Few days ago, during a conversation in chat, someone asked a question; Should I buy Hive and power it up, or should I buy HBD and deposit them in savings to earn a 20% APR, which is what the interest rate currently set at by the witnesses.

To which, a simple and direct answer was provided...

Powering-up hive and curating gives ~12% APR plus the influence on chain (which can be very important depending on who you ask), while depositing HBD in savings gives 20% APR.

However, I had to bring up the subject of "Opportunity Cost" which many tend to overlook. And the reply was "What is opportunity cost?", so that gave me the idea about writing this post to explain it.

What is "Opportunity Cost"?

It is the cost of doing an activity, rather than doing a different one instead. Some value which you are giving up by investing your capital or whatever you are investing in option A, instead of investing it in an opportunity with more lucrative returns, which we can call option B.

In simple terms, and to keep it Hive related. An investment in HBD is great, 20% APR is by all means awesome. Especially when taking into account the relatively low risk, and the short amount of time the funds would be locked up for before they are liquid and fully available at our disposal again.

Compared to the ~12%ish APR you can get from powering up Hive and actively or passively curating, and the whooping 13 weeks lock up period for powering down (This isn't a big deal depending on your HP or if only powering down some profits).

The thing that gets overlooked when making such a decision about which option is better to invest in, Powered-Up Hive or HBD, is that opportunity cost we defined earlier.

If we calculate our opportunity cost for investing in Hive instead of HBD, purely from an APR stand point, HBD being the option with the higher returns (20% - 12% = 8%). We would be making 8% less for choosing Hive over HBD. The choice would seem easy to make, but is it?

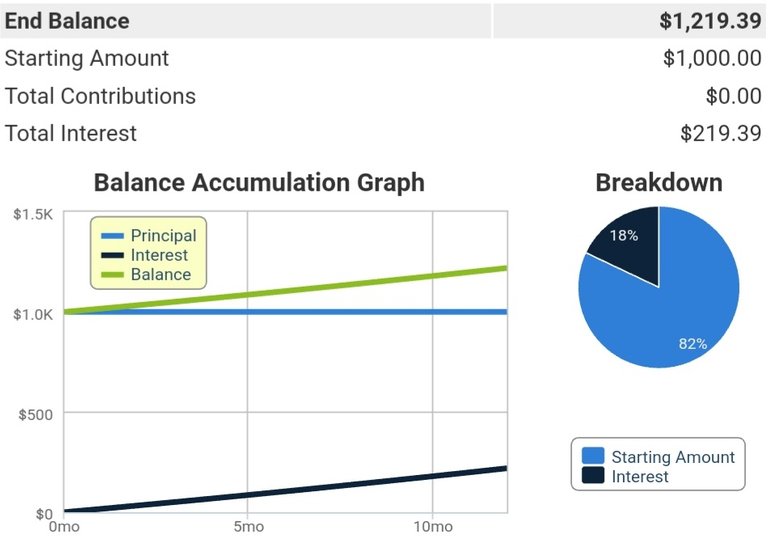

If I am to invest $1000 in HBD assuming the 20% APR stands, by the end of a 1 year cycle (claiming and compounding interest monthly) I would end up with $1,219.39

This is $219.39 In profit after 1 year, with my initial investment of $1000 remaining the same.

Pretty simple and straightforward so far, which is great, but now, let's look at what can happen if I invested in HP instead.

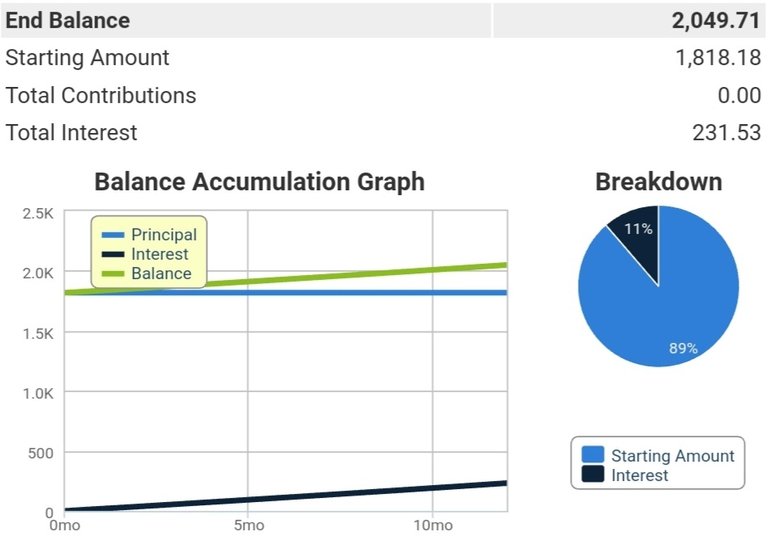

At the time of writing this article, Hive is priced at $0.55 each. So, if I dump $1000 into Hive, I would get 1,818.18 Hive that I can power up and get approximately ~12% APR (About 9% from curation + About 3% interest rate on powered up Hive). With a slight edge over HBD being that the compounding of the interest rate happens in a smaller time frame. It's very rapid regarding HP interest, but can be considered weekly in regards to claiming curation rewards, so let's just go with compounding it weekly for easier calculation.

At the end of a year, I would end up with 2,049.71 Hive. A profit of 231.53 Hive. If we assume the same price holds for Hive at the end of that period ($0.55/Hive), I end up with $1,127.34, so a $127.34 in profit.

The real Opportunity Cost:

HBD, as you may already know, is an algorithmic stable coin. Its price should remain stable at around $1 each, despite some quick peaks and dips that might happen from time to time. Its price keeps stabilizing around the $1 mark.

This fixes our profit in one year with $1000 invested in my example above at $219.39. It can be less if witnesses decide to lower the 20% APR. But it won't be more than that.

Hive's price on the other hand is not fixed at this current value of $0.55, it fluctuates, it can moon and it can dip! Its price is decided on by the free market's law of supply and demand on the various exchanges it's listed on.

An increase of 10% from its current price of $0.55 which we presumably bought for with our $1000 investment, so a $0.60 price of hive by the end of that one year investment, we would end up with:

2,049.71 x 0.60 = $1229.82

A profit of ~$230 which already surpasses what can be made from the same investment in HBD. If Hive goes to $1, that would be a profit of $1049.71, and if it moons, well.. You do the math!

Such profits are not possible with that fixed 20% APR on HBD, as its price will remain somewhat fixed.

This potential that can be missed on the investment made with the same capital, is the cost of that opportunity. Assuming an end price of $1 per Hive, the opportunity cost would be the difference between the end results of those two investments.

Potential profit from HP with $1 end price ($1049.71) - Potential profit from HBD ($219.39) = ($830.32)

So the opportunity cost in this example would be about $830 of "missed on" profit. Almost 400% more profit than what you might have made when investing that $1000 in HBD. Which is about 103% profit on the initial investment, instead of that 20%

Risk vs Reward?

Assessing the risks involved when making an investment is part of the game as well.

And the cost can be calculated similarly.

True, Hive will most likely increase in price, but it also might go down too.

A downturn of 10% ($0.50/Hive) by the end of that year investment, would leave you with $24.85 profit for example. Still in the green, but way less than what a deposit in HBD would've made. Or even worse, if Hive crashes to $0.10 You'd end up with a loss of $795 on your initial investment.

No one can predict what will happen, but one can predict what might happen, what is more likely, and what is less likely to happen.

This is Crypto after all, and it is wild! But, I try to be realistic and look at the worst case scenario as well as the best case scenario.

Best case is, of course, Hive moons. And we have already seen an ATH of over $3/Hive last year, before the whole crypto market came down crashing in a fierce bear market. And Hive did actually hold up pretty well in this bear run compared to all the others.

Worst case is, well.. It's the crypto world.. You know how it goes. Never risk what you cannot afford to lose. 😎

It is very unlikely that Hive would get zeroed out, honestly, even with a zeroed out BTC... Because despite everything, this is a social platform that offers in the least a "free blogging space". With a token that does have a use case, and a community that considers this blockchain and platform as their home!

I believe, even a low of $0.25/Hive is NOT an option anymore.

AND, for the sake of our comparison between those two options (Hive vs HBD). If Hive goes to 0, then rest assured HBD would be worthless too.

With all that said, we now know that the risk is there, for both. One possibly is riskier than the other but with far greater possible outcome (profit margin wise).

So, all those things and more, need to be included and thought of when making a decision about any investment, Hive vs HBD in this case.

Last but not least, and needless to say that this is not a financial advice.🙃 But I personally think that an investment in Hive is far more superior than its HBD counterpart. Little riskier? Maybe, depends who you ask. But that small extra risk pales in comparison to its potential rewards.

At the cost of 8% less profit, for the solid potential of 103%+ profit. And between those two options (Hive vs HBD) I personally think it's fair to say that it's well worth taking the Hive ride! 🤘

Header Stock image and Page Dividers were created by me using Picsart Mobile App.

© 2022 @yaziris.

Posted Using LeoFinance Beta