I sprinkle throughout my posts talk about leverage and "ratio trading" and all sorts of jargonified code speak that I am trying to communicate but also realize that only those "in the know" can really understand.

Today we had a great PIMP meeting, after two weeks off I went on some long rambles, we heard from @thgaming , @snook , @enginewitty and even @thorlock showed up to pay us a great visit.

Being upside down is not exactly like a rug. Its way, way weirder. And as some of you might fondly remember, or some of you will only begin to learn now, crypto is one of those places where sometimes "ratios" get really out of whack.

So today I want to tell you a story.....

100 years ago I wanted to buy a farm and I went to the bank of grandpa to make my dreams come true.

What I couldn't articulate at the time, but somehow my grandfather sensed, was that I had found a beautiful emerging market niche in which to plant my flag and make my mark. We bought the farm after grandpa's first visit to see the region and some example properties; above is his next visit, his first ever visit to our farm Buena Vista.

I didn't know much about Colombia (I know more now) or its economics or history; I had only lived in and around Colombia for about four years back then.

I didn't know much about human-scale economics then (I know more now); I had only taken 51 credits in economics courses at the University of Wisconsin - Whitewater then.

I didn't know much about managing money then (I know more now); beyond being good at math - I was very talented at being broke.

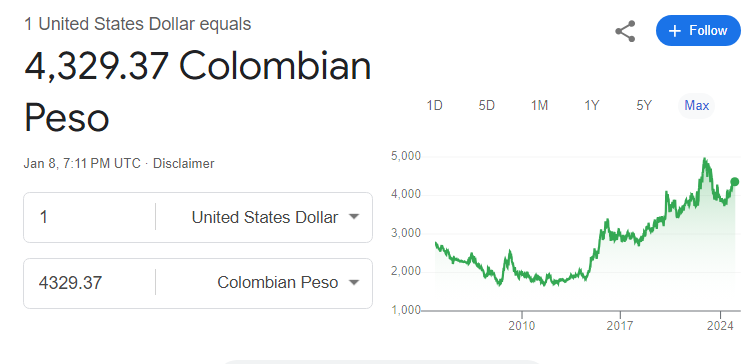

So I took out a $28,000 loan at 9% interest at 1850 pesos per dollar to buy a 80 million peso farm. Those of you with calculators will see that 51.8/80 or 64.75% collateralized is pretty solid.

We'r Rockin' the Ship!

-Joshamee Gibbs (fictional character)

Which is all well and good, right up to and through the guy getting crushed to death by the cannon. And now you are underwater.

See in economics class you hear about a "foreign debt crisis". I know now what it means.

It means buying a farm for 80 million and owing 100 million after paying interest and principle for 7 years at "emerging market" rates.

Once you "know" about leverage you can't unsee it. Its everywhere.

Its just about which side of the trade you are on.

Don't cry for me Argentina because its was 7 years later that I turned 2.5k usd into an even bigger farm, right next door using a (not even particularly) well-timed four step leverage chain: USD to SL assets to DEC to Hive to Pesos. I learned some lessons about leverage along the way.

And I am not talking about "debt", the modern way by which people think about getting access to the fantastic mathematical powers of leverage.

We have been in a very unique time for setting up leverage chains. Or ratio trades. Or currency arbitrage. Or whatever you want to call it. I wouldn't be surprised if there are a web of leveraged threads spun around the world.

You better believe it that if I can figure this out, "they" got it figured out.

It doesn't really matter, because I made my own thread, and I'm weaving it together now.

Be careful out there everybody, this will be the time the scammers come out to play harder than ever. Guard your keys. Guard your words. Guard your trades.