Hello, SPIer's. Today is Sunday and we end the SPI week with our weekly dividend payment this evening and every Sunday at 21.00 GMT.

What is SPI?

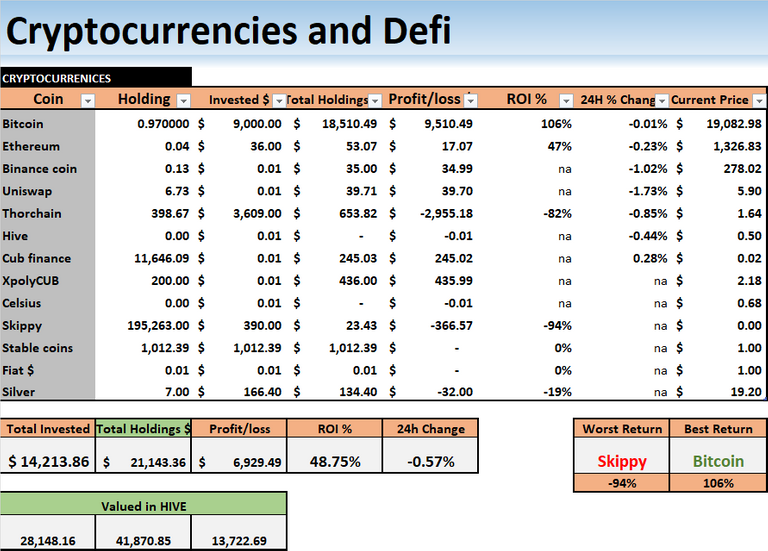

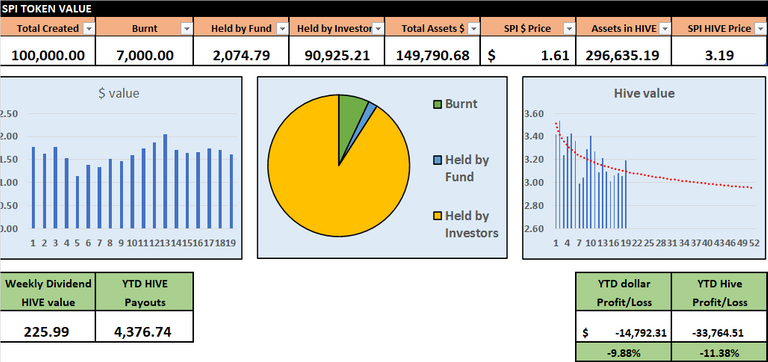

SPI tokens are growth investment tokens that pay a weekly dividend. They have been circulating for over 2 years, on STEEMHIVE. Mostly sold for 1 HIVE, each token today is worth over 4 times its HIVE issue value and 12x its dollar value. On top of that, token holders receive roughly 8% more SPI's every year from weekly dividends. We raised $13k from issuing SPI tokens for the first year which has been used to grow a diverse portfolio of investments, many of which provide streams of passive incomes. SPI tokens are part ownership of all SPinvest tokens/accounts, assets and income. The price of each SPI token is its liquidation value as SPI tokens are 100% backed by holdings. Handcapped to roughly 94,000, no more can be minted are issued. Adding, hold and compounding has us on the road to major growth and these tokens are still growing in value.

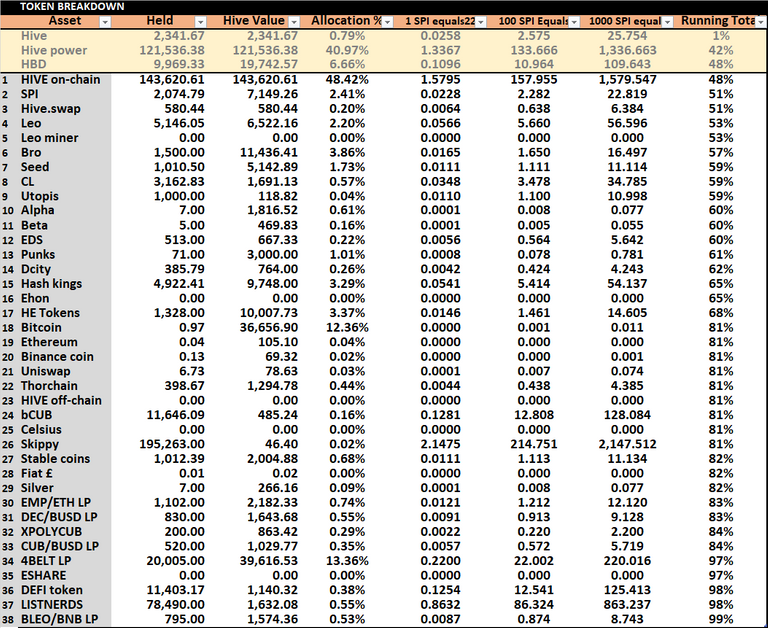

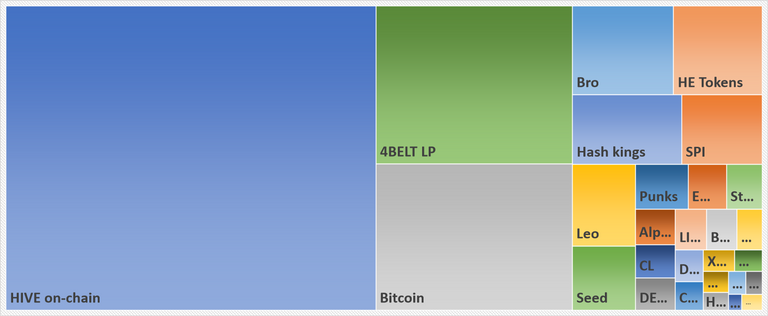

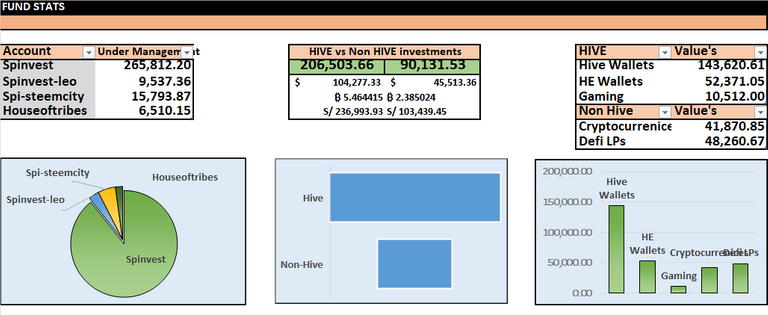

SPI tokens are part ownership in an actively managed fund. We have our hands in over 20 investments with the lion share being HIVE, BTC & ETH. We dont FOMO are chase pipe dreams. Tried and tested works best and is safest. Our motto is "Get rich slowly" and compounding down on sound investments is our game. You should invest in SPI tokens with the mindset of not selling for 3-5 years minimum. Let's have a look at this week's on-chain HIVE earnings.

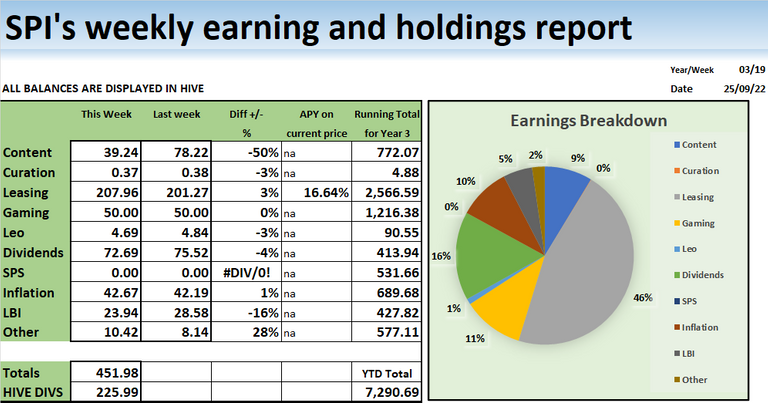

This week we are back to porridge and earnings are back to normal. The weekly boast of 50 HIVE from the gaming account will help us out going forward and I see the amount of WOO we are receiving each week from delegating HP is increasing so that's good. The APY for that has fallen some but it's still over 20% for now and that's hard to find on HIVE. Content rewards are half of the last weeks, we must have had a whale vote the week but overall content rewards have been slowly increasing even with our 3 posts per week.

We can that leasing is our best overall earner bringing in just over 2500 HIVE from the year start, gaming comes in second as this has been where I have been adding JKs incomes to, it's coming from defi but he gamifies it. Content comes in 3rd with HIVE inflation close in 4th. We earn almost as much from inflation then we do from content, there's a difference between passive and active incomes. 3 posts equal a week worth of HIVE inflation.

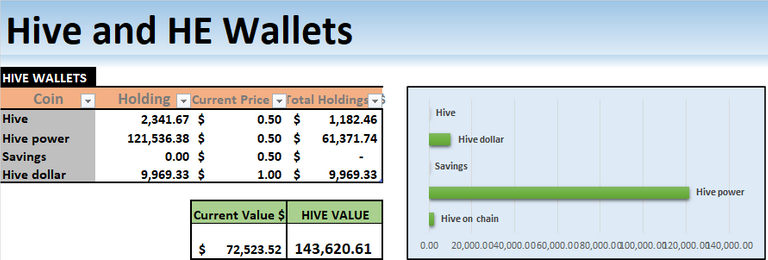

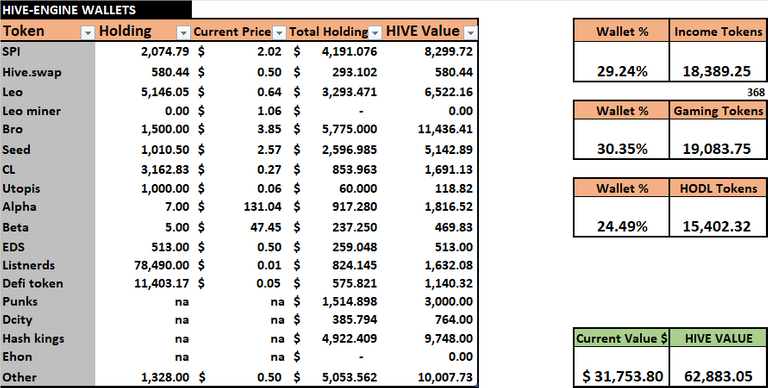

Not really alot fo chance with our HIVE wallets or HE wallets. I updated the HE wallets to include EDS. We were able to gather up 500 quickly at 1 hive each but I've noticed over the past few days that people are now putting in buy orders for over 1 HIVE each which is cool to see. We have started to receive LISTNERDS unstakes and im dumping these as fast as I get them (weekly). They are not worth much but I think they will be worth less the longer we hold them so conver to HIVE asap. Not much happening with other stuff.

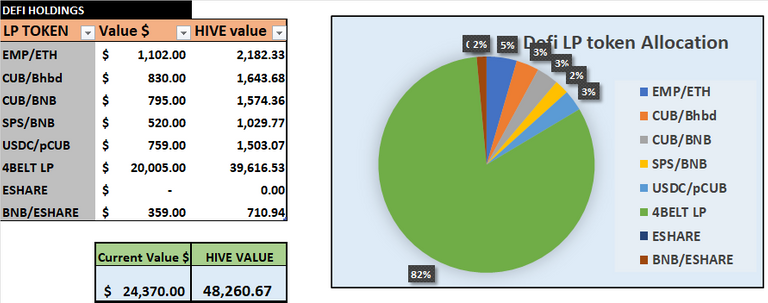

We are still holding the bulk of our defi money in the 4belt LP on CUBfinance as i wait for the price of ETH to drop. I notice that the value of this LP kingdom has not increased since last week. It claims to pay 12%, 10% from auto compounding and 2% in the form of CUB tokens. We got $7 worth of CUB tokens for staking $20k but no increase in LP value. Maybe there's a bug are something but I will be watching this and if it's the same on the same day's time, I will unstake from CUBfinance and just stake directly to belt.fi itself as it pays out 6% which is 3x more than we are getting now.

EMP is still falling, down to 0.59 so pulling out of that when its peg was at 0.72 was a good move. We invested 10 ETH into this platform and pulled out closer to 13 ETH which was converted into $21,500 currently worth over 16 ETH so we are doing ok and I feel that ETH will drop further as the bear market takes over and I have a target of 20 ETH at a price of close to $1050. You might be thinking, that's not happening but if you can remember pre-merge news, ETH was trading at under $1k so it's very likely to revisit these levels as we head deeper into crypto winter. I would love to double our ETH holdings in under 1 year, that would be amazing and when do convert that BUSD into ETH, it'll be parked somewhere to earn an easy 3-5%. Last bear market we saved BTC and ETH in cefi, this cycle, I think we'll use defi after what happened to Celsius and others.

HIVE price of the SPI token is up and the $ price is down. In a bear market, we can expect to see this happening alot as the price of our holding decreases. Because alot of our defi wallet contains stable holdings, we a sort of protected somewhat against a market crash. If HIVE drops by 10% as an example, then our $20k 4belt LP will be worth 10% when valued in HIVE. If HIVE drops faster than BTC and ETH, then the HIVE price of the SPI increases. If HIVEs price increases faster than anything else we hold, the HIVE price of SPI drops and its dollars value increases. There's alot of layers to it and over the past 3.5 years, I have witnessed alot of different scenarios play out from week to week. The great thing is because I fill in these reports each week, I know exactly where our funds are and how they are performing. If this was all automated, I would see the numbers but it would be in 1 ear and out the other.

We are floating along doing ok, SPI is not set up to be fast-paced, always moving funds around to "maximize" yields or get involved with every project going. SPI is set up to stack cryptos and play the cycles as best we can to our advantage. The markets are down, this is what happens and when you can accept that this is all part of the game and understand that things go up and down and there are a few years of waiting around, you can play the game better. As long as long term the market trends upwards, we're all good. Right now, all im trying to do is preserve some of the gains we have gotten from the bull market, might seems to little to late but i've been doing it already for months. We have around 9000 HBD and over $21k in stables. That's about as much as the fund was worth in total before the bullrun started. Now think about if we can 5-10x that money from buying in somewhere around the bottom and selling out and somewhere around the top. BTC seen bottoms of $3500 and tops of over $65k (18x), ETH had bottoms of under $150 and a top of around $4800 (32x), HIVE had a bottom of 9 cent and top of over $2.60 (28x). If we can achieve half of those gains, we could turn our $30k of stables into $300k. It looks doom and gloom now but we'll get used to these cheap prices. I have a project planned to launch when prices are at their cheapest and plans to launch in 2023. It'll be a time based and planned to last between 2-3 years. 2023 is still months away so no point in talking about that much now, just a soft shill.

That's the weekly update report for this week. Have a great week everyone

Thank you for taking the time to read through this week's SPI earnings and holding report. We post every Sunday to keep our investors up to date so please follow the account if you would like to track our progress.

f