Hello dear Cent Community. The cryptocurrency market has started to revive in the last week. There is also a revival in Cent in terms of price, liquidity and transaction volume. Last month, we announced that we would evaluate liquidity and transaction volume data in US Dollar terms. We are getting the data from BeeSwap and Tribaldex.

Compared to last month, the transaction volume in Cent's liquidity pools has increased excessively. There is more liquidity inflow in Hive, BTC and HBD liquidity pools compared to other liquidity pools. The three liquidity pools are equalized at 48% APR. The liquidity pool with the highest APR is the HBD/Cent pool with 63%. Last month, there was $5647 worth of liquidity in liquidity pools. This month, there is $9208 worth of liquidity. In last month's report, the total monthly transaction volume in the pools was $4356. The monthly transaction volume this month is $17,164.

- Hive/Cent liquidity pool has $3405 worth of liquidity. $9222 worth of trading volume in the last month. Current APR in the pool is 48%.

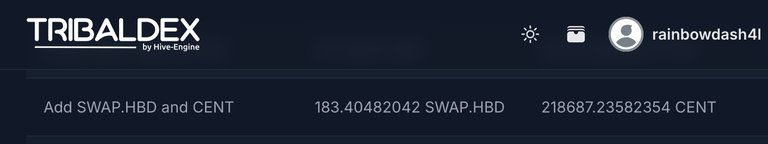

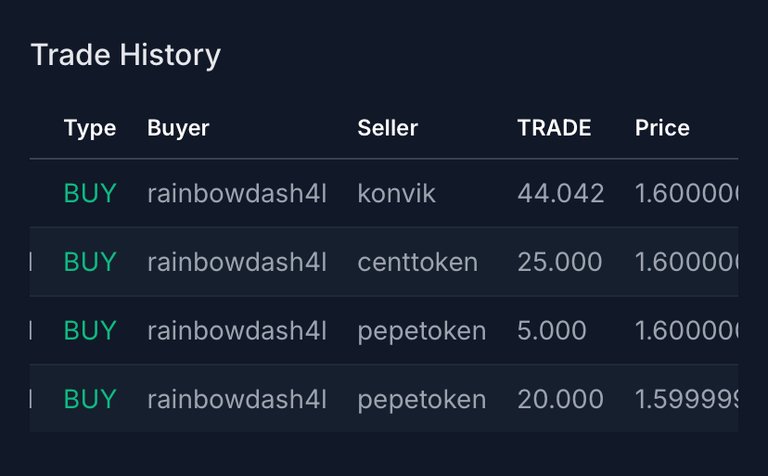

- HBD/Cent liquidity pool has $1320 worth of liquidity. $1572 worth of trading volume in the last month. Current APR in the pool is 63%.

- Cent/BTC liquidity pool has $1614 worth of liquidity. $2572 worth of trading volume in the last month. Current APR in the pool is 48%.

- Cent/Bee liquidity pool has $986 worth of liquidity. $934 worth of trading volume in the last month. Current APR in the pool is 51%.

- Cent/Leo liquidity pool has $983 worth of liquidity. $1913 worth of trading volume in the last month. Current APR in the pool is 48%.

- There is $900 Hive worth of liquidity in the Cent/Pob liquidity pool. $951 worth of trading volume was realized in the last month. The current APR in the pool is 48%.

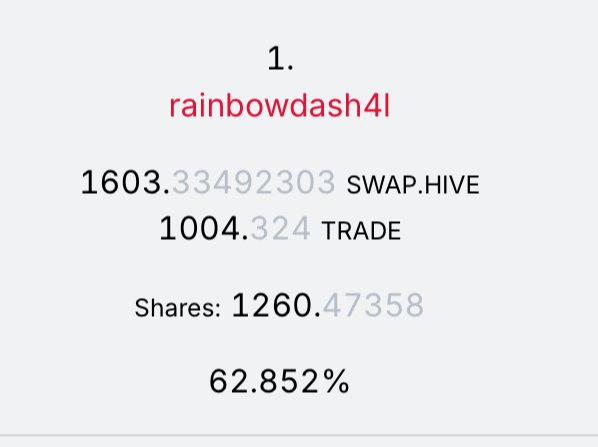

We created the Hive-Trade liquidity pool last month. The current data is below. We will start to obtain comparative data next month.

- There is $898 Hive worth of liquidity in the Hive/Trade liquidity pool. $661 worth of trading volume was realized in the last month. The current APR in the pool is 33%.

The previous month's report is here. The reward distribution period in the HBD and BEE liquidity pools is about to be completed. We will restart the reward distribution period in both pools. In particular, the HBD/Cent pool is one of the liquidity pools we strategically support. Follow @centtoken to be informed about new announcements and reports early.

Posted Using InLeo Alpha

)

)