Last night, I attended @cloflo's financial talk which helped us understand why it’s important to start saving early and which funds to keep in mind depending on your financial goals. Like any money talks, it can be stressful for the mind. It weighs heavy in our head space as we think about how to earn more money.

Diversifying your source of income means more cash flow, which allows you to achieve your goals faster so you have time to… retire? I find this all weird and twisted, but it’s unsurprising since this is the institution of life according to capitalism. This is what society dictates of us, common folks, who grapple with the daily struggles of surviving.

We’re well-aware of the disproportionate disadvantages of belonging to a lower social class, including the lack of privilege to be financially independent. That’s why education is key, right?

Fernando (2023) states, “By better understanding how to budget and save money, individuals can create plans that set expectations, hold them accountable to their finances, and set a course for achieving seemingly unachievable goals.”

Therefore, Filipinos must be financially literate to avoid living beyond their means, accumulating bad debts, and falling victim to financial shocks or investment frauds. Your financial education serves as your safety net when life just happens. Or your foundation to being a homeowner, a business owner, a parent, and more.

Financial beginnings and why I can't set goals

While I understand its utmost importance, I had difficulty accepting that I must have a financial goal. I grew up in a turbulent household, where I needed to be conscious of our budget from a young age. I calculated which materials in school I could save on my own so I don’t have to ask my parents. I purposefully say that they’ve already given my allowance even though they haven’t. The goal is to survive and that means serving food on your plate.

As an adult with some purchasing power, my mind automatically counts my pay and distributes it to the bare essentials. The rest would be an occasional treat, here and there. How about savings? I put away some to a depleting emergency fund – it gets used for my therapy. I'm surviving pretty well, but what now? I lost my ability to dream as I escaped our former living conditions.

“What do you want to achieve?” Clo asked.

I held back my tongue to say, “Nothing.”

I lost the art of wanting something big. Do I want to get married? Do I want to have a car? Do I want to retire early? Do I want to…

I took a moment to pause. There must be a mental block from an emotional wound, which most likely was caused by my upbringing. Ah!

It’s not that I don’t want to want something. It's just that I wouldn’t want things as a kid because I always heard my parents arguing about money. It made me feel like a burden despite wanting to ask for ice cream, a toy, or new shoes, so I suppressed all wants and told myself I was fine with what I had. As a young kid, I learned to be content, which is a good value to have, but it pushed back my childlike imagination. To imagine is to dream. Now it’s like I’m left with a paper airplane without a destination.

This tells me I have inner child work to do, mentally going back into a space where I could talk to my younger self and tell her she can trust me for her dreams and wants. I am a responsible adult and I wouldn’t allow us to reach a point when we’re wondering what’s for dinner. She has to imagine a bright future because that's what children excel in and tell me what it is she wants.

"A home please," I heard. "Then there's Ate Paw in the living room and Kate inside playing games, and our dog, Timber, running in the backyard. Oh, there's flowers! A garden of lettuce!

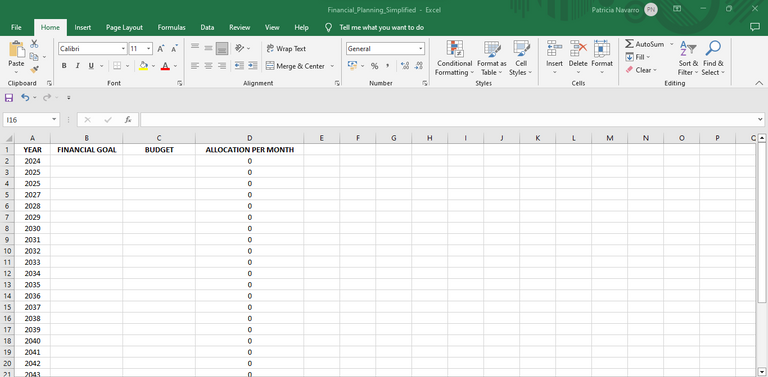

My present self took this information and wanted to translate it into concrete goals. Thankfully, @cloflo provided a sample template of a simplified financial planner that I could use to give myself an idea when I want to have a house and how much should I allocate per month.

In ten years, siguro? Hahaha.

Final thoughts

The main inspiration for this post is the thought, "What's the use of education if you don't want to do anything with it?" It sounds like a mistake, parang you are willfully submitting yourself to destruction, but as you read, meron siyang emotional wound na pinanggagalingan.

Honestly, nakakadestabilize malaman kung ano ang origins ng financial illiteracy natin. But it's up to us to break the cycle but you have to remain compassionate sa sarili mo. Still, you have to be gentle and talk to the right people. Ask for advice. It's going to be okay 💜

Thank you for reading! Salamat ulit Hive PH for hosting this talk!

ᴬˡˡ ᵖʰᵒᵗᵒˢ ᵃʳᵉ ᵐⁱⁿᵉ ᵘⁿˡᵉˢˢ ᵒᵗʰᵉʳʷⁱˢᵉ ˢᵗᵃᵗᵉᵈ.