I have always liked market based games, and then of course fell in love with dCity, a spreadsheet wank's wet dream of a game. I like numbers, I think a lot of people do. Just some only the like the "number go up" part.

You'll remember we opened and closed the YIELD sale within less than 72 hours. I had fun surprising you, and I am pretty sure no one has done this before. Several days later we even got featured by @gadrian, whoops too late! How fun is that! What could be more DEFI than defying expectations?

And of course our YIELD capital is hard at work, while we type and post and comment, eat and sleep. Is there anything else to do while we watch and wait?

Yes, we can play a game.

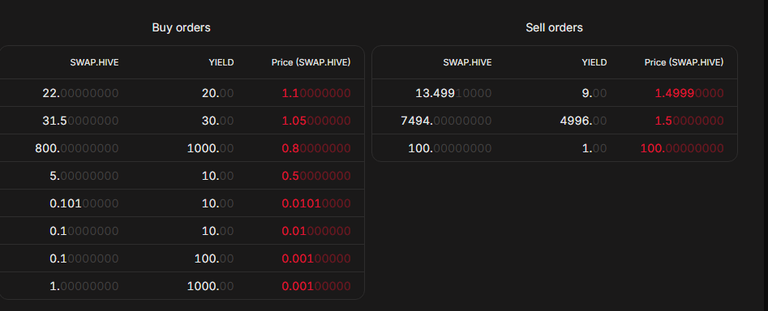

Let's take a look at what we are dealing with:

This is the game board. And before we dive into the "buys" and the "sells", and what they mean, we should first talk about the neutral option, one that every YIELDteam member should be aware of:

Strategy 1: Do nothing!

With all or part of your YIELD tokens it may be wise to DO NOTHING, and just let them sit in your wallet, comfortable in the fact that they are backed up by our debank maneuverings. At the end of each period, you will get dividends and maybe even something more.

Strategy 2: Play the Market

What does the market represent? Assuming YIELD is backed up by assets, we can in any moment calculate the NAV of YIELD. But only at the "end of period" will we clear the board, pay dividends and sell again (for a few days maybe) at NAV.

So we should think about this "game board" as a future's market.

A. "Buys"

What does a bid of 1.1 HIVE for YIELD mean? No new YIELD will be sold during this period, so only holders can sell here. A "Buy" represents a futures contract at 1.1 HIVE. If you think the end of period price will be greater than 1.1 HIVE, its a nice open contract. It pays no yield, but also costs no premium, it expires in 30 days if left unfilled.

If you are a holder and think the end of period price will be less than 1.1, it makes sense to accept the contract and sell into this buy order.

B. "Sells"

What does an offer of 1.4999 HIVE for YIELD mean? A "Sell" represents a futures contract at this price. Again it earns no yield (so must be CANCELLED at end of period to receive divs), but if you think the end of period price will be less than 1.4999 HIVE, its a nice open contract.

If you have some swap.hive and think the end of period price will be greater than 1.4999 HIVE, it makes sense to accept the contract and buy into this sell order.

Does this make sense?

I need feedback, because I have played market games with @rycharde since I was a baby learning blockchain. I want to make a really good guide post, but nowadays I wonder if it isn't better to offer a bounty to someone with more time.

Give me your feedback in the comments.

"End of Period"?

When we first announced, I thought 1 month periods would be very convenient. Now, after thinking on it and chewing the fat for over 1 week, I think I see an optimization.

Is it worth it? Let's talk it out.

Dividends can really be taken at any period, this is less concerning, but really when you math it, dividends should be targeted when HIVE is dipping.

And new sales should be done at NAV when HIVE is pumping.

Could we even be this agile? Well, once per month perhaps we could. We don't have to catch every dip and pump, but just be on the look out for good periods for this throughout the month.

Already it sounds "complicated" to explain.

I would love feed back on this as well :

Option 1: Definite monthly period (clear board 1st of month, finish divs, rebase if necessary and new sale by 7th of each month).

Option 2: Be a little more flexible, target 1 div/rebase per month, 1 fresh sale per month. Do it surprise style when we feel like it because the math says "GO".

That's all for me today on YIELD tokens, I'm back to the grind for next week already, and I've got some great stuff cooking. Luckily YIELD runs itself with the dexfinance suite of tools that definitely seem to be "autobalancing and compounding" all over the place!