Back in 2020, we found ourselves unable to pay for an American Express Gold Card. We had added a couple of family members as authorized users. They allowed themselves to accrue larger and larger balances until they could no longer pay within the 30 days typical of charge cards. It was far more than we could pay. The result was that the card went into default. This shut down my other AMEX accounts. And, it also led American Express to file a lawsuit. We were able to settle the account by cashing out some Bitcoin. American Express then offered their Optima card, which is an invitation-only card that allows you to reestablish a relationship with them. After a year of using the card with no problems, it is possible to apply for a new American Express card. Prior to that, you are in AMEX Purgatory with the Optima card.

One Year Later

We completed a year with the American Express Optima. We could not use it very much. The card only has a $900 limit, which is very small compared to my spending needs. We have other cards with much larger credit limits that are less trouble to use. Still, the Optima had some usage from time to time.

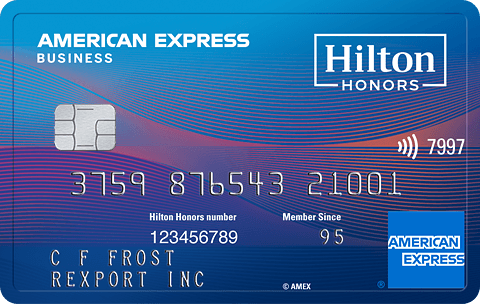

The year ended mid March. However, to be certain, we waited until April 1 to apply for a card. It was of greater advantage to apply for a business card. So, we opted for the American Express Hilton Honors Business Card. As aspiring travel bloggers, it is in our interest to be able to stay at hotels for free or at discounted rates. This is possible when every purchase can earn Hilton Honors points.

Why A Business Card?

We opted for a business card for three reasons. First, we intend to travel and blog as a business when we retire. Second, business cards typically get more generous lines of credit than personal cards. Third, business credit cards, particularly AMEX business cards, do not report to your personal credit profile.

As travel bloggers, having a business name containing the word "Media" gives us a little more credibility when asking for special rates. Travel agents and travel writers may receive special rates from time to time. If we choose to use that chit, having a business card makes it more official. If that doesn't work out, we will still be accumulating hotel points with every purchase. Every hotel stay, flight, dining experience, and adventure will earn points towards free stays.

In terms of credit lines, business cards typically offer more generous credit lines than personal cards. They do not always start off with a high limit. However, they will calibrate to higher limits over time based on your monthly spending.

And, it is possible to use your business card for personal purchases. There are ways to tag expenses as business or personal within the online account management. But, you could also add yourself as an authorized user to get a second card. This way you have one card for business use and another for personal use on the same account. When you receive your monthly statement, charges are usually separated by card.

Finally, since business credit lines do not report to your personal credit, it is possible to have high utilization without it affecting your personal credit. So long as you do not default, it is as if the credit line does not exist. Ironically, by having good personal credit, it makes you more likely to acquire additional business credit cards.

Card Advantages

The advantages of the Hilton Honors Business Card include higher points earning when staying at Hilton hotels, higher points for dining and fuel, complimentary Gold status for perks when staying at their properties, and some other travel benefits. Some general travel benefits include rental car insurance and airport lounge passes.

Disadvantages

Of course, not everything about getting the Hilton Honors Business Card is a win. One disadvantage is that there is a $95 annual fee. Of course, this is small compared to the value of the benefits.

Another disadvantage is that there is only one tier of business card. The personal Hilton credit cards have three different tiers, including the Hilton Honors American Express Aspire card, which has an annual fee of $450. That card gets you straight to Diamond status. The business card can achieve Diamond status after spending $40,000 in a year. For a business, this is certainly doable. But, that's more than just spending $450 on the annual fee.

The Hilton Honors Business card also does not earn its highest rate for staying at other hotel brands. Sometimes, when you're traveling, there are no Hiltons nearby. In this case, it's probably better to use the card to pay for hotel stays using a travel portal that also pays points for some double-dipping.

American Express is not as prevalent outside of the USA. Certainly, large hotel brands will accept it. However, it may not be supported at local shops or restaurants when traveling internationally. Having Visa or Mastercard alternatives help in this circumstance.

Future Plans

In future, we may opt for a business airline credit card. Unfortunately, American Express only has Delta Airlines cards, which do no fly out of our local airport. Instead, we will need to apply for a business card from another bank, such as a United Airlines, American Airlines, or even a Southwest Airlines card. Unfortunately, our credit troubles prevented us from expanding our lines of credit until today. But, after a year, offers are starting to arrive in the mail.

About Credit

It is important to point out that credit cards should be used responsibly. You should avoid buying things you cannot afford. If you are going to carry a balance, it should be for items that will generate income. Or, you can carry a balance if your overall cost to finance will be a lower volume of interest. Credit cards are great for fast money. By fast money, we mean that you buy and pay off quickly. It is silly to expect to never carry a balance. Sure, some people are able to charge and pay off their credit cards every month. This is preferable. However, if you must carry a balance, keep it to two or three months. Stagnant balances on credit cards will drain away your money. Credit cards work best when you are churning money through them continuously. Even if your balance never goes down, so long as the new expenses replace old expenses you're fine. It's when your old expenses hang around with your new expenses that credit cards are a problem. They'll gang up on you and extort you with high interest.

Posted Using LeoFinance Beta