(Base image generated using Nightcafe. Photo edits made using Paint 3D)

This past month I have been changing my personal investment strategy as well as reviewing the current strategies being pursued in the market by financial advisors and investment professional.

Full disclosure, I am not licensed in anyway to give investment advice. I cannot tell people what to do or give them specific instructions on what I do. This is just how the law works in the United States, it is what is.

That being said, I can speak to the current system, its rules, my understanding of how institutions think, and the tools institutions use to make decisions.

The current financial system is very interesting. Most people look at the stock market and they think it has always been. The fact is the current stock market is not representative of anything historical and is a modern creation.

I don't mean like relatively speaking I just mean the stock market today is very different than the stock market even 20 years ago.

In today's market there are things done on the back end that impact liquidity and thus prices. Some of these things are:

- If the market changes "too much" in a day the exchange will restart the market from the previous day and act like the crazy did not happen.

- If a stock has large swings of about 20% or more they usually freeze trading for that security.

- Large investors and institutions do large trades in a Peer 2 Peer way instead of on the public market.

So when people say, the stock makes no sense, they are kind of right. It is essentially setup to have reduced perceived risk and large volume trades happen off the public market and unbeknownst to most traders.

I must warn you, I am a bit unconventional in my approach's to most things. I do not like to just copy and paste. I like to learn from the mistakes of others as much as possible and then I go out on my own and learn from my own mistakes, ouch!

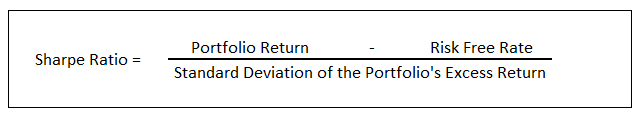

Typically when I invest off chain I reference something called a Sharpe ratio. All institutions use this even if they don't tell you. It was developed by William F. Sharpe in 1990...yes this thing is not new.

Here is the formula:

This formula is fairly complicated. It only has 3 variables but those variables have variables and assumptions. I personally don't think everyone needs to know their Sharpe ratio. But people should know it exists and think in terms of Risk weighting your returns. If you seek out the highest return in the market you need to realize that investment probably has high risk too.

You can build complicated portfolios with low theoretical risk and high returns; these are typically short term strategies that end in months or sometimes years; more often than not these strategies do not work. These investment strategies usually have some other risk that just doesn't show up in the formula; arbitrage does not exist.

So when your investment advisor says, keep it passive this might be good advice but you should ask, what is my Sharpe ratio? Just see what he/she says and then based on that you might want to ask more questions.

This does not mean you should pull all your money out and bury it in the ground, just ask more questions.

If your advisor can't answer simple questions then maybe ask what he/she is getting paid for? Granted they probably won't like this question. LOL!

Full disclosure, I have tried to make a Sharpe ratio for some crypto projects as well as BTC and Eth. The reality is these markets are so new I am not sure a Sharpe ratio even means anything. The Sharpe ratio is backward looking so right now it is only a useful tool in traditional finance / stocks .

That being said, the Sharpe ratio is a tool and has some flaws. You should not necessarily invest based on a Sharpe ratio, just add it to the list of things you consider before making a decision.

This post is not financial advise so please take this for what it is. The early morning blog of an excited Hurt.

Thanks for reading my blog. My BTC acquisition strategy is going well. Fingers crossed I get through it unscathed. 🤞

Additional Info about me and the communities I have the pleasure of being a member of:

• Please consider voting for Neoxian as a witness!

• Don't forget to check out The City of Neoxian's Weekly Paper! https://peakd.com/hive-177682/@neoxiancity/neoxian-city-weekly-paper-2023-07-09

• Please consider voting for Hive PIZZA as a witness!

• Join the Hive PIZZA Guild Discord -> https://discord.com/invite/hivepizza

• My Blog -> https://peakd.com/@hurtlocker

• Follow me (@hurtlocker) on Twitter -> https://twitter.com/Hurtlocker360

Posted using Neoxian City