Hi HODLers,

Today, I will shine some light on an event that happened last week on the Fantom Blockchain.

There are a lot of things to learn from it (the most important one is that leverage is evil).

Who are we talking about?

This Degen goes by the name of Roosh in the Fantom community.

He deposited $50 million worth of FTM (roughly 59 million FTM tokens) on a DeFi protocol called Scream (Lending Platform) to take out a loan for two other tokens:

$SOLID, from the protocol-to-protocol crypto exchange called Solidex, this was the ve(3,3) exchange developed by Andre Cronje and his team before they quit.

$DEUS, the native token for a Swiss-army financial services platform called Deus Finance

The DeGen Trader got $37mn worth of this 2 tokens as you have to be over-colateralized on Scream (as for most of the DeFi Lending platforms).

What did he do next?

The whale then locked up his haul of those two smaller tokens in a four-year staking contract. These contracts allow you to get the best APR on these platforms and to participate in governance.

So, he’s now levered and illiquid.

Crypto Markets started to drop...

And as any Altcoins $FTM took a nose-dive. Our trader is getting closer and closer to liquidation levels.

A $50mn liquidation is an important event and could have brought the network to his knees.

At some point, one of the members of the Deus Finance DAO lent Roosh $2 milllion to help prevent this.

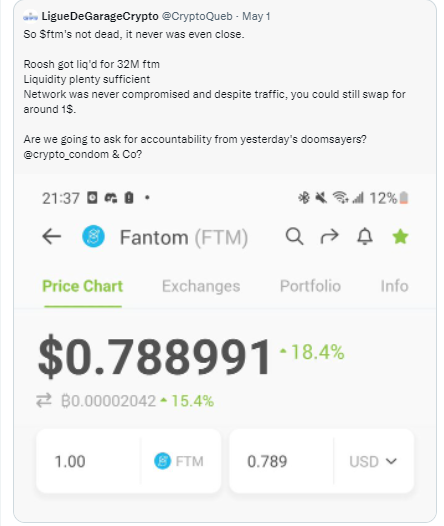

It did not completely prevent the liquidation as 11mn $FTM got liquidated pushing the price of $FTM from $0.85 to $0.79.

Following this 1st liquidation, three other followed bringing the position to just around 18mn tokens.

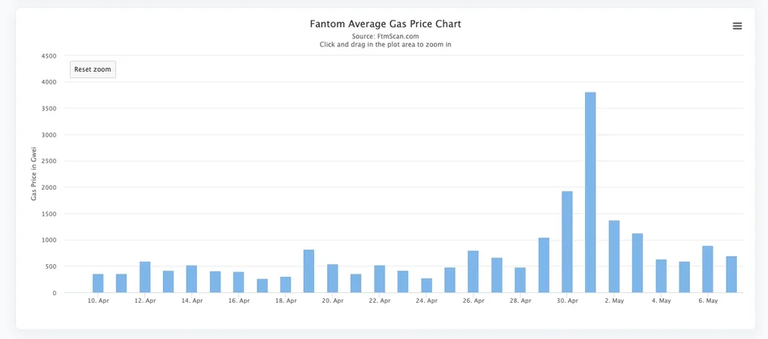

As these trades to liquidate took place on-chain, gas fees skyrocketed

(Source: FTMscan)

Congestion of the network is having a cascading effect as FTM price goes down:

- Users might want to sell $FTM making the gas fee issue worse

- Other DeFi users might want to add colateral to prevent their own liquidation but cannot get through with such high GWEI and failed transactions. These would push more liquidations and so on and so forth...

We could have ended in a death spiral!

But we didn't. Fantom just got slow and expensive for a while but kept running.

As our DeGen Fantom Whale put it in a funny tweet (I can't believe he is laughing after being liquidated)

Source:

How $50 Million in Loans Nearly Crashed Fantom

Latest Analysis

Posted Using LeoFinance Beta