Last week the DAG size of Ethereum got to over 5GB in size. Meaning that GPUs or ASICs with 5GB of memory would no longer be able to mine Ethereum. In practice, this had no effect on GPU mining, but it did have a fairly substantial effect on the Asics miners mining Ethereum.

Did we get a scaled-down version of the future post Merge?

If we take a look at what happened around the 16-17 of August. As that is around when the shift happened to the 5GB DAG size. And in case you are wondering why the DAG size matter. It in simple terms is the size of the data set that is used to solve the equation. Meaning is you have less memory than the DAG size you are unable to solve the answers to the equation.

Now back to August 16-17. This is when the DAG size got over 5GB in size. Meaning all the basic miners that had up to 5GB of memory no longer could be used for mining Ethereum. This meant that they had to be turned off, or... Swapped to another coin using the same algorithm. In contrast to a GPU who can mine basically all the different coins. An ASIC miner is a machine specifically built to mine one algorithm and nothing else.

And it just happened that Ethereum has a fork, meaning it is the same algorithm, that has a much smaller DAG size, Ethereum Classic. So it is assumed that most ASIC miners simply swapped from mining $ETH to mining $ETC.

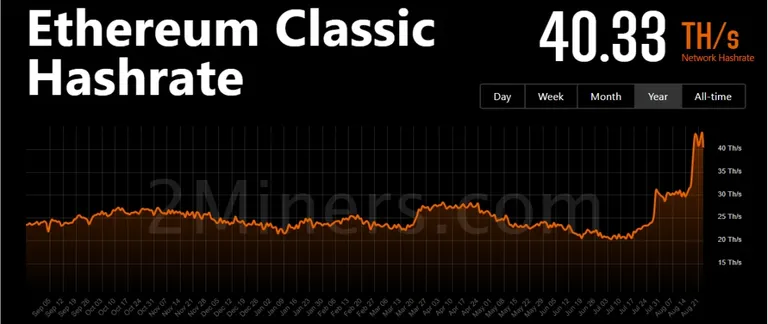

Both charts are sourced from 2miners.com

The timeframes are set to year simply because that makes a smother line and makes any change easier to spot. On the daily chart, the up and down make the overall changes harder to spot. Well at least for $ETH that is the case. The jump in hashrate on $ETC is pretty easy to spot no matter the time frame.

On $ETC we can see that the hashrate makes a big jump from around 30Th/s to ~42Th/s. And that is almost a 50% increase of hashrate overnight. And in the meantime, if we take a look at $ETH we can see a dip, a little one at the very end. And despite not all hashrate moving over to $ETC from $ETH it still had that big of an impact on t$ETC´s overall hashrate.

How did $ETC handle the increase in hashrate

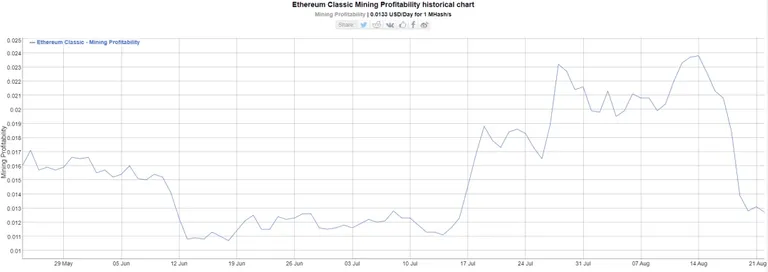

We can take a look at the profitability of mining $ETC and see if there is anything there that shows an impact of the increase in hashrate.

The chart is sourced from bitinfocharts.com

Well what do you know, it looks like the profitability takes a nosedive on the 18th, the day after the increased hashrate is introduced. It looks like the profitability is closed to cut in half as well. But as they say, correlation is not causation. And that is true. No matter what anyone says. And just to be clear, I would argue that in order for the increase in hashrate to be solely responsible for profits cut in half. It would have to mean the hashrate would have to be doubled. At least I would assume it would. But I might be wrong on that.

Let us look at other factors that can impact mining profitability. One such factor is of course the price of $ETC. So let us look at the price chart and see if there was a corresponding drop in price.

Chart sourced from Coinmarketcap.com

As we can see in the chart the price for $ETC was pretty stable, it was not until the 19th that the price fell. So while this did impact the profitability. It is not to that extent. If we look at the price drop we can see it is around $8 or 20%. So it would be impossible for the drop in price to impact the profitability to a bigger extent than that.

There is one more thing however that can affect the profitability. And that is the difficulty to mine. That basically means how hard is the equation the miners are tasked to solve.

The chart is sourced from 2miners.com

We can here see a similar spike in the difficulty as we saw in the hashrate, But the increase is not as big in relation to the difficulty before the increase as the increase in hashrate was compared to the hashrate before the increase. Here the increase is ~37.5%.

And there might also be other factors that could directly impact the $ETC price of course. But they would most likely be factors that would impact the price. So in a sense, they are accounted for indirectly.

I feel fairly safe to say that the majority of the drop in profitability for mining $ETC is a factor of the things mentioned above. At least the vast majority of the drop, I would argue, can be explained by these factors.

The takeaway

The takeaway here is the impact the massive hashrate currently mining $ETH will have on all other minable coins when the Merge happens. What we have seen here was a fairly minimal drop in hashrate for $ETH, I would guestimate it to be 35Th/s. And not even all of this hashrate then moved over to $ETC and it still had this massive impact.

What will then happen to all the other coins when the rest of the hashrate is forced from $ETH? Well, the most likely scenario is that profitability will drop very low. This is because the miners will go where they can make the most profit, and that is most of the cases where they can mine most efficiently. That will most likely be the case since the massive exodus of hashrate will mean that almost all minable coins will be over-saturated.

Miners who either have inefficient mining equipment, or high power costs, will be forced to stop mining. Or mine at a loss. And I personally do not see the majority of miners mining at a loss.

I hope that you have enjoyed this look at what has happened to $ETC. And what is very likely to happen to all minable coins the days after the Merge. Have you seen any errors I have made please let me know so I can fix them. And also please share your thought on the future after the Merge, whether it is the future of mining or just for Ethereum in general. Please feel free to share away in the comment section down below.

If you would like to support me and the content I make, please consider following me, reading my other posts, or why not do both instead.

See you on the interwebs!

Picture provided by: https://pixabay.com/

Resources