INCOME token continues strong, and more people are becoming aware of the great bonuses for holding the token. This is exciting for me, because we have worked and continue to do so to bring great value to the members of the program, both the token holders as well as the projects we participate in. So achieving additional recognition is a great way to confirm that we are on the right track.

23 days ago we announced that the INCOME fund was over 90k HP, and now I am happy to say we have over 92k. Our progress is very nice, and should continue at a good pace for a bit longer. We are well positioned for what is coming.

I am hesitant to discuss some drama recently, but I should mention that I have withdrawn, hopefully gracefully, from the brofund. I was a founding member with @raymondspeaks, but I suppose conditions have changed over the years. I hope the best for Ray and his efforts - I still am a 'core team' member of the CINE tribe, which I will continue to be as long as I am allowed.

So with that said, today I will break down our official ABV, or Asset Backed Value, with an eye on adjusting our listing of our remaining INCOME minted the last time there was some interest in the token.

Main 'HIVE' positions:

So our main positions on the fund are HIVE Power, which we are actively working to grow, and HIVE SBI, which is only growing by 1 per day right now. We value each HIVE SBI unit as 0.5 HIVE value internally.

HIVE Power: 92,045.237

HIVE SBI: 20821 = 10410.5

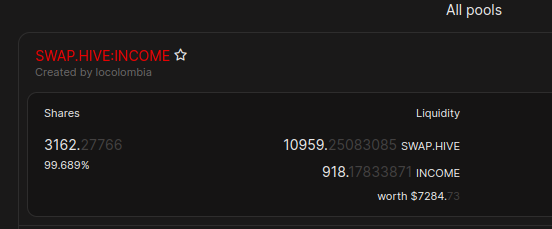

We also have a 'corporate' LP position in the Swap.HIVE:INCOME pool. The INCOME tokens in the pool are not counted as circulating, but the Swap.HIVE is counted on the fund. This may seem counterintuitive, but its actually the cleanest way to calculate, I'm open to other interpretations, but I think I've considered them all. We could potentially consider the INCOME tokens as 'in the fund', but that wouldn't make a difference in the math.

Swap.HIVE in corporate LP: 10959.25

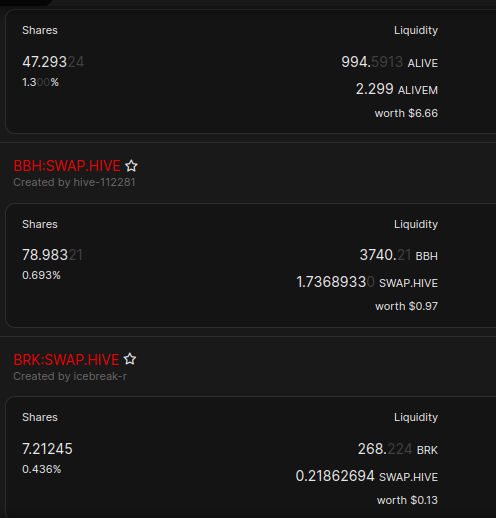

Other LPs:

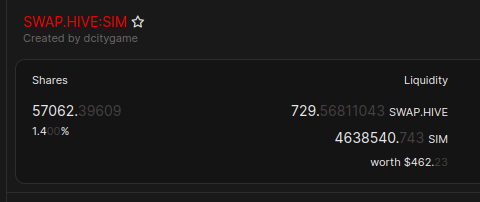

Swap.HIVE: SIM - 729.57 Swap.HIVE

Minor LP positions:

HIVE-Engine positions:

So in spite of the fact that we continually are trying to convert what is possible to convert into HIVE while HIVE is cheap, we still have a number of tokens on the account. Some of these pay dividends or provide other benefits, some are 'impossible' to sell.

Some of these positions are easier to value than others, but we do our best. If there are any questions about the valuations placed, don't hesitate to ask in the comments, I have been working on this for several days so its possible the prices on some of these items have changed slightly in the meantime.

ARMERO 24000 *0.285 = 6840 HIVE

ECOBANK 1596 *5 = 7980 HIVE

WORKERBEE 1500 * 1.5 = 2250 HIVE

ASTRA 110000 * 0.01 = 1100 HIVE

XV 364 * 2.1 = 764.4 HIVE

DBOND 535 * 1 = 535 HIVE

SIM 5.4M * 0.000165 = 891 HIVE

PIMP 52k * 0.011 = 572 HIVE

LVL 5.1M * 0.000068 = 346.8 HIVE

MYRIANODE 500 * 2.5 = 1250 HIVE

LGN 287 * 0.7 = 200.9 HIVE

DRIP 208 * 1.5 = 312 HIVE

LENM 56 * 5 = 280 HIVE

NEOXAG 210k * 0.00108 = 226.8 HIVE

CARTEL 121.31 * 5.5 = 667.205 HIVE

ARCHON 28.6k * 0.006 = 171.6 HIVE

ARCHONM 80 * 10 HIVE = 800 HIVE

BXT 125.523 * 1.16 = 158.1 HIVE

DAB 64 * 2 = 128 HIVE

VIP 100 * 1 = 100 HIVE

SCV 13956 * 0.015 = 209.34 HIVE

CHAOS 47 * 2 = 94 HIVE

FSPS 393.07 * 0.0395 = 15.526 HIVE

CTPM 5024 * 0.05 = 251.2 HIVE

CINE 117k * 0.000566 = 66.222 HIVE

CCDPACK 39 * 6 = 234 HIVE

ONEUP 29.6k * 0.0005 = 14.8 HIVE

COLT 150 * 0.108 = 16.2 HIVE

TEAMPH 151.8k * 0.0034 = 516.12 HIVE

PSX 3055 * 0.00465 = 14.2 HIVE

TOTAL: 27005.413 HIVE

Other Assets

Already, we have challenges with hive-engine tokens, where although there are markets, many are illiquid and the reason for holding versus dumping some of these tokens is precisely because we think they are worth more than we can get right now for dumping.

This is an even bigger problem in valuing some of the other assets. We have some 'super' assets in PsyberX. Will these ever be worth anything? Maybe, it seems there is some development going on with both games, although I am no longer 'in the loop', I continue to relay some recommendations through Bob, I see the chances as greater than zero. Some of the problems might be in the past, but either way can we honestly put value on these assets? Its more like a gamble at this point.

What about SPK and Ragnorak? How about DLUX? However people feel about these things, they are really in the same camp as PsyberX. Whatever the differences in how these teams present themselves, on paper these tokens are as much of a gamble on the edge as other assets, even though both/three of these projects have received DHF funding. Its funny to think about, and I of course I am not making any accusations, but perception is a powerful thing. Math on the other hand doesn't have the luxury.

Hopefully this discussion lends some credence to why we only sell new mints above the ABV, as its quite possible that our fund is worth much more than this estimate. But of course a solid estimate has value, so we do the work anyway. Which brings us to the totals.

Total HIVE assets value backing the fund: 141173.4 HIVE

Hive Power: 65.2%

Hard HIVE backing: 80.8%

Circulating tokens: 13117.283 INCOME

ABV: 10.762 HIVE/INCOME

Conclusion

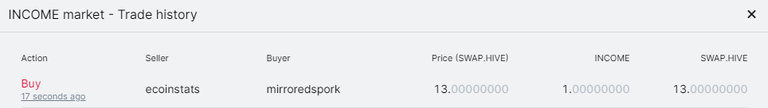

We still have 964 INCOME that we minted but never sold, we will now list them at 13 HIVE. This is sufficiently above our ABV as to account for moonshots and possible undervalue, fulfills our commitment to never sell below previous mint sales, and gives some liquidity to possible new members wanting to come in at a fair price.

Remember the daily dividend pool is fixed, so as tokens have been coming out of the pool, and if and when we sell any new tokens, the dividends will start to droop slightly. We will keep an eye on when we can compensate by increasing the daily pool. The health of the fund is the most important thing, of course divs given out are not compounded to grow, but I think we are in a good position to soon raise this number.

We have also increased the number of posts featured daily in our curation report to 15 from 14. I hope our members continue to enjoy helping us curate our voting trail daily.