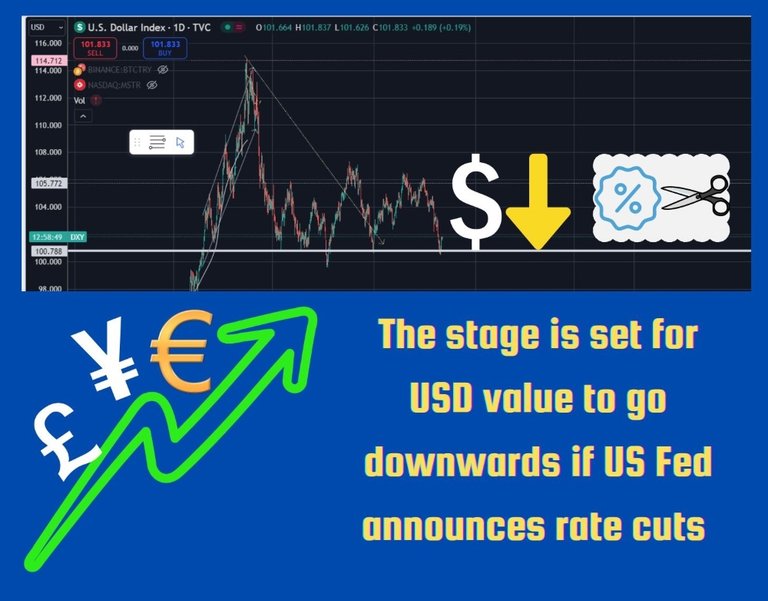

DXY index signals a trend of USD's declining value against major global currencies

On August 23rd, news was all about the DXY index with DXY touching yearly lows of 100.6 range.

Top traditional safe haven asset - USD begins to decline against other global currencies

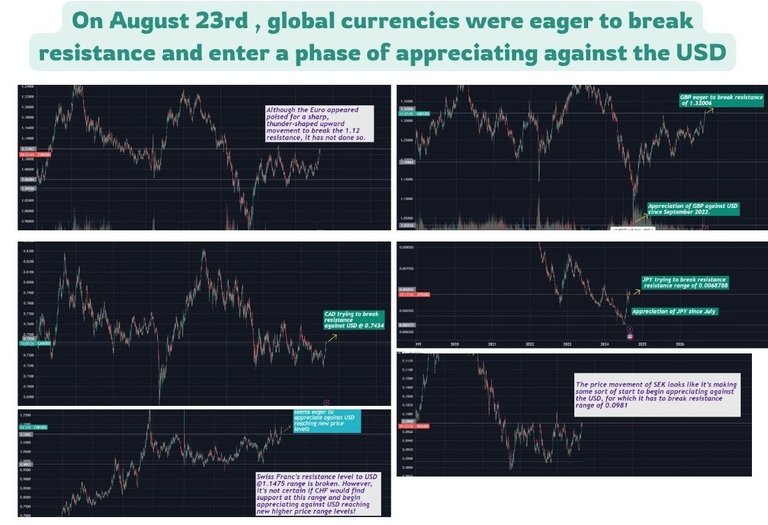

DXY measures the strength of the USD against 6 major Global currencies – Euro (EUR), Japanese yen (JPY), British Pound (GBP), Canadian dollar (CAD), Swedish krona (SEK) and Swiss franc (CHF).

Here the Euro has the most weight in the index constituting 57% of DXY index with the JPY being the next weighty currency constituting 13% of the DXY index.

When USD’s value declines, the next currency that would be considered as a safe haven asset is Euro!

Safe haven assets are investments that people turn to during times of market volatility and uncertainty. The goal is to protect the value of their wealth by moving their money from risky markets to safer investments.

Historically, traditional safe-haven assets have been the US dollar and gold.

Shifting Trends in USD Value: Interlinked with Monetary Policy Moves of US Fed

There was a phase when USD's value rose against the top global currencies due to US FED’s interest rate hikes. This led to the DXY index touching a high range of 114 on September 2022.

After this, the rising trend of DXY changed as it declined and stabilized oscillating within ranges of – 100.8 and 105.

US Fed had begun raising interest rates gradually from March 2022 from 0.25%. This rate increase phase ended on September 2023 as US Fed paused its monetary interest rate hike-cut policy. Since then the USD interest rate that's been increased to 5.5% is kept unchanged.

Banks managing other major currencies like the EURO began increasing interest rates to prevent further depreciation of their currency against USD.

Since then, the global financial community have been wondering on when will the US FED begin to cut interest rates again.

Global Financial Markets awaiting news of US Fed cutting interest rates

Now, there's speculation that the US Fed led by Chairman Jerome Powel feels that the time is ripe to initiate interest rates cuts.

Jerome Powel had given indications that US Fed is gearing up for a change in policy in his recent speech at the Jackson Hole symposium. He

stated that favorable conditions necessary for such a policy change have been met with a drastic drop in inflation and cooling down of labour markets

This statement pulled down DXY index to the yearly lows of 100.6, from where it bounced off rising above the support of 100.8 in the subsequent days.

So, there is now a huge expectation of US Fed beginning to start cutting interest rates with an announcement to that effect likely to happen at the next US Fed’s meeting on September 18.

Missing this date, US Fed may announce rate cuts on November or December, with 2 more meetings in line for the US Fed this year.

Forex traders reacted to expectations of US Fed cutting interest rate

The market on 23rd Aug had reacted to this expectation, with Forex Traders selling off USD for Euro which appreciated to 1.12 $ against USD.

Tradingview chart showing Euro/USD pair price movement

The reasoning behind the move being USD is bound to depreciate in value against Euro as price of currency appreciates when interest rates are hiked and depreciates when interest rates are cut.

Inverse Correlation of currency value with interest rate changes

When interest rates are hiked, cost of borrowing increases so money supply in the economy is reduced which reduces liquidity. When interest rates are cut, money supply is increased as borrowers can borrow money cheaply and acquire funds to invest and do other activities.

Value of money decreases with inflation in the scenario of rate cuts, and increases in the scenario of rate hikes as liquidity of money is reduced which induces people to save not spend money.

Generally, with higher interest rates people are induced to buy USD bonds, or deposit money in banks as it bears higher interest rates.

Right now, the prevailing market sentiment is that the US Fed is likely to cut interest rates by at least a 25 basis point in the upcoming US Fed meeting at September 18.

Is it the right time for the FED to cut rates???

Let us see, how much Money supply(liquidity) has decreased in the US economy due to Fed’s rate cuts measures –

M2 Money Supply measures total money supply in the economy by counting circulating cash, deposits in checking accounts and other 'near cash' deposits which can be quickly converted to cash. M2 has declined by 5% from 21.793 T to 20.638 T.

This may not be a sufficient reduction in liquidity as required as US Stock Market indices are at their peaks. There is a general feeling that stock valuations are over-valued and stretched.

These charts are of Nasdaq, S&P 500 and DJI

So, the question arises, will it be sound for the US Fed to cut interest rates now?, or would be more prudent for US Fed to take measures to reduce further USD supply in the economy before the rate cut move?

Whatever is the case, we will soon find out if the US Fed would cut interest rates this year.

I feel that if the US Fed does undertake to cut interest rates, they would do so cautiously starting with a small percentage cut of 0.25%.

The impact of that move on financial markets and US Economy should be monitored for a period before the US Fed does any other policy changes.

Hope you enjoyed reading my post. If so, give me an upvote. Thank you!

Posted Using InLeo Alpha