Buyback is a magic word in crypto - it sounds great, gets people excited and generally seems like a responsible thing to do. But spending money always gets people excited, and if we are honest with ourselves, we should realize there are ways to do it better and more effectively than others.

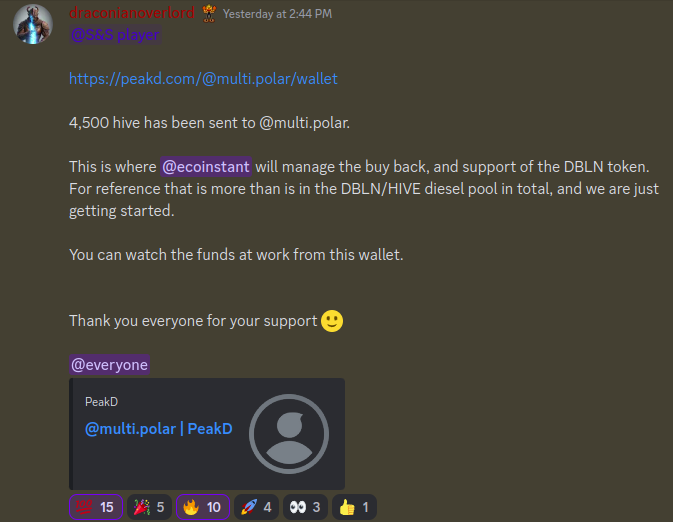

After many years of watching different strategies, engaging in my own and even watching many projects squander lots of money, I finagled myself into a position to run a sizeable buyback program - for the quite popular Serfdom and Sorcery game being developed by the @psyberx team.

So today I would like to take the time to announce I am finally rugging explain some things about buybacks, how they work, and what some of our strategies will be. I want to do this in a public manner, like most of my posts on related topics, because if someone finds value or wisdom in my words then the whole cryptosphere can potential benefit.

Project managers - read carefully. Green candles might be fun to watch (for a day or so), but they are not the point of buybacks!

What is the purpose of a Buyback?

I will use the present example of DBLN, where our announcement post clearly states that this is to 'support the DBLN market'. DBLN token is an inflationary token, compared to @psyberx's other token LVL, which is hard capped.

Support can mean many things, and it could mean 'price go up', but it can also mean 'price not go down so much', and it could also mean 'increased liquidity'. If we can do two of three, or even all three, then we know we are being quite effective.

Another thing to note, about a buyback fund, is that the size of the fund matters. The more we can do with less money spent, the more efficient we are being. Spending money today is fun, but saving money for tomorrow is wise. With an inflationary token of any kind, we can be pretty sure that tomorrow there will be more tokens than today - keep this in mind.

Psychology of Markets

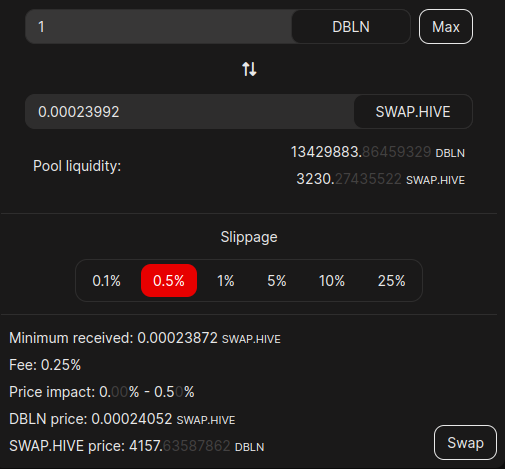

I'll start with the order books, because these are an important part of the markets, although with a pool (or multiple in the case of DBLN) they are not the end of the story. Yesterday, with the announcement of the buyback program, the price of DBLN went from 0.00018 all the way to over 0.00025, a 35%+ increase - so we can say the buyback is working really well.

Except I haven't spent a single HIVE yet. This was all a psychological reaction from the players, likely anticipating a heavy handed buyback program dedicated to short term green candles. Front-running a buyback program is a classic move that has probably made people money more than once.

Remember that order books have spreads, and listing an order is kind of like an option - an offer to buy or sell at a certain price different from the one today. The price in any given moment is not the last sale price, its the pool price.

Pools work with infinite liquidity, basically price slides and at any point there are always tokens available to be bought or sold. Not everyone 'gets this', and it is a relatively new technology, I even have a primer for those interested. There are more than a few misconceptions about these new liquidity tools.

So let's review the basics -

- Pool price is the real price

- Order books are options to buy/sell

- 'Price go up', 'Price not go down so much' and 'Increased Liquidity' are the metrics of any buyback.

- Player(Holder) psychology matters

- Inflationary tokens will keep printing

- Longer-term thinking is wise

- Greater effects with less money spent is efficient

So what am I actually doing?

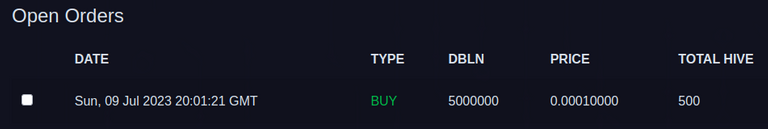

So far I have set an option to buy up to 5M DBLN tokens at 0.0001 - this is a signal to the market - remember the fund has actually not spent anything yet - there is no cost (on HIVE) for making a market order.

So up to this moment, we still have all our dry powder - the price has pumped 35%, players seem happy and are still spending on the limited edition NFTs - which means the fund is still growing.

This may not be the only thing we will do - but the aim is to make the money last and support DBLN in the long-term - this means giving confidence to players when they decide whether or not to make a purchase. In my experience a few short-term green candles and running out of money does the opposite.

Comments, concerns or questions? Leave them for me down below.