Introduction

Humans used the barter system before the invention of money. Barter is an exchange system, that goods being exchanged for goods. Barter is commonly used for goods of primary need (food and clothing), for example, the exchange of cow for goat. Barter is a complex system, related to the agreement of the parties, transportation, and determination of the value of goods, this is the weakness of barter.

Before Coins Founded

The weakness in barter, especially in determining value, which is often felt to be unfair to one party, gives an idea to use certain goods as a medium of exchange. The goods must be valuable, easy to carry, and durable (not easily damaged).

The Mesopotamian shekel was invented around 2500 BC, where the Mesopotamians used it for primary goods transactions and paid workers every month.

Shell money has been used as currency by several civilizations in the Americas, Asia, Africa, and Australia.

Coin

The Lydians invented money around 600 BC, referred to as the Lydian Coin, which was a coin made of pure gold and silver. The initiator of Lydian Coin is Herodotus. Lydia Coin increased trading activity both internally and externally, thus making the Lydians the richest nation in the Asia Minor area in its day.

The Arabs used the dinar (gold) and dirham (silver) currency around 700 to 1200 AD. Those times were the golden age, banking instruments had been implemented, such as deposits, checks, and loans.

The Indian nation uses the rupee (silver) as its main currency. Sher Shah Suri introduced the rupiya around 1540 AD, continuing until the Mughal rulers.

There was a Goldsmith Banker in England around 1450 AD who performed the function of gold banking. This Banker is a successful institution in its era, dominating Gold Banking across the United Kingdom and Europe.

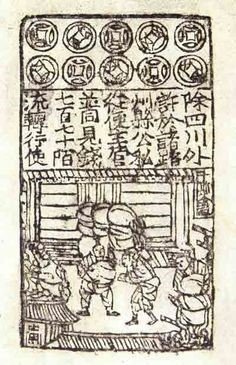

Paper Money

The Chinese first discovered paper money called “Jiaozi”, which began to be used in 960 AD. Jiaozi is a certificate of proof of ownership of coins, which at that time were used simultaneously. With Jiaozi, merchants can redeem the coins elsewhere. Technically the merchant puts a coin to the agent, the coin is recorded on a piece of paper that can be used for buying and selling goods. Jiaozi is the forerunner of paper money used around the world. The use of paper money in China lasted until around 1400 AD, when China finally eliminated all existing paper money due to inflation, then started using it again in the 1700 AD when interacting with Europeans.

The European Banknote was first published by Stockholms Banco, the predecessor to the Central Bank of Sweden. The European banknote replaced the bronze plate as the Bank ran out of coins and ceased operations. The banknote is a representative of gold and silver deposited in the Bank so that the Depositor gets the Banknote as proof, which can be exchanged back for gold and silver or can be used as a means of payment. In other words, the Banknote is guaranteed by gold and silver.

In 1944 AD there was the Breton Woods System, the USDollar was partially backed by gold, and all international trade used the USDollar as the benchmark rate. In 1971 AD the President of the United States, Richard Nixon, ended the era of guaranteeing USDollar with gold, so it was called fiduciary money, namely money whose nominal value is greater than its intrinsic value. The nominal value is the value listed on the money itself, while the intrinsic value is the value of the raw materials to make the money. People use fiduciary money because they believe in the party that issued it, the Central Bank. Fiduciary money today is known as “fiat”.

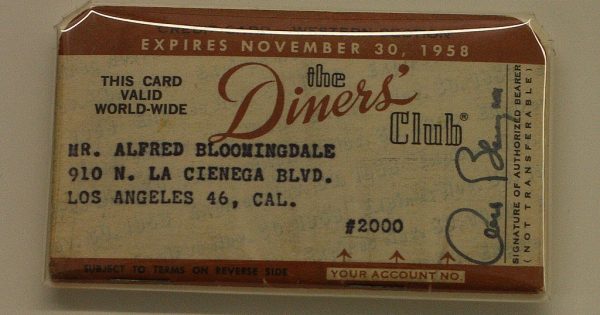

Electronic Money

Along with the development of the payment system, paper money developed into electronic money, where payment requires the internet, and a smartphone or computer. In principle, electronic money is fiat money that is printed by the Central Bank electronically. The beginning of the use of electronic money was a credit card initiated by the Diners Club in 1950 AD, then a debit card which was first issued for business executives by Seattle's First National in 1978 AD, the discovery of an ATM or "Automated Transaction System" as a continuation of the use of debit card.

The emergence of the Paypal application in 1998 AD is another innovation in the financial sector, the application provides an electronic wallet for users to make several deposits in the form of fiat and get electronic money in return. Can be used to transfer or receive payment of wages from internet-related jobs such as freelancers, and online commerce.

Cryptocurrency

Bitcoin is a digital currency that uses blockchain technology, written based on cryptographic code, so it is called a “Cryptocurrency”. Bitcoin can function as a medium of exchange and an asset like stock securities, discovered by Satoshi Nakamoto. In 2008 AD bitcoin.org was registered as a domain, Between 2008 and 2009 AD it has no value. The initial Bitcoin rate is $1 for every 1309 Bitcoins. The first transaction of Bitcoin was made by Laszlo Hanyecz, in Jacksonville, Florida. He purchases 2 Pizza with 10000 Bitcoin.

There are altcoins, which stands for (alternatives to bitcoin), which have emerged, using the same cryptographic code as bitcoin. Altcoins fix the shortcomings that exist in bitcoin such as security, transaction speed, and shipping costs. There are also stablecoins, cryptocurrencies that offer price stability. Stablecoins are generally guaranteed by USDollar, some are guaranteed by commodities. Stablecoins are a bridge between fiat and cryptocurrency, it can be a save heaven when cryptocurrency prices are experiencing a deep decline.

Conclusion

Money always develops from time to time by technological developments. In my opinion, when a fundamental weakness of the type of money is discovered, there will be newer technology to replace it. Just as shell money replaces barter due to a complex barter system, gold and silver replace shell money due to overstock of shell money or in other words inflation. Paper money is replacing gold and silver due to the safety factor of transporting gold and silver which was vulnerable to robbery. Electronic money principally is paper money in electronic form, it gives convenience that is related to paper money. Cryptocurrencies are replacing paper money due to the declining value of paper money (associated with inflation). Blockchain technology will continue to develop, can go hand in hand or even replace the existing monetary system.

Reference & Further Reading

Posted Using LeoFinance Beta