This post has been compiled and uploaded to explain each part of the EDS ecosystem and how everything feeds into EDS. By the end of this post, you should understand EDS completely.

- 1/ What are EDS tokens?

- 2/ What are EDS miners?

- 3/ What is EDS-vote

- 4/ What are EDSD?

- 5/ EDS eco-system - All Working Together

- 6/ EDS Flip

1/ What are EDS tokens?

EDS is an inflation-proof HIVE income Bond/token. Each EDS is backed and pegged to 1 HIVE with the price never increasing or decreasing. Investors simply hold EDS in their hive-engine wallet to receive a HIVE income payment each Monday. No staking is required. The weekly HIVE income pool is equal to a 12% APY of the @eddie-earner HIVE POWER balance. This is worked out like this.

Weekly HIVE income pool formula

- @eddie-earner HP Balance * 0.12 / 52.18

EG,

100,000 HP * 0.12(%) / 52.18 (weeks in 1 year) = 229.97 (Weekly HIVE income pool)

EDS is a 100% HIVE-based token so everything it receives is converted to HIVE and powered up to the main account @eddie-earner. EDS tokens were launched in August 2020 with a hardcap of 500,000 tokens and a public sale of 20,000 EDS tokens at 1 HIVE each. This public sale was a one-time-only sale and the remaining 480,000 EDS will be minted until 2042. Please see EDS allocations below.

- 20k - Public sale (finished)

- 300k - EDS Miner tokens = EDSM & EDSMM tokens

- 60k - EDSD Token = HBD-backed token to reward EDS

- 120k - EDS-vote - HP Delegation to EDS reward service

EDS mintage is slow and is projected to take another 18 years before all 500,000 are in circulation. We have planned a slow release of EDS tokens over a long period because we must ensure all EDS that are minted are backed with 1 HIVE/HP each. Since its launch in August 2020, EDS has never fallen under its peg and never will while under my management.

HP balance growth is built into the EDS model through how it handles its HIVE and HP incomes against having to pay out HIVE incomes. HP growth is very important to EDS because it ensures the weekly HIVE income pool increases each week. We earn HIVE and HP through HP leases, delegations, HP inflation and content rewards from weekly update posts. We base the HIVE income payments on a 12% APY of the HP balance because this is the minimum amount we should earn from HP and any income over 12% is saved/compounded into the HP balance. We can earn 18+% based on getting 12-15% from private leases, 3% from HP inflation and 2-6% from content rewards. EDS-vote and EDSD boost this further again.

- How @eddie-earner HP growth works example

If we have 100,000 HIVE POWER

We earn an 18% APY equal to 345 HIVE per week

We pay out 12% of 100,000 as HIVE income pool equal to 230 per week

We can power up the remaining 155 HIVE to @eddie-eaner

This is equal to over 6% HP growth on the HP balance per year

This results in the EDS HIVE income pool increasing by 6% per year making your HIVE income payment inflation-proof.

The End Goal for EDS

The end goal is to sustainably mint EDS tokens into circulation that are backed by 1 HIVE each until all 500,000 tokens are minted. By this time, the @eddie-earner account will have a HP balance of over 500,000. When all EDS are minted and circulating, the EDS APY for HIVE income payments will increase massively because we will earn the same HIVE from our HP balance but no longer need to back new EDS tokens.

We will have an ever-increasing HP balance and a hardcapped token resulting in a higher HIVE income payment each week being split into a set amount of tokens. Inflation and future proof.

2/ What are EDS Miners tokens?

EDS has 2 sold-out miner tokens.

- EDS-Miner - EDSM

- EDS-Mini Miner - EDSMM

Both EDSM and EDSMM are set to reward a yield of 20% on average per year for 20 years in EDS tokens. Both miners distribute EDS using the same hive-engine code as many tribe miners use which is lotto-based. Below is some key information about EDS miners.

| EDS Miner Stats | EDSM | EDSMM |

|---|---|---|

| Minted | 2500 | 50,000 |

| Each sold for | 10 HIVE | 1 HIVE |

| Total HP raised | 25,000 HIVE | 50,000 HIVE |

| EDS Allocated for rewards | 100,000 EDS | 200,000 EDS |

| Reward draw frequency | Every 8 hours | Every 1 hour |

| Reward amount (20 rewards per draw) | 0.228 EDS | 0.057 EDS |

| EDS minted per day | 13.68 EDS | 27.36 EDS |

| EDS minted per YEAR | 4996.62 EDS | 9993.24 EDS |

Both miners combined mint 287.28 EDS per week, 14,990.27 per year. These mintage amounts are set in stone and will not change anytime in the future. This lets EDS slowly and consistently mint new EDS into circulation while being able to back them with HIVE/HP at the same time. Because EDS miner rewards are set, we are minting the same amount of EDS into a larger circulating supply each year which results in a decreasing EDS token inflation. EDS's inflation will drop to 0% in around 2042 when EDS miner rewards stop and EDS hardcaps at 500,000 circulating tokens.

- Example of EDS miner inflation

In 2024, we have 50,000 circulating EDS and EDS miners mint 15,000 tokens. This results in a 30% EDS token increase.

In 2039, we'll have 450,000 circulating EDS and EDS miners mint 15,000 tokens. This results in a 3.34% EDS token increase.

Impact of EDS miners on EDS

We sold 75,000 HIVE worth of miners and all that HIVE was powered up directly to the @eddie-earner account. This meant that EDS powered up HIVE alot faster than it minted EDS tokens and now we have a large surplus of HIVE/HP for backing newly minted EDS tokens. Remember, the EDS HIVE income pool is equal to 12% of the @eddie-earner HP balance so when the last EDS miners sold out, the EDS APY had peaked at over 37%. This is because we had around 100,000 HP feeding a 12% APY into only 30,000 EDS tokens priced at 1 HIVE each.

Since EDS miners sold out, the EDS APY has been on a slow decline as per its model. Between 2023 and 2024, the APY dropped from 37% to 28% with a current weekly decline of under 0.13% per week. As our HP balance/income grows and EDS miner rewards are set, the EDS APY decrease slows down to a point when it starts to increase. We call this the EDS flip. This is when EDS can produce enough income to pay both the weekly HIVE income pool and back newly minted EDS without having to eat into its HP balance surplus. EDS mining rewards are set but our HP balance earning and growth potential is unlimited.

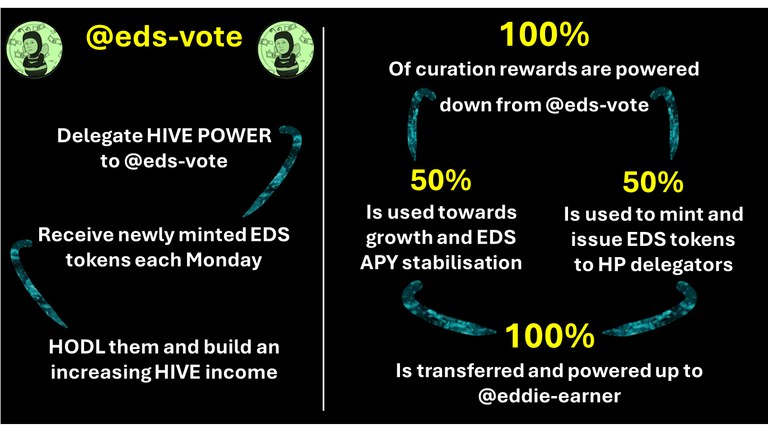

3/ What is @eds-vote?

This curation account is set up to reward EDS tokens in exchange for HP delegations to @eds-vote. The idea is that not everyone has liquid funds to buy EDS or EDS-related tokens but everyone has HP so anyone can mint EDS tokens via HP delegation opening EDS up to the whole HIVE community.

Each HIVE account gets 1000% of voting power each day (x10 max upvotes per day). We have split our voting power between proxy curation and small upvotes for @eds-vote delegators and EDS token holders. Those delegating over 1000 or 2500 HP will receive an upvote and those holding over 100 EDS will receive a small upvote. Upvotes from @eds-vote are not guaranteed and should be considered a bonus if you receive them.

@eds-vote's sole purpose is to mint and distribute EDS tokens backed with curation rewards. Questions about upvotes will fall on deaf ears but I update auto voting 1-2 per month when I have time.

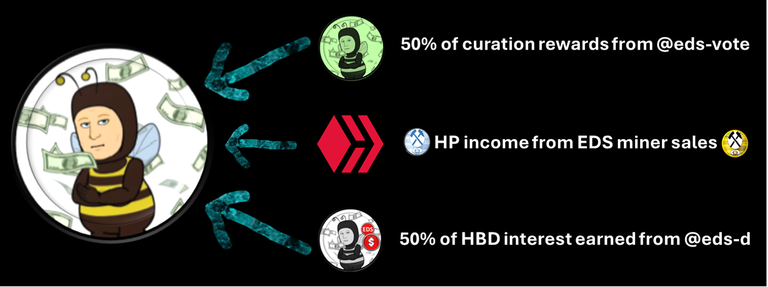

All HP earned from curation is powered down from @eds-vote and transferred to be powered up in the @eddie-earner wallet. We use 50% of the curation rewards to mint EDS tokens into circulation. The remaining 50% is used toward increasing the weekly EDS HIVE income pool thus adding value to EDS.

In the table below, you can see estimates of how long EDS-vote can run for depending on how much HP is being delegated in and how many EDS it will mint per year versus its allocation.

| HP Delegated in | Run Time | EDS Minted Annually |

|---|---|---|

| 50,000 | 20.62 years | 2000 |

| 100,000 | 15.14 years | 4000 |

| 150,000 | 13.52 years | 6000 |

| 200,000 | 12.23 years | 8000 |

| 250,000 | 9.80 years | 10,000 |

| 300,000 | 5.70 years | 12,000 |

| Delegating 1000 HP yields | NA | 40 EDS per year |

** Based on earning an average of 8% APY from HP curation

*** The EDS allocation set aside for @eds-vote rewards is 120,000 EDS

Impact of @eds-vote on EDS

EDS-vote powers down all the HIVE it earns from curation rewards and mints 1 EDS for every 2 HIVE it powers up to @eddie-earner. This ensures each EDS token minted from @eds-vote is backed with HIVE/HP while also adding growth directly to the @eddie-earner HP balance.

Currently, EDS-vote funnels 400 HIVE per week into @eddie-earner. This 400 HIVE mints 200 EDS and increases the EDS HIVE income pool by roughly 0.90 HIVE each week. When we power up HIVE faster than we mint EDS tokens, we increase the EDS APY which speeds up the EDS flip. The more HP being delegated to @eds-vote, the more EDS we mint, the HIVE income pool increases quicker and we get closer to the EDS flip faster. @eds-vote so far has been a game-changer for EDS.

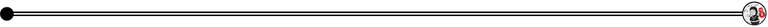

4/ What are EDSD tokens?

EDSD tokens are EDS Dollars. EDSD tokens act as a HBD bond being backed and pegged to 1 HBD each. Investors can buy these directly through their HIVE wallet and cash out any amount with a 3-day cash-out time. All incoming HBD to the @eds-d account is added to the savings wallet.

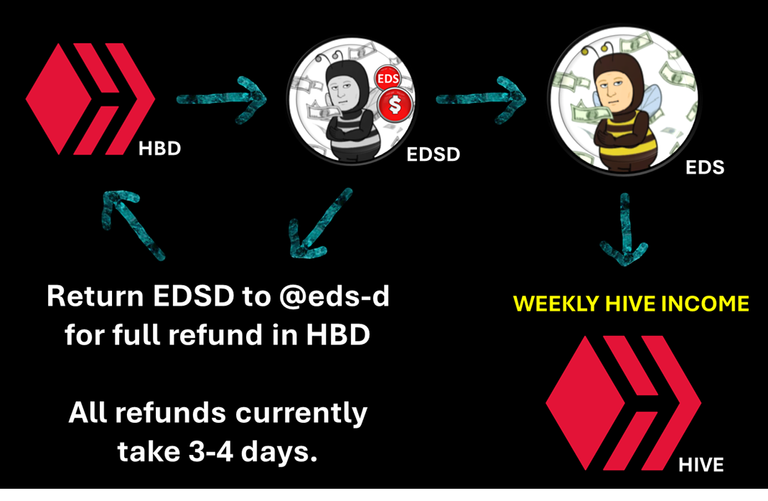

The reward model for EDSD is the same as EDS-vote with 50% of rewards being used toward minting new EDS and the remaining 50% being powered up to @eddie-earner. In this case, the rewards are monthly HBD interest payments. The main USP for EDSD is that it converts HBD interest payments into HIVE each week and mints EDS with that HIVE. This is unique because the amount of EDS that is minted each week depends heavily on the HIVE dollar value and HBD to HIVE conversion rate. Because EDSD adds this HBD to HIVE weekly conversion, we add an element of gamification to the EDS ecosystem because each week, the EDS mintage from EDSD is different.

When HIVEs dollar price is low, EDSD will mint more EDS and in reverse when the price of HIVE is high, EDSD will mint less EDS. From my POV, HIVE under $1 is cheap and when we think 10+ years out, under $1 is very cheap.

If we think long-term which we do, earning 20% with HBD is good but HBD will never increase in value and it is pegged to 1 dollar which is losing value/spending power due to inflation. Taking your HBD interest as EDS tokens that are pegged to HIVE which over time should increase in value might yield more long-term. Plus you'll earn a growing weekly HIVE income from your EDS rewards.

To make a case why EDSD could yield better than HBD savings wallet long-term. HIVE bottomed at 9 cents in the 2018-2021 cycle and has bottomed at 25 cents in the current cycle. Thats a 3x difference bottom to bottom which is much better than earning 60-80% from compounding HBD at 20% per year for 3 years. If you believe HIVE's price will increase each cycle as I do, it's a no-brainer.

Example

If HIVE goes to $2 in this coming cycle, all the EDS issued by EDSD at under 40 cents would be worth 5x the dollar value. This would be equal to earning a 50% APY for your HBD if sold at that time.

EDSD was started with a 500 liquid HBD kitty balance its holds in @eds-holdings. This liquid balance is used to fund the weekly reward. When the @eds-d account gets its monthly HBD interest payment, it withdraws it and sends it to the @eds-holdings account to back up the kitty. Only the interest is withdrawn from @eds-d, this can be verified at any time by checking the HBD saving wallet balance against the current circulating EDSD supply. Having this kitty lets EDSD pay out weekly rewards.

Impact of EDSD on EDS

All of the HBD interest earned from the @eds-d HBD balance is converted to HIVE. 50% is used to mint EDS at the value of 1 HIVE each and the remaining 50% is powered up to @eddie-earner. As with EDS-vote, this model powers up 2 HIVE for every 1 EDS minted. This ensures each EDS token minted from @eds-d is backed with HIVE/HP while also adding growth directly to the @eddie-earner HP balance.

5/ EDS eco-system - All Working Together

Everything under EDS (EDS miners, EDS-vote and EDSD) has been created for 2 reasons.

1 - As a way to sustainably mint new EDS into circulation

2 - To accelerate growth for the @eddie-earner HP balance

We have the end goal for EDS to ensure all 500,000 EDS are backed to at least 1 HIVE/HP each when the hardcap takes place and because this is a #1 priority, this was factored in heavily when creating the models for EDS miners, EDS-vote and EDSD. We have also made each sub-project investment currency different. EDS & EDS miners are traded for HIVE, EDS-vote deals with delegated HP and EDSD deals with HBD covering the 3 main ways people invest within HIVE.

The EDS eco-system has been modelled to ensure EDS can not fail. I don't say that lightly either, it's not possible. By the time the last EDS is minted into circulation, the @eddie-earner balance will be at least 500,000 HP. Here are a few key numbers you should be aware of.

- The @eddie-earner account currently has 110,000 HP (at time of writing)

- We use the 20,000 HIVE EDS presale and 75,000 HIVE EDS miner sale money to pay weekly HIVE incomes.

- We power up a surplus of over 6,000 per year from all incomes directly earned from @eddie-earner after HIVE incomes are paid.

- EDS-vote has an EDS allocation of 120,000 that are minted 1 EDS for every 2 HIVE it creates. When EDS-vote mints the last of its allocation, 240,000 HIVE will have been powered up to @eddie-earner.

- EDSD has an EDS allocation of 60,000 that are minted 1 EDS for every 2 HIVE it creates. When EDSD mints the last of its allocation, 120,000 HIVE will have been powered up to @eddie-earner.

If it takes 20 years for EDS-vote and EDSD to issue their allocations

- Current Balance = 110,000 HP

- 20 years of powering up surplus earned HIVE = 120,000

- 120,000 EDS minted from EDS-vote = 240,000

- 60,000 EDS minted from EDSD = 120,000

Totals = 590,000 HP

I show the example over 20 years because EDS miner rewards will have stopped by this point and this will be the earliest time EDS will be able to hardcap. I have also not factored in HP compounding or increased earnings to show conservative numbers. It's better to set the bar low and then clear it by miles!

That is how everything within EDS works together and feeds into @eddie-earner and how it's not possible for EDS to ever fall off its peg of 1 HIVE. By the time we hardcap EDS, its HP balance will be closer to 1,000,000 than 590,000 🚀.

6/ When will the EDS APY flip happen?

This is no longer as easy question to answer because the answer is changing all the time. When EDS was only EDS and EDS miners, we could predict HP incomes and EDS miners mint a set number of EDS so this was easy. When we added EDS-vote and EDSD, they added a lot of new variables into the mix and we can no longer show charts and tables because they would be soon outdated. What if EDS-vote lost 100k in HP delegations as an example, this could add months to the flippening.

I can still look into my projection spreadsheets and make a decent ballpark.

Based on all of today's numbers as of 24th March 2024, the EDS APY bottom will happen in 442 weeks at 16.71% and then it will start to increase in 459 weeks. By the time we hardcap, we're projected to have 930,843.47 HP. These projections factor in HP compounding and earnings growth.

It's an ever-changing number but one thing is for sure, it'll not happen anytime soon and EDS is 100% for the long-term investor. Think of your EDS as burnt and now you get a lifetime of weekly HIVE income payments paid out each Monday. The flip will happen when EDS is ready, there are ways to speed it up but for the foreseeable future, we are minting EDS slowly into circulation, we're growing the HP balance nicely and EDS token holders are enjoying weekly HIVE incomes equal to over 20% APY. We are not in any rush, happy with growth and ok to let the model do its thing over time.

FAQ'S

(Populated from questions in comments)

Last edit - 04/05/2004