Observing the movements of the TOP100 BTC Richest wallets, I expected to see something more significant in their actions since many of us believe that we are in BULL MARKET. However, to my own surprise, what I have found I have not liked very much since I have observed negative movements of these whales.

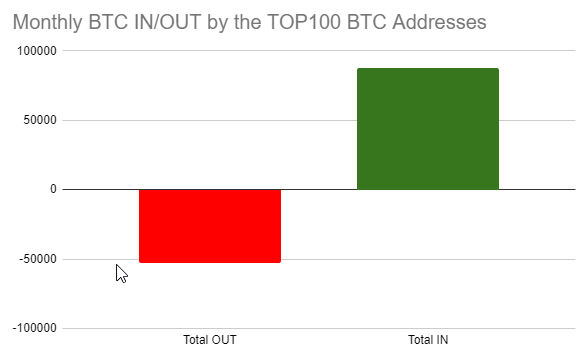

If we look at the movements made during the last 30 days, we can see what we could expect.

The ratio between the BITCOIN accumulated in these wallets and the BITCOIN withdrawn is 1.67, that is, these rich entities have accumulated 1.67 BTC for each BTC that they have parted with. Which is normal for those of us who think that the BULLS are back...

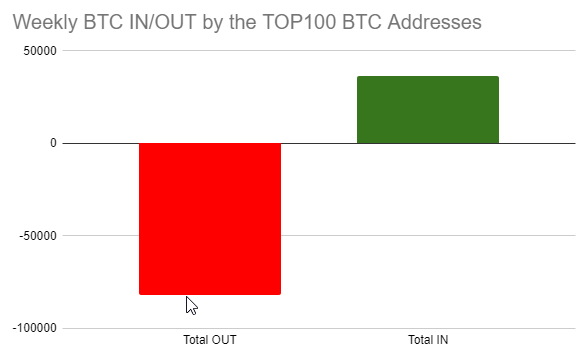

However, we see the problem this last week, and it is that I really expected to see something else.

During these last 7 days, these whales have withdrawn 82,000 BTC and have accumulated ONLY 36,600 BTC, that is, a negative relationship.

This data does not help me confirm if the BULL Market has returned, in fact it seems very bad data to me.

It is clear that some institutions will be seeking refuge in BTC given the bankruptcy news, but it does not seem to me that this has been the main "driver" of this mini-bull Cycle that we are experiencing. Rather, it seems that the cause of the rise in crypto prices was caused by CZ and BINANCE having Converted $1 Billion From Industry Recovery Initiative to Bitcoin, Ether, BNB...

I'm afraid we're not out of the woods yet.

Let's see what happens today in the speech of the FED and Powell, I think it is a key moment.

Have a nice day.

@toofasteddie