Hello SPIers, Welcome to 2025.

We have started this year with a fund worth just over $200,0000, up around $60,000 from the start of 2024. This will be the last year we expect our bags to pump in this current cycle, so let's try to make the most of it. This will be SPI's second bull year and much was learnt during 2021, not so much what to invest in but when to invest, sell out and HODL. I sold alot of stuff at the start of 2022 but by halfway through the year, SPI's next few years were obvious. This is a simplified version but...

2022 - Continue to liquidate defi positions and sell rewards to USDT

2023 - Buy ALT tokens to HODL & build out SPI eco-system (xv token)

2024 - Convert 1 BTC to HIVE when the ratio reached 1 BTC to 200k HIVE

2025 - Sell ALTS and HIVE for USDT

2026 - Chill, collect interest and liquidate earnings into USDT

2027 - Use USDT to get 2 BTC back and invest the rest into ALTS & HIVE

2028 - Repeat from 2024

Happy New Year! The year to sell

We have done everything we should have for the past 3 years, bought and built at the right time, converted BTC into HIVE at our target and HODL'd the rest. This year should be pretty easy because we have to sell. I dont worry about trying to hit the market tops, im sure whatever price we sell cryptos at in 2025 will be higher than the price of that crypto in 12-24 months time. Meaning if I sell ETH at $5k and it goes to $8k, I dont care because it'll be back to under $3k by the start of 2027.

Lots are saying this is a super cycle much like gold had when ETFs were introduced but gold does not have havling cycles so I reckon we're on a 4-year cycle until BTCs dominance over the market drops alot. Supercycle are not, this time next year, USDT will be our biggest single holding. SuperSimple 😁

Powerdown Started

In preparation for having to sell some HIVE as part of our BTC trade, I have started a full power down of the @spi-store account for 200k HIVE. Why so early? Well, the markets dont just go up and normally during a bull year, there is normally a run during Spring, a correction in Summer and then the final run toward the end of the year. An opportunity to sell high, buy low, sell high might arise. HIVE went from $0.84 in March 2021 back down to $0.20 by June, and BTC dropped over 50% during the same time. The cost is 180 HIVE a week from potential curation income which is like dust compared to the upside of holding liquid.

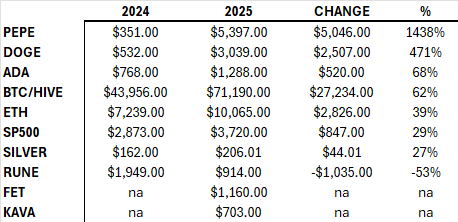

Comparing the Start of 2024 with 2025

Not too surprising to see that meme tokens are the best performers of the year for us. We bought our PEPE for $130 so our gain to date is sitting at around 41x. This could be worth remembering for the start of 2028 maybe that meme tokens pump.

Im happy to see non-crypto holdings as well, our bags in SP500 and silver are small but it's nice to see them increase. As SPI grows, we will get more involved with traditional investing so these are just small bags to show these are good investments.

Thank you for checking out this update

Happy New Year Everyone!

Getting Rich Slowly from June 2019

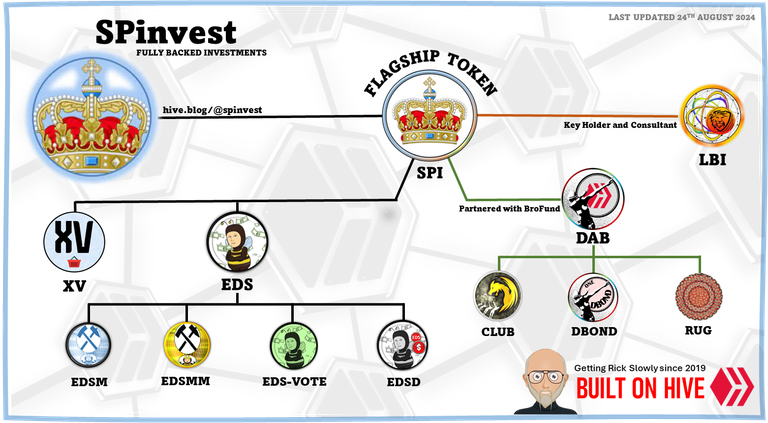

| Token Name | Main Account | Link to hive-engine |

|---|---|---|

| SPI token | @spinvest | SPI |

| LBI token | @lbi-token | LBI |

| Top XV token | @spinvest | XV |

| Eddie Earners | @eddie-earner | EDS |

| EDS miners | @eddie-earner | EDSM |

| EDS mini miners | @eddie-earner | EDSMM |

| EDS-vote | @eds-vote | n/a |

| EDS DOLLAR | @eds-d | EDSD |

| DAB token | @dailydab | DAB |

| DBOND token | @dailydab | DBOND |

| RUG token | @rugem | RUG |

Stay up to date with investments, and fund stats and find out more about SPinvest in our discord server