News

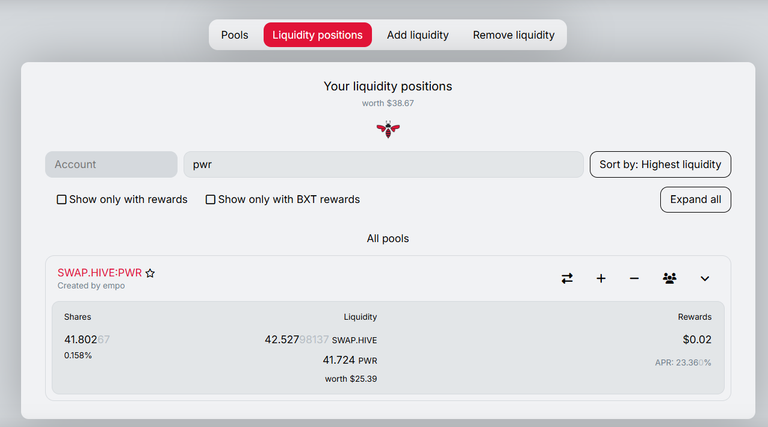

This past week hasn't been so great for me in this liquidity pool, but I've still been able to add 0.187 PWR and 0.19 Swap.Hive to the mix. It's not a bad figure, but I like the continued growth. In addition, Hive has been weaker and continues to fall in line with the market in general.

The liquidity pool's profitability has remained constant this week and that's very good news because profitability with stability is undoubtedly the best combination for a long-term investment.

I have to look for more solid power sources for this pool

Performance remains in line with the previous week.

I'm going to expand the type of investments I make in Hive and have chosen pools as a good way to increase the returns I get on-chain.

Why use pools? Because they don't require a lot of time to manage, I don't have too much free time, and because I think they offer good performance.

My investment strategy in Beeswap pools:

- I will choose pairs that have currencies that I like and think have a good future.

- The minimum performance has to be higher than the 20% that can be achieved in Hive.

- If it is possible that they have good liquidity.

- Have daily transaction volume

- If possible they are linked to Swap.Hive

- 7 pairs maximum

First pair - SWAP.HIVE:PWR -

- Liquidity - High

- Negotiation - High

- Profitability - 23,36% APR

- Linked to Swap.Hive - Yes

Token Name

Hive Power Ventures

Supply (Circulating / Total / Max)

60000.000 / 60000.000 / 1000000.00

Issuer

@vventures

Website

https://peakd.com/hive-167922/@empoderat/introducing-hive-power-ventures-pwr

Description

Backing the PWR token with HIVE.

Precision

3

Staking

No

Delegation

No