KEY FACT: MARA Holdings has made a significant investment in cryptocurrency by acquiring $600 million worth of Bitcoin between October and November 2024, bringing its total holdings to 34,797 BTC, valued at $3.3 billion. The purchase was financed through a $1 billion convertible senior notes offering, with funds also allocated for repurchasing existing debt and further acquisitions. This positions MARA as one of the largest corporate Bitcoin holders, second only to MicroStrategy, and emphasizes its advocacy for Bitcoin as a strategic national asset.

Source: MARA

MARA Holdings Secures $600M in Bitcoin, Becomes Top Institutional Holder

MARA Holdings, formerly Marathon Digital, has purchased approximately 6,484 Bitcoins at an average price of $95,352 per coin, totaling $618.3 million between October 1 and November 30, 2024. This acquisition brings the company's total Bitcoin holdings to 34,797 BTC, valued at approximately $3.3 billion. This acquisition was captured in the Regulation FD Disclosure (Item 7.01) of the US Securities and Exchange Commission (SEC) published on December 2.

On December 2, 2024, MARA Holdings, Inc. (the “Company”) announced that, during the period between October 1, 2024, and November 30, 2024, the Company acquired approximately 6,484 bitcoin for approximately $618.3 million in cash at an average price of approximately $95,352 per bitcoin, inclusive of fees and expenses. Source

This acquisition by MARA Holdings positions the company as one of the largest corporate holders of Bitcoin, second only to MicroStrategy. To finance this substantial purchase, MARA Holdings conducted a $1 billion offering of 0% convertible senior notes due 2030. The company plans to use approximately $199 million of the proceeds to repurchase its outstanding convertible notes due 2026, with the remaining funds designated for additional Bitcoin acquisitions and general corporate purposes.

MARA Holdings is moving in line with other major corporations that are leveraging debt to increase their Bitcoin holdings, a strategy popularized by MicroStrategy. These companies aim to capitalize on the cryptocurrency's potential long-term appreciation by issuing debt securities at premium prices and channeling the proceeds into Bitcoin.

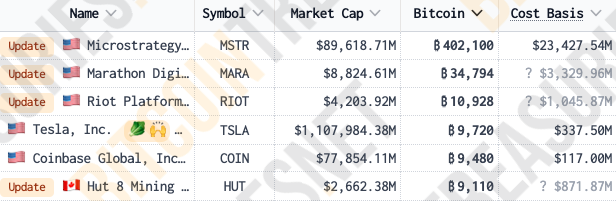

So far, over 30 public companies now hold a combined 508,554 BTC, worth nearly $48.4 billion. MicroStrategy remains the leader with 386,700 BTC, valued at $37.6 billion followed by MARA Holdings.

MARA as the second-largest corporate Bitcoin holder. Source: BitcoinTreasuries

Beyond corporate investment, MARA Holdings has urged the U.S. government to adopt a more aggressive stance in securing positions in Bitcoin and Bitcoin mining. The company emphasized the importance of holding substantial Bitcoin reserves as a matter of national security, drawing parallels to the country's gold reserves.

Following the announcement, MARA Holdings' stock experienced fluctuations. The company's shares closed at $26.41 on December 2, 2024, a slight decrease from the previous close. This volatility pinpoints the cryptocurrency market's response to significant institutional investments.

With Bitcoin's total supply capped at 21 million coins and its price nearing $100,000, companies like MARA Holdings are ramping up their Bitcoin acquisitions to position themselves ahead of potential future shortages. This strategy shows a growing confidence in Bitcoin's role as a long-term store of value and a hedge against inflation.

Again, MARA Holdings' recent Bitcoin acquisitions reveal the increasing institutional interest in digital assets. This may set a precedent for other corporations considering similar investments. This is making a case for the possible rise of Bitcoin over $100,000 in the coming weeks.

If you found the article interesting or helpful, please hit the upvote button, and share for visibility to other hive friends to see. More importantly, drop a comment below. Thank you!

This post was created via INLEO, What is INLEO?

INLEO's mission is to build a sustainable creator economy that is centered around digital ownership, tokenization, and communities. It's Built on Hive, with linkages to BSC, ETH, and Polygon blockchains. The flagship application: Inleo.io allows users and creators to engage & share micro and long-form content on the Hive blockchain while earning cryptocurrency rewards.

Let's Connect

Hive: inleo.io/profile/uyobong/blog

Twitter: https://twitter.com/Uyobong3

Discord: uyobong#5966

Posted Using InLeo Alpha