Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI has just recently come under new management, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

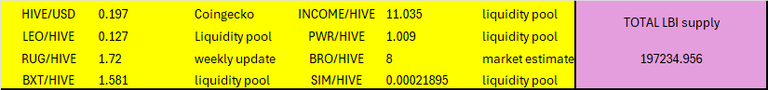

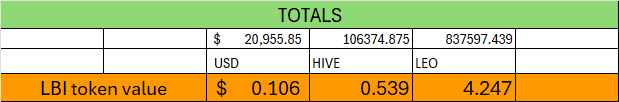

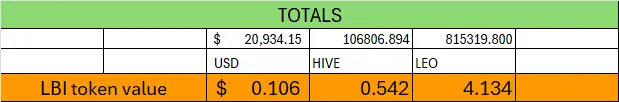

Here are the token values used at the time of this report:

And here is the link to last weeks report for comparison:

Now, lets get into it.

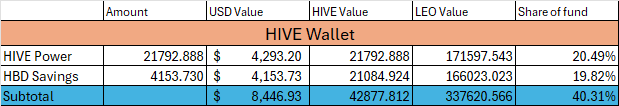

HIVE Wallet

Less HP growth this week, as I have slowed down with the content I've been able to get out. Content does not come natural to me, so over the first month or so when I had lots to post about it flowed pretty easy, but now that we have settled in to the new routine and LBI has stabilized on its new path, content is less interesting and update posts are about all I can come up with.

80ish HP growth and 7 HBD for the week. We are getting close to a baseline. Next weeks report will have the lowest content income in it, I only did the update post, and @no-advice ran the RUNE guessing game, and that's it. We shall see how this week looks. Long term, my goal is that content income should be completely unnecessary for LBI to grow.

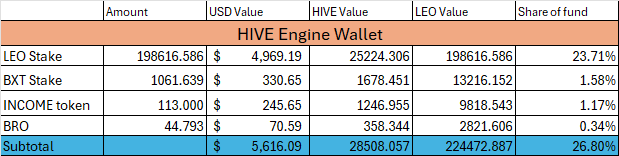

HIVE Engine

Leo.voter payouts are working more consistently so we added almost 200 LEO for the week. Also added a few BXT, INCOME and BRO as usual this week. LEO has declined in value, dropping around $130 over the week. LEO is now 23.71% of our total fund value. When we relaunched LBI, it was at 31.38%. So, the good news is that overall, the fund has not lost much value, despite that significant decline by LEO. I'd love to see LEO turn around, and start to move up. I do believe it will happen in time, but for now there are still more farmers dumping LEO for HIVE than buyers wanting to accumulate LEO. Hopefully that changes, but time will tell.

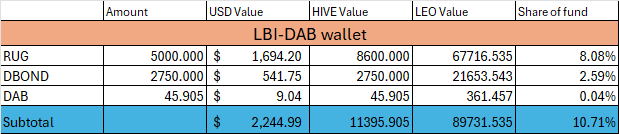

@lbi-dab wallet

Steady week for the DAB wallet. I did sneak a little extra from here into income for the week on the last day, just to top us up to a new record income week. I did also sell a few DBONDS (from our RUG earnings) and put those few HIVE into mainly the PWR wallet. Minted 8.6 DAB for the week, so we are growing.

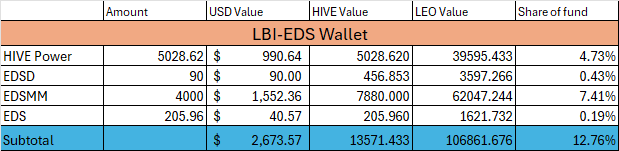

@lbi-eds wallet

Just chugging away, doing exactly as it is meant to do here. No changes made, and just over 20 EDS minted for the week. Reliable and growing over time.

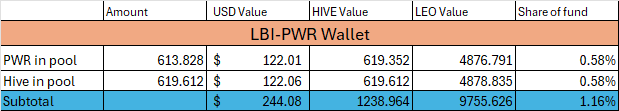

@lbi-pwr wallet

Adding funds here and there to this wallet, so it grows a bit faster than just the organic growth we get. For this wallet, the HIVE value is the most relevant measure for growth, and we added 63 HIVE value for the week, from a combination of organic growth, and extra funds.

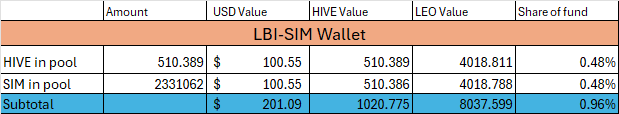

@lbi-sim wallet

Slow growth here. As I'm concentrating on the PWR wallet, this one is just organic growth for the week. The SIM power payout was missed a couple of days this week, still seems to be some gremlins in the system.

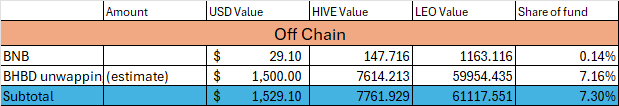

Off-chain

No change this week.

Totals

The amounts are virtually unchanged from last week. USD value is unmoved, HIVE value is down a little, LEO value of the fund up a bit. Here is last weeks numbers for you to compare:

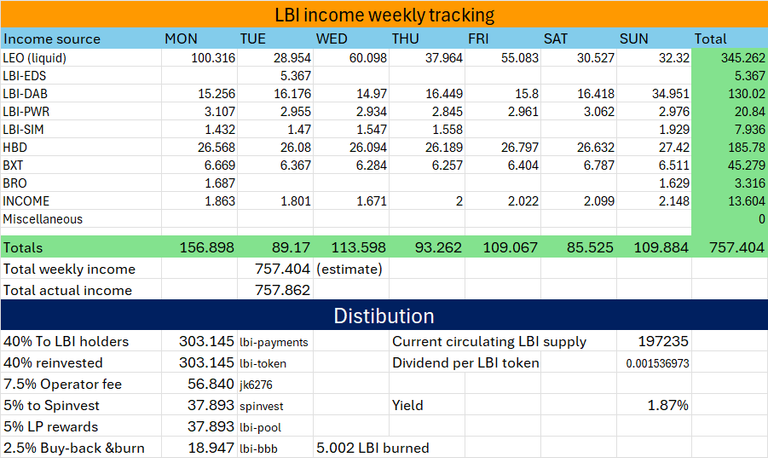

INCOME

Good news here, with The total income this week beating out last weeks number. Last week, I "cheated" a bit, adding some funds to the income total to get a number that was up on the week before. This week, I did a little again, but a lot less than last week. If you look closely, the LBI-DAB income for Sunday was more than normal. This was achieved by selling a little more DBOND (earned from the RUG investment) than I usually do. Quite pleased to have boosted income without having to game the system much this week.

Onwards to 1,000 LEO per week.

We burned 5.002 LBI this week, boosted the LP yield a little, and sent out over 300 LEO for dividends for the first time. Onwards and upwards.

That's it for this weeks update post. If you are just finding LBI for the first time, here are some more posts to learn more about our project:

https://inleo.io/@lbi-token/lbis-september-2024-recap-2zc

https://inleo.io/@lbi-token/lbi-august-2024-recap-9vv

https://inleo.io/@lbi-token/dividends-resume-for-lbi-holders-bci

Thanks for checking out this post, have a great week everyone,

Cheers,

JK.

Posted Using InLeo Alpha

)

)