Hello SPIers, today we look into an S&P500 investment SPI made a few years back. We rarely talk about our SP500 investment because it is a fairly boring investment but its been increasing since we bought it and I thought it would be good to give everyone an update.

(Charlie Munger - Warren Buffet's business partner/right hand for 45 years)

What is the S&P500?

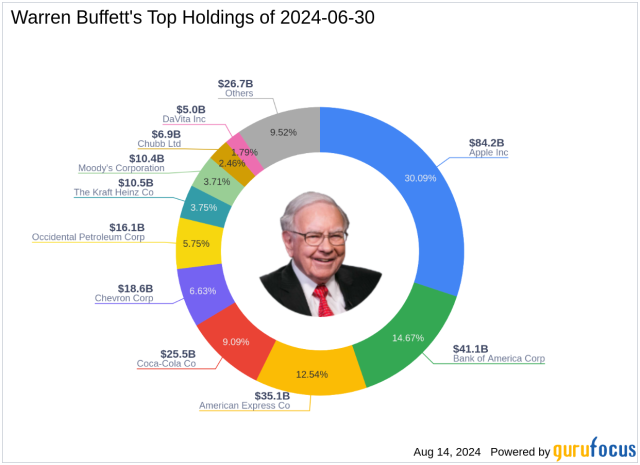

The SP500 index fund tracks 500 of the largest, publicly-traded companies in the US. These include Apple Inc, NVIDIA, Microsoft, Amazon, Meta, Tesla, Alphabet and many other American companies.

It is commonly used as a benchmark for investors meaning they will compare their returns to the SP500 to see if they under or over-performed in the market with 95% of "Professional" fund managers not being able to beat it. Over the last 50 years, the S&P 500 has yielded an average of 8% annually. This has increased to an average of 9% over the past 20 years. These averages do not include reinvesting dividends.

There are thousands of different indexes, the FTSE index for example tracks UK companies, a world index like VOO tracks global companies. Some indexes will specialize in high-yielding dividends, others will invest only in ethical companies or only tech companies, etc, but the SP500 index is by far the most popular worldwide. It is the go-to fund for most people so it's the one we will start with for SPI.

Warren Buffett's advice to his wife is to invest 90% of her inheritance in a low-cost S&P 500 index fund which speaks volumes of the credibility of the fund. Personally, I'd go 50/50 SPY and VOO but thats just me as a non-American having a little faith in the rest of the world.

Why SPI invested?

As we move through crypto cycles and the size of the fund grows, it only makes sense to move profits during bull years into safer investments focused more on long-term holdings that are never touched. We took a little profits from the last bullrun, held HBD for a while and at the start of 2023, we jumped into the world of stock investing.

Long term. Most of the world's innovation is coming from North America and has been for decades. Companies like Mircosoft, Alphabet, NVIDIA and Amazon are the most valuable in the world. Technology will only be used more in the future and these companies will continue to dominate. Long term, money will be in tech companies and the SP500 contains the best in the world. Good to hold 20-50 years and HODL gang.

Our Investment

In February 2023, I made 3 deposits of $800 each to eToro and invested it into a SPY ETF. This is one of the most popular S&P500 indexes. Please see below how it has performed for us. (I wish eToro displayed it like this for me,😂)

| Date | Stock Value | Dividends | Cash Wallet | Yield |

|---|---|---|---|---|

| 28th Feb 2023 | $2400 | $0.00 | $0.99 | 0% |

| 31st Dec 2023 | $2952.38 | $31.78 | $32.77 | +23% |

| 31st Dec 2024 | $3666.91 | $36.88 | $69.65 | +24% |

| 15th Jan 2025 | $3643.36 | $0.00 | $69.65 | -2% |

| Result | +$68.66 | +51% |

It looks like we jumped in at the perfect time 2 years, our $2400 invested has increased by 51% which is way more than the expected 8-9% per year. We have earned $69.65 from dividends so thats a little cash to reinvest someday, maybe a few oz's a silver 🩶

My Thoughts

Stock markets are continually hitting new time highs, we've been lucky the first 2 years and I think either this year or next year, we'll get a bad year and see a double-digit loss. The plan for us is to just hold it and add to it each cycle. Last cycle, we put in $2400 to test it all out and see how it works. This cycle, it would be nice to deposit $10-25k into this depending on how well we do by the end of 2025.

Long-term thinking, having a small allocation of the fund in real-world assets helps SPI become more diverse and gives us exposure to the stock market and a hedge against crypto. As the fund grows through the years, this allocation will also grow. Having 99% of assets in crypto with a fund worth under $1M is ok cause we're growing and need to be more risky. If the fund were worth $10M, we might want 30-40% in the stock market because ultimately our focus will have changed from aggressive growth to passive growth using more stable investments.

Why dont we have a Crypto500 index? Seems like a no-brainer and not that hard to set up. You could have the top 50,100 and 250 indexes. Maybe it has been tired and I've never seen it. I'd love to run a project like that but it could not be done on HIVE, it could be done but it would not be worth it cause there is no money on HIVE. An idea like that would need to be an ERC-20 token on ETH where the proper money is and then bridged out to other chains.

Anyways, thinking to ramble on. Thats a wrap, i hope you liked this update and if you never knew SPI had some S&P500 ETF's, now you do and we're already up 51% 🚀

Thanks for checking out the post

HAVE A GREAT DAY!

Getting Rich Slowly from June 2019

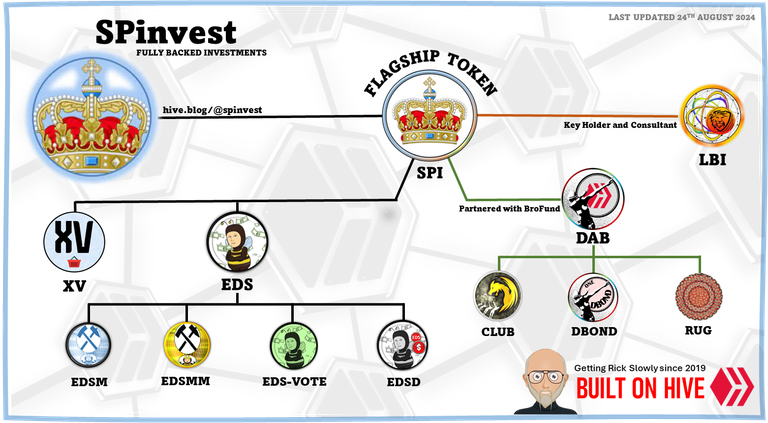

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDSI |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| EDS-vote | @eds-vote | n/a |

| EDS DOLLAR | @eds-d | EDSD |

| DAB token | @dailydab | DAB |

| DBOND token | @dailydab | DBOND |

| RUG token | @rugem | RUG |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server