Crypto markets continued to trend upwards yesterday, adding 4.1% to the global cryptocurrency market cap according to CoinGecko at the time of this post, but this positive change was not enough to influence the outcome of an assessment of Coinbase's operations conducted by credit rating agency, Moody's.

Instead, the agency downgraded the exchange's Corporate Family Rating (CFR) from Ba2 to Ba3, below non-investment grade, and lowered its rating of the exchange's guaranteed senior unsecured notes from Ba1 to Ba2, adding that both ratings remained under review for a further downgrade.

Moody's credited Coinbase's "substantially weaker revenue and cash flow generation due to the steep declines in crypto asset prices" and "reduced customer trading activity" for its rating decision, and cited Coinbase's failure to diversify as a potential cause for a further downgrade.

"Coinbase's ratings could be downgraded should Moody's conclude that its profitability will continue to be significantly challenged in the current or lower crypto asset price and trading volume environments," It noted. "Its projected cash flow utilization would significantly weaken its cash debt coverage, there is evidence that Coinbase's expansion has limited its expense flexibility, there is increased likelihood that regulatory or crypto asset market structure changes could further lower trading volumes or transaction revenue, or lead to regulatory restrictions, or there is likely to be a sustained deterioration in the firm's franchise strength resulting in weaker ability to retain talent following its restructuring efforts."

This latest development follows a series of unfortunate developments in the crypto space:

- Terra LUNA/ UST's implosion,

- Tron's USDD de-pegging and other stablecoins struggling to hold to the dollar,

- Celsius freezing withdrawals due to market volatility,

- Three Arrows Capital reportedly collapsing and leaving a whopping $666 million in debt to broker Voyager Digital,

And so, here's today's news:

- Voyager Digital limited withdrawals because of its exposure to Three Arrows Capital.

- Coinflex also paused withdrawals.

- Thieves made off with $100 million after hacking Harmony's Ethereum Horizon bridge.

Voyager Digital limits withdrawals

On June 22nd, Toronto-based broker Voyager Digital announced that it may issue a notice of default if Singapore-based hedge fund Three Arrows Capital (3AC) failed to make a loan repayment by June 27th.

According to a statement, the broker lent 15,250 bitcoin to 3AC as well as $350 million in USD Coin, loans which amount to $666 million altogether.

The company initially asked for a repayment of $25 million in USDC by June 24th and subsequently asked for the entire balance owed to be paid by June 27th.

"Neither of these amounts has been repaid," the broker noted, "and failure by 3AC to repay either requested amount by these specified dates will constitute an event of default. Voyager intends to pursue recovery from 3AC and is in discussions with the Company's advisors regarding the legal remedies available. The Company is unable to assess at this point the amount it will be able to recover from 3AC."

CoinFLEX, "the home of crypto yield", is now pausing all withdrawals.

According to a press release posted on its website, CoinFLEX notified its users today that "Due to extreme market conditions last week & continued uncertainty involving a counterparty, today we are announcing that we are pausing all withdrawals."

Binance CEO: Not all failing projects are worth saving

In a blog post, Binance CEO Changpeng Zhao noted that while Binance recognizes its duty to protect users and to help industry players, providing a bailout to projects should not be viewed as a binary position.

He said projects that are poorly designed, poorly managed and poorly operated are just bad projects and should not be saved. Adding that while it was regrettable that some bad projects had a large number of users because of "inflated incentives, 'creative' marketing, or pure Ponzi schemes, "Bailouts here don't make sense. Don’t perpetuate bad companies. Let them fail. Let other better projects take their place, and they will."

Thieves disappear into the sunset with $100 million after Harmony Horizon hack

There's been a $100 million exploit attack on Harmony's blockchain, with the altcoins being swapped for ETH.

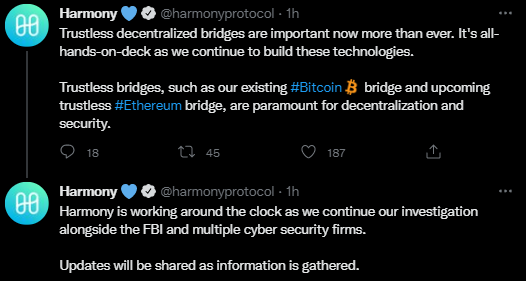

Updating followers on Twitter earlier today, the Harmony team acknowledged the theft and stated that it had begun working with national authorities and forensic specialists to identify the culprit and retrieve the stolen funds.

"Note this does not impact the trustless BTC bridge; its funds and assets stored on decentralized vaults are safe at this time," it assured. "We have also notified exchanges and stopped the Horizon bridge to prevent further transactions."

The team also reiterated its position on the value of trustless bridges despite recent developments.

Closing Thoughts

Well, friends, there you have it. There's always excitement in the crypto space, and the past day has seen more activity than most in recent times. Perhaps it's a good sign that all coins are trending upward again. I'm hoping that this represents a turnaround, and I'm guessing the team at Coinbase are also hoping for the same thing.

Thanks, everyone, for your time and attention.

Resources: Moody's, Wall Street Journal, Cointelegraph, Finbold, Binance

Posted Using LeoFinance Beta