Last week, I took a closer look at how our DAB wallet is travelling, and reviewed and updated its positions and plans for the future. Today, we'll take a look at our @lbi-eds wallet, and add similar details for performance and the plans going forward. If you are new, and are not sure what LBI is all about, these posts can help your research to understand our project a bit better. For existing LBI holders, it's always good to have a clear idea of where we are invested and keep across our plans, and add your feedback into how your funds are invested.

Here is the link to last weeks post about our DAB wallet in case you missed it.

Firstly, what is EDS?

EDS is a project set up and run by @silverstackeruk under the @spinvest umbrella. It's main account is @eddie-earner and there you will find its weekly updates, along with a great weekly initiative to help people achieve their savings goals called "Saturday Savers Club". It has been running for years, and EDS has been constantly growing and building into a Hive Engine powerhouse. 100% HIVE, it has combined clever tokenomics with a relentless pursuit of Hive Power to build a fully backed asset base for the primary EDSI token.

Under the EDS banner, there are a few separate initiatives to look at:

EDSI - the main token for EDS - it is minted in various ways and always backed by 1 HIVE per EDSI. The yield token that rewards holders with a weekly dividend, currently around 20% APR. In fact, looking back through EDSI's 157 weeks of reports so far, it's APR has never dropped below 20%.

Mining tokens - EDSM and EDSMM use Hive engines mining contracts to mint new EDSI tokens. These are all sold out, but do come on to the secondary market from time to time. LBI has bought a significant number of these miners (EDSMM specifically) since our relaunch.

@eds-vote - A delegation account where you can delegate HIVE Power to earn a weekly EDSI reward. It profit shares it curation income between delegators and the EDSI program. Yield is lower than other delegation services, but it really benefits EDSI holders as it strengthens the overall position of the EDS ecosystem.

A HBD backed token - EDSD is minted 1 for 1 with HBD. The HBD people put in is then added to savings to earn 15% interest. A portion of the interest is used to mint new EDSI to EDSD holders, with the other chunk added to EDS wallet like eds-vote to improve the overall ecosystem.

LBI's position.

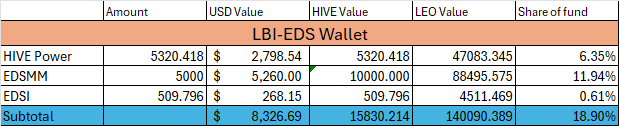

You can view our EDS position simply by checking our dedicated wallet - @lbi-eds. Here is how it looks right now:

As you can see, it represents a significant portion of our investments, being almost 19% now of the total LBI asset base.

We have been able to pick up a good number of the EDSMM mining token, which sets this wallet up for many years (17 to be exact) of consistent growth. 5000 EDSMM will mint us 1000 EDSI each year for 17 years to come (likely a bit more depending on how many other holders unstake miners to sell at times). These are valued in our wallet at 2 HIVE each. I will decrease slightly the book value each year to adjust down the value as the years pass.

This wallet also holds 5300 HP in it, delegated to eds-vote to earn more EDSI. We did have some EDSD, but shifted out of that into all HIVE based assets.

The great thing is that the HIVE value will always increase on for this wallet, year in year out. If we drop the HIVE value of the mining token by around 500 HIVE per year, that will be offset by around 1200 - 1300 EDSI minted each year - predictably - and all valued in our wallet at 1 HIVE each. EDSI usually trades above 1 HIVE, but we maintain a 1 HIVE valuation for them to keep the bookkeeping easy and the valuation nice and conservative.

Plans for the future.

In the short run, not much at all. This wallet is our most passive position. We have this bag packed, and now all we really need to do is watch is grow. Watch the asset base grow and watch the HIVE income EDSI generates grow. I'm not planning to add any new funds in, but you never know. If an opportunity popped up to pick up more miners at a good price, I'd consider it. If some spare HIVE appeared for us, I'd consider adding to this wallets HP and boosting the eds-cote delegation. I wouldn't mind picking up more EDSI directly off the market with spare funds, but we grow by 25 EDSI per week passively so that isn't a high priority.

Overall, the position as it stands is strong, and will grow predictably for years to come. I think this wallet will be seen over time as one of the big strengths of the overall LBI basket, and securing this position by picking up these miners in particular gives LBI an excellent foundation as an income generating token.

EDSI is the ultimate get rich slowly investment, not all that exciting in the short run, but amazing over the long haul. EDSI will reach a point where the APR stops declining, (it's getting very close) and it will then only every increase - this is programed and guaranteed by its genius tokenomics. LBI will benefit from this position for the rest of it's life - without a doubt.

The only risk for the EDS project revolves around SSUK. Like all HE investment projects, there is the risk of the project admin rugging, going awol, giving up or moving on and abandoning projects. SSUK has been around and run these projects for ages, and I rate this risk as very small - but never zero.

To learn more about EDS - check out the @eddie-earner account.

To learn more about LBI - look into our recent content with our weekly update posts the best way to keep up with what we are doing.

Thanks for checking out this post,

Cheers,

JK.

Posted Using INLEO