In the last year we have experienced extreme rates of inflation as we have an upward pressure on energy and food and a decline in export as a result of Covid and the war in Ukraine. As this normalizes how will this effect your savings if you are in the EU?

It sure is shocking when you hear a monthly annoucement of inflation rates of over 10%. These are yearly rates so on a monthly scale dividing them by 12 is more representative and it is not going to do that much damage if it normalizes by the end of the year. So let's do a quick computation.

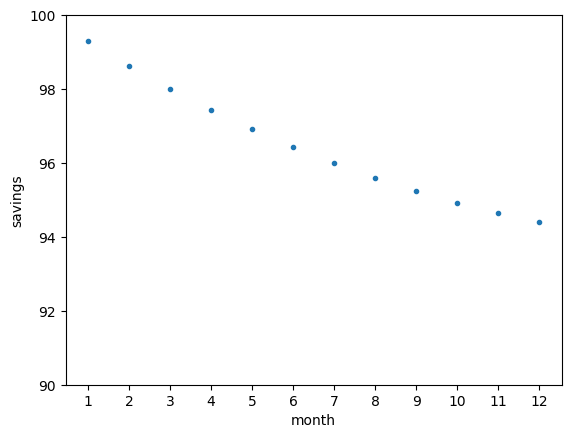

Let's assume that the inflation in January is 8.5%, EU rate, and then linearly goes to 3% by the end of the year. The 3% is just a rough esitmate based ECB historical data in Germany and the linearity is also based on some historical data, have a look over here is some nice evidence why we assume it is linear). Let's get back to the calculation. You then can just take the product of all the rates to determine the yearly inflation rate. Assuming you have a 100 euro sitting in the bank your money will inflate like this:

The data points correspond to the inflated value at the end of the month. The yearly rate is 5.6% which is fairly close to what you would get if you just do the whole computation with average rates. Also note that the reverse process will affect your savings in the same way because products commute, or in formulas a x b = b x a, so if we change the order of the rates we end up with the same number.

The dollar is sitting at about 6% inflation US rates. So it would be more optimal to convert your euros to dollars atm. I have no idea where the dollar is going to be by the end of the year but it is seems likely to be in a better shape. Seems like a better deal to get dollars. Of course putting your dollar in a HBD savings account might even get you further ahead in the game :D

I suspect this is a somewhat simplistic view on inflation but I would be happy to hear from any experts about how to create more accurate models and what the optimal ways are to dealing with inflation while minimizing risk ^^

Many thanks to mobbs for giving me a topic to write about ;)

Cat tax