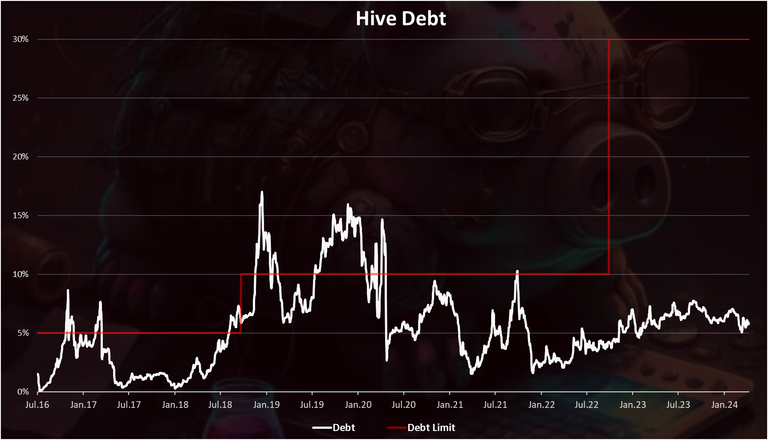

The Hive debt is an essential parameter for the Hive ecosystem. The stability of the HBD depends on it. If the Hive debt grows above the debt limit that is set by the chain, then the value of HBD will drop. Since the last Hardfork in October 2022, this limit is set to be at 30%. Before, it was set at 10% and in the very early days back in 2016 it was at 5%.

Let’s take a look how has the debt performed in these market conditions.

COVER

The Hive debt is calculated according to the following formula:

DEBT = HBD in circulation / HIVE Market Cap

Like many things on Hive it has its specifics. More details how exactly is the Hive debt calcuated.

There are nuances when calculating the debt as it is not straight forward. A few things to consider: exclude the HBD in the DHF, take the HIVE virtual supply as a HIVE supply and the feed price from the blockchain when calculating the market cap. More details in the post above.

Here we will be looking at:

- HIVE supply

- HIVE market cap

- HBD supply

- Historical debt

- Debt support price

- HBD market and on chain price

The period that we will be looking at is from the very beginning 2016 - 2024.

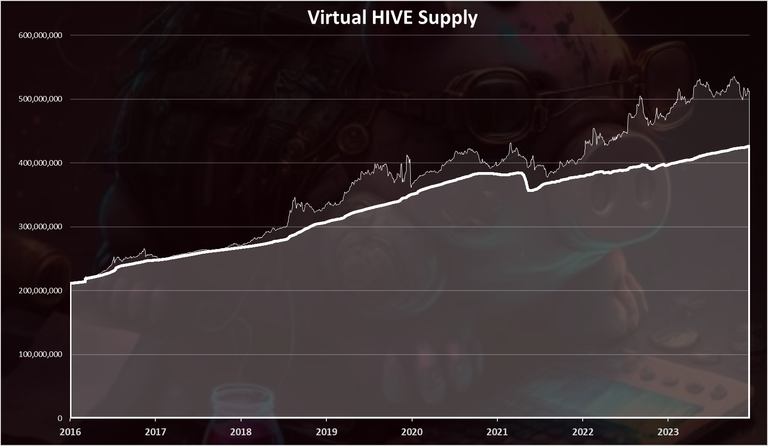

HIVE Supply

As already mentioned, when looking at the HIVE supply there are two data points. The regular HIVE supply, that is simply the amount of HIVE tokens in circulation and the second one the virtual HIVE supply that includes the theoretical HIVE that can be converted from the overall HBD supply.

Here is the chart.

This is the all-time chart for the supply starting from 2016, including the old versions 😊.

The light color on the top is the virtual supply.

We can see that the supply started from around 200M, and now we are at 426M. It doubled in a period of more than seven years.

We can also notice that in the last years we have had a drop in the supply, and ups and downs. This is due to the two ways conversions and burning HIVE for HBD.

Another thing to notice here is that the virtual supply has increased. While this is due to the low price for HIVE it is also because of the HBD in the DHF, that is included in the virtual supply. On the other hand, this HBD has increased a lot in the last two years, and it is now increasing the virtual HIVE supply. Excluding the HBD in the DHF from the virtual HIVE supply might be a better option, but the chain is set to calculate this as well.

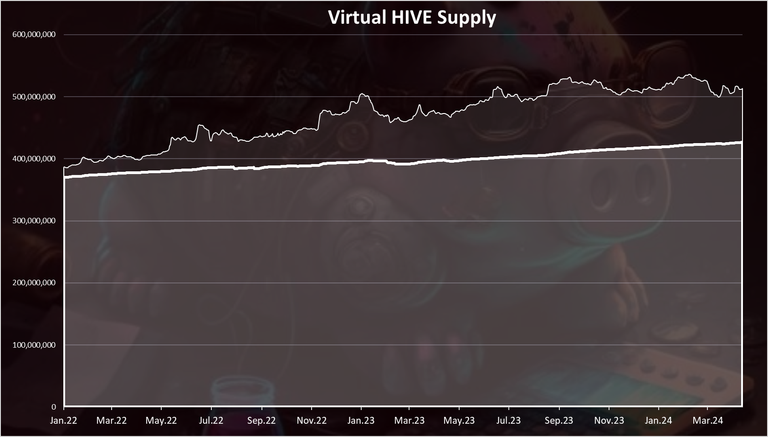

When we zoom in 2022-2024 HIVE supply, we have this:

This period represents the recent happenings. At the beginning of 2022 the HIVE supply was 370M, while at the end of 2022 it was 395M. A regular 25M increase. We are now at 426, meaning a 56M HIVE has been added in the last two years and three months, or around 25M yearly, where the projected inflation is as well.

HIVE Market Cap

As mentioned, the debt takes into account the HIVE market cap, including the virtual HIVE supply. When calculating the market cap for the debt we multiply the virtual supply and the feed price for HIVE, not the market price.

Here is the chart for the market cap:

A lot of volatility and oscillation here. It’s not a surprise having in mind the relatively small market cap of the token. In both previous bull markets HIVE reached more than 1B in the market cap. Now we are around 200M. Will see thing will evolve going forward.

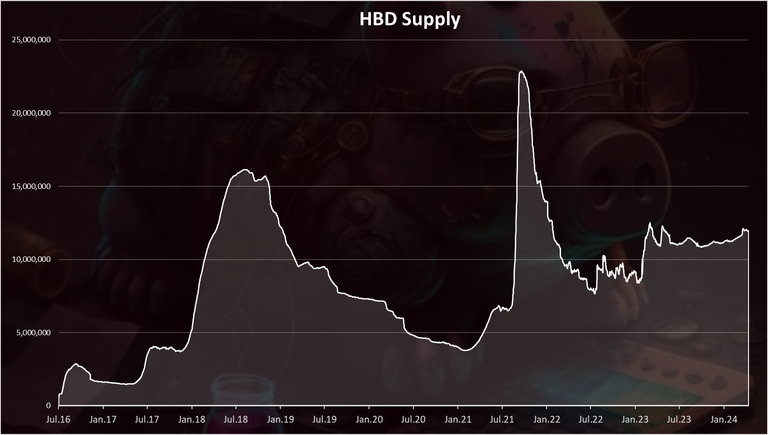

HBD Supply

Next for the HBD supply.

Here is the chart.

Note: This chart doesn’t include the HBD in the DHF that is now a dominant HBD holder with 22M.

We can notice the two peaks in the supply in both of the previous bull markets. First in 2018 when there was around 16M HBD, and then later in 2021 when for a short period of time the HBD supply reached 25M. Now we are around 12M.

Hive Debt

When we apply the above, we get:

DEBT = HBD in circulation / (Virtual HIVE Supply * Feed Price)

DEBT = 12M / (517M * 0.38) = 6.1%

A 6.1% debt in April 2024. Things have been volatile in the last days, so this number will change fast.

The chart for the historical debt looks like this.

This is the all-time chart starting from 2016. We can see that in the past the debt limit was broken on two occasions.

First in 2018 and it lasted for a short period of time, and then again in 2019 and it lasted for six months.

In October 2021 there was another breach of the 10% limit but for just a few days. This happened after a massive expansion of HBD in August 2021 when a lot of HBD was created because of the high HBD price, the supply was at 24M, but it was fast converted back, pushing the HBD supply down, and the debt.

After the last change and the increase in the debt limit, we are now far from breaching it. In fact, from the creation fork for Hive, back in 2020, the debt limit didn’t have any significant breach and the HBD price didn’t break the peg on the downside.

The overall debt has slightly increased int the last two years, going from around 4% to 6% and has been hovering around this spot for a year now. Far from the 30% limit.

One conclusion that we can get from the above is that HBD holders seem to be careful with HBD, they know the risk of HBD losing the peg if the debt is reached and everyone is adjusting their positions reducing the HBD supply in the bear market.

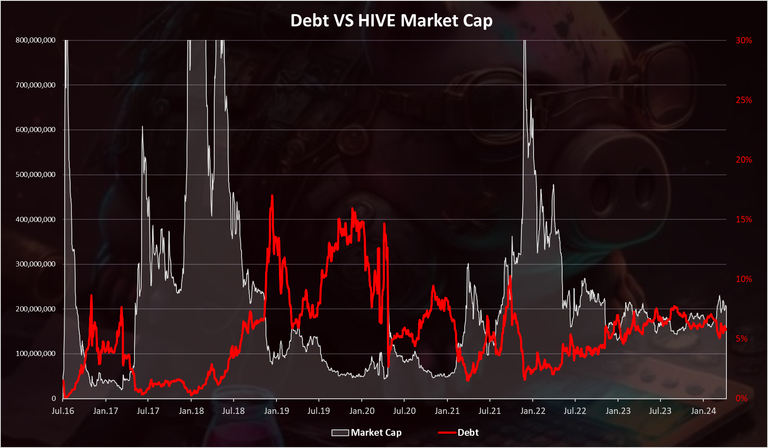

Debt VS Market Cap

Now a few comparison charts against the debt.

First the market cap.

If we plot the debt and the market cap on one chart, we get this.

The overall trend here is the drop in the market cap is inversely correlated with the debt. As the Hive market cap drops, the debt increases. Although we can notice that it has been a much smoother ride in the last two years, unlike the first years.

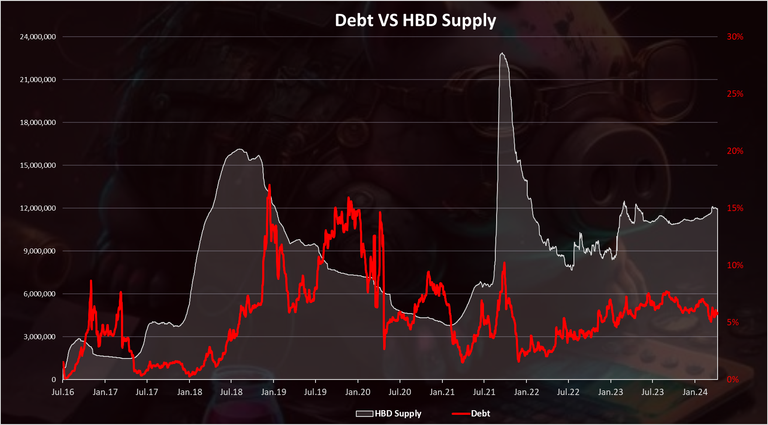

Debt VS HBD Supply

Here is the chart showing the debt against the HBD supply.

Some trend from above is first we have an expansion in the HBD supply and then an increase in the debt. The debt usually lags a bit after the expansion of the HBD supply.

But again, we can see that in the last two years we have had a more stable situation with small increases in the HBD supply and the debt.

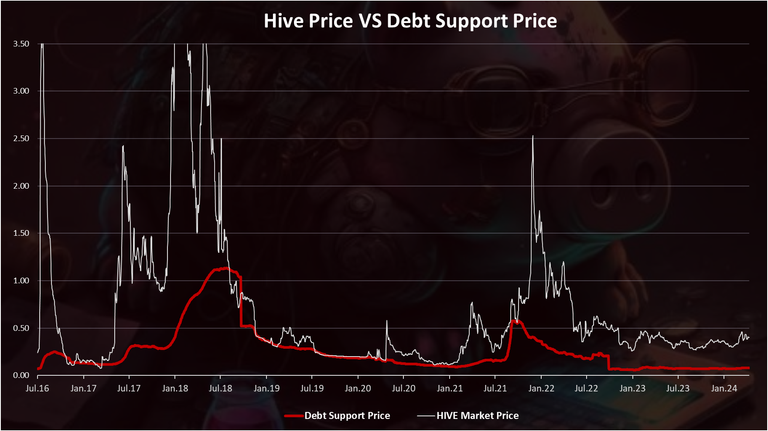

Debt Support Price

The debt support price represents the Hive price that supports the current amount of HBD in circulation. If the Hive priced drops below this price, and the HBD in circulation remains the same as it is at the moment then that HBD will no longer be valued at one dollar.

At the moment this price is at around 7 cents for 11.1M HBD in circulation and a 30% debt limit.

Historically the chart looks like this.

The white is the regular, with red is the debt support price.

We can see these two follow each other in a self-balancing act. In the first bull run in 2017, the HIVE/STEEM price increased, so does the debt support price and it was at $1 for a moment. Then the HIVE/STEEM price dropped and crossed the support and HBD/SBD lost its peg in 2018. The excess amount of HBD/SBD was slowly removed trough the years, and the HIVE/STEEM price increased above the support.

Another cycle repeated in the last bull market in 2021, but this time the increase in the support price was not as high, and when the pull back happened, the regular HIVE price didn’t touch the debt support price. As we can see the two lines came together closely on two occasions, in December 2020, and for a short period of time in October 2021. At the moment these two a very far apart after a long bear market. Although we can notice the drop in the support price back in October 2022, this is after Hardfrok increased the debt limit and lowered the debt support price. For a 10% debt limit, the current support price is somewhere around 20 cents.

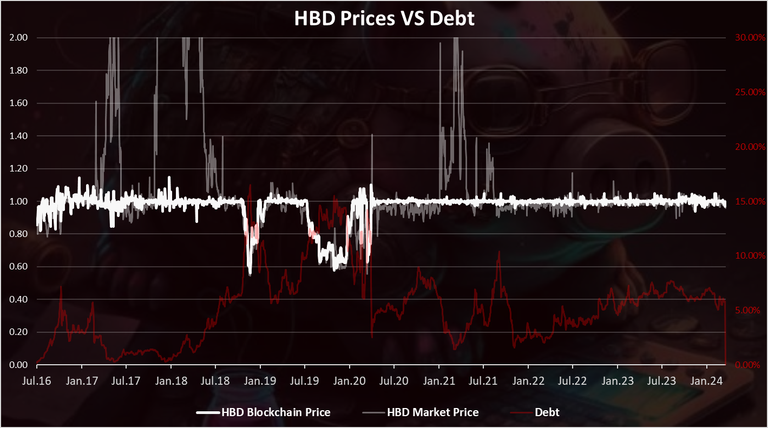

Debt VS HBD Prices

The one thing that everyone around doesn’t want to see is a drop in the HDB price.

But HBD losing its peg is by design and it has happened in the past. The debt is the key parameter when this happens.

Here is the chart.

This is a long-term chart for context.

The strong white is the HBD price that the blockchain provides when converting HBD to HIVE. The grayed out is the HBD price on the external markets and the red is the debt.

We can see that the market price for HBD, formerly SBD, has never dropped significantly below the price levels that the blockchain provides. The gray line has not dipped significantly below the white line. Also, it is worth noting that the market price for HBD can be wrong at times, because of low liquidity, no exchanges listings and bed coin aggregators’ prices.

The blockchain price itself has lost its peg whenever the debt was above the limit. For a short period of time in 2018 and once again in the second half of 2019 when it lasted longer, for more than six months. In this period the debt level was more than 15%. The HBD/SBD price at the time reached as low as 0.6$.

What price will the blockchain value HBD after the 30% debt limit is reached?

This depends on how high the debt is. If the debt is higher, the HBD price will be lower.

Example table:

| Debt level | HBD On Chain Price |

|---|---|

| < 30% | 1.00 |

| 40% | 0.75 |

| 50% | 0.60 |

| 60% | 0.50 |

As we can see from the table, for a debt level between 30% and 40%, the HBD on chain price will be in the range of 0.75 to 1.00. For a debt level higher than 50%, the HBD on chain price is closing on the 50 cents mark. But as we have seen historically the lowest the lowest HBD/SBD has been 60 cents. Now with the increased debt limit, it is even harder to reach such lows, as there will need to be a significant increase in the HBD supply on one side, and a sharp drop in the HIVE price. While not impossible it is very hard to happen, especially in a short time frame, as the two contradict each other.

Live data for the Hive debt here:

https://www.hbdstats.com/

All the best

@dalz