Fintech as the word suggests is the combination of finance and technology. It also implies using advanced technology with financial data to deliver the best financial services. FinTech is using modern tools and innovative methods to improve and automate monetary services. The combination of advanced technology with financials allows fintech companies to be more efficient and reduce costs associated with each financial transaction

Evolution

It may sound surprising but Fintech has evolved since the 19th Century in the form of transatlantic cable which facilitated the first electronic fund transfer system using technologies such as the telegraph. Post-launch of the transatlantic cable, the first credit card was launched by Diner's Club, which was then followed by American Express. However, it has gained popularity in the 21st century with online trading, phone banking, and online payment structure. It is used by companies to manage and expedite their operational management and cut down on irrelevant costs. It is further used in households, educational institutions, retail stores, the banking industry, and many more sectors. Fintech has evolved to include blockchain also.

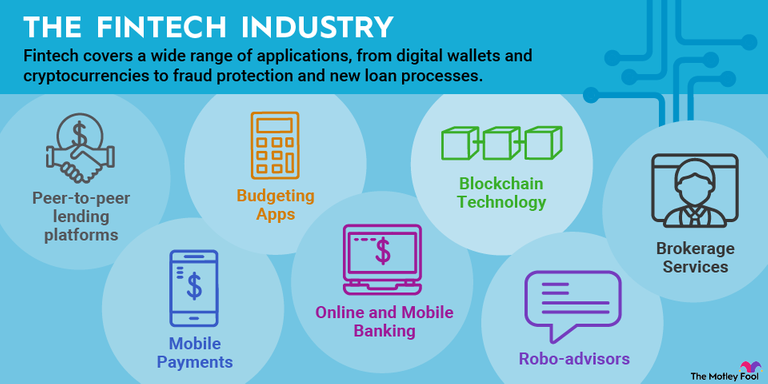

Fintech is widely used in many areas of finance as listed below-

• Investment apps like Robinhood make it easy to buy and sell stocks from your mobile device

• Crypto applications, including wallets and payment applications that allow one to hold and transact in cryptocurrencies and digital tokens like Bitcoin.

• Robo-advisors- Online platforms that invest money automatically on one’s behalf.

• Payment apps like PayPal, and Zelle which make it easy to pay day-to-day expenses online instantly in a go.

Scope

The scope of a fintech was limited to traditional banking systems including the issue of credit cards. However, in recent and modern times, non-banking financial institutions and banks have been quick to adopt fintech to remain competitive with competitors. The companies are offering digital lending, mobile payments, cryptocurrency, and blockchain and adopting Artificial Intelligence (AI) concepts.

The fintech scale has expanded to include the banking sector, education, management sector, and small and large-scale companies that aims to offer consumer-centric, technology-driven financial solutions which are based on the advanced concept of fintech.

Fintech is making use of automated customer service technology, utilizing chatbots and AI interfaces to assist customers with basic tasks and keep down staffing costs which broadens its scope of expansion in current times. It is also used to control to fight fraud by leveraging information about payment history and keeping surveillance on transactions. Many tech-savvy people are keeping close track of Fintech development as it is the need of the current hour and investing in similar products and services crafted on the basis of the same.

With the above facts, ###it can be concluded that the scope of Fintech funding is widening, but regulatory implications do exist. However, if used with proper understanding, and precautions, and in a meaningful way, it can prove to be a boon to individuals, companies, and education sectors. It can be as quick as an AI/Chatbot in recent times. Thus, it is meant for the trending and fast-growing needs of people across the globe.