Evening

With crypto market still not being able to recover from the loss of its largest algorithmic stable coin UST, other big stable coins are also under pressure. USDT the largest stable coin had already lost its peg briefly down to $0.95 on 12th May. USDT market cap plummeted down from $83 Billion to $75 Billion over the period of last seven days.

This marks the largest decline in market capitalization for the first time in Tether's history. USDT is currently trading at $0.999 just a little down below the peg, as per data from Coinmarketcap.

Tether the company behind USDT continues to honor is obligation of redeeming USDT for $US, with $2 Billion worth USDT redeemed only on May 12th. Centralized stable coins like USDT claims to have actual fiat in form of cash, commercial papers, bonds and crypto backing.

In case of de-pegging users can purchase centralized stable coins like USDT off the market and sell them the coin issue for exactly $1 US, thereby pocketing profit. Meanwhile Tether claims to be committed to redeeming all verified customers.

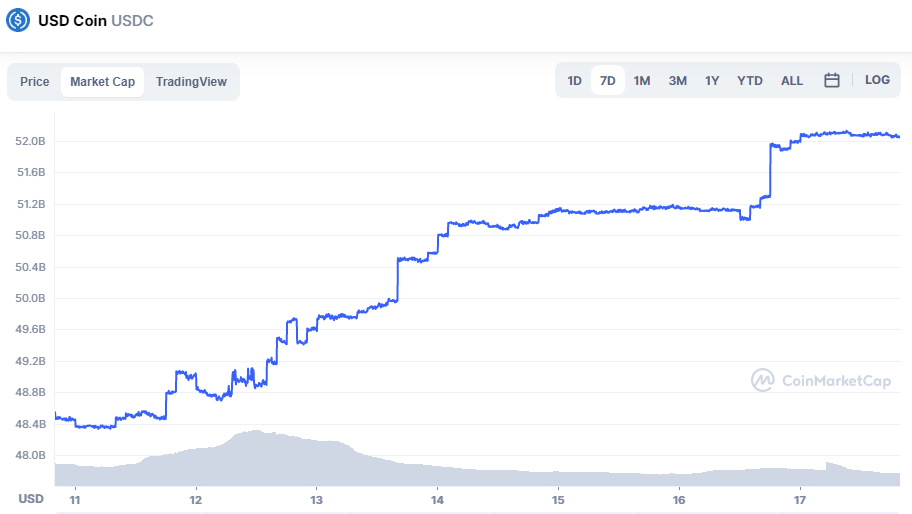

Some other stable coins like USDC and BUSD continues to benefit from declining marketcap of USDT, as investors are turning away from USDT and seeking other alternatives. Marketcap of USDC have swelled from $48.48 Billion to 52.04 Billion over the last 7 seven day, whereas BUSD marketcap is up from $17.16 Billion to $18.26 Billion over the same period.

Apparently Tether is holding true to its promise of redeeming USDT for now, but the question is for how long? If the redeeming pressure continues and gets super imposed by panic, things can get sour for Tether pretty quickly and Tether's claims of its stable coin having 100% backing will be tested.

Posted Using LeoFinance Beta