols. However, the benefits that come with the technology, such as more accessibility, transparency and the immutable nature of blockchain, more than make up for the effort.

Posted Using INLEO