Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

Well, it's been quite a week. Hive engine had big issues, LEO is super cheap currently and lots going on. Let's see what it has all meant for LBI.

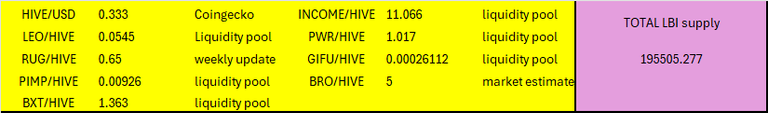

Here are the asset prices at the cutoff time for this report:

And here is the link to last weeks update for comparisons:

https://inleo.io/@lbi-token/lbi-weekly-holdings-and-income-report-week-27-week-ending-2-february-2025-yk

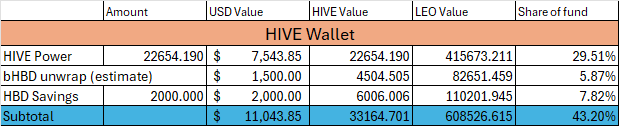

HIVE Wallet

I've reorganized this section a bit to include the bHBD unwrap we still have pending. Nothing has changed yet, it is still pending but I think it will start any day now. Had a fresh response from Khal in our ticket apologizing for the delay. Then Hive Engine had it's issues which probably delayed everything some more. Anyway, this should start soon, and it'll be real nice to have this part of LBI's history put to bed finally.

We added 56 HIVE over the week, a fairly standard week for us.

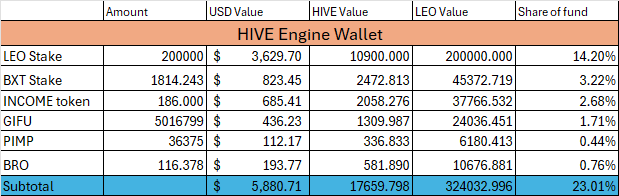

HIVE Engine wallet.

Keen observers may notice that we have less GIFU this week. The answer is that we don't really, I have just moved some into a new wallet. we will hold 5,000,000 GIFU in this wallet for the long run, but extra is now in a new wallet @lbi-storage. I'll talk more about that in a minute.

Other than that, not much has changed with our HE holdings, other than LEO dropping in value by a couple thousand dollars. It feels really odd to see LEO sitting at just 14% of the total fund.

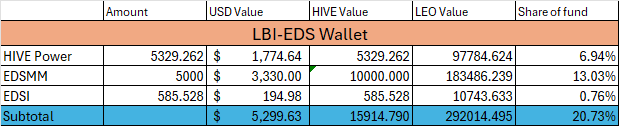

@lbi-eds wallet

22 EDSI added for the week, which is a little less than normal. Likely this was impacted by the HE troubles, and will return to normal. This wallet hold at around 20% of our fund, and continues to add reliable passive growth to the mix.

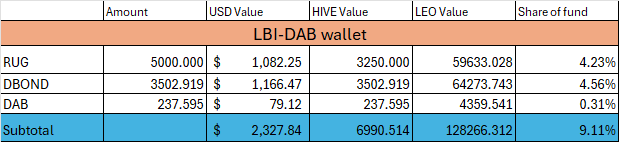

@lbi-dab wallet

No DBOND added this week as RUG rewards were postponed due to the HE issues. Next week should be a double payout from RUG. 9 DAB for the week, which is in line with what we would be expecting.

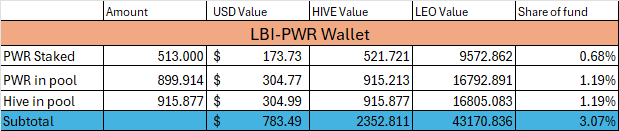

@lbi-pwr wallet

Again, not a lot of news for this wallet over the week. Steady growth and steady income coming in. I see that @empoderat is utilizing the APR's on offer from Binance to give PWR a boost, which he outlined in this recent update post. Interesting stuff, and it'll be fun to keep an eye on how this all pans out.

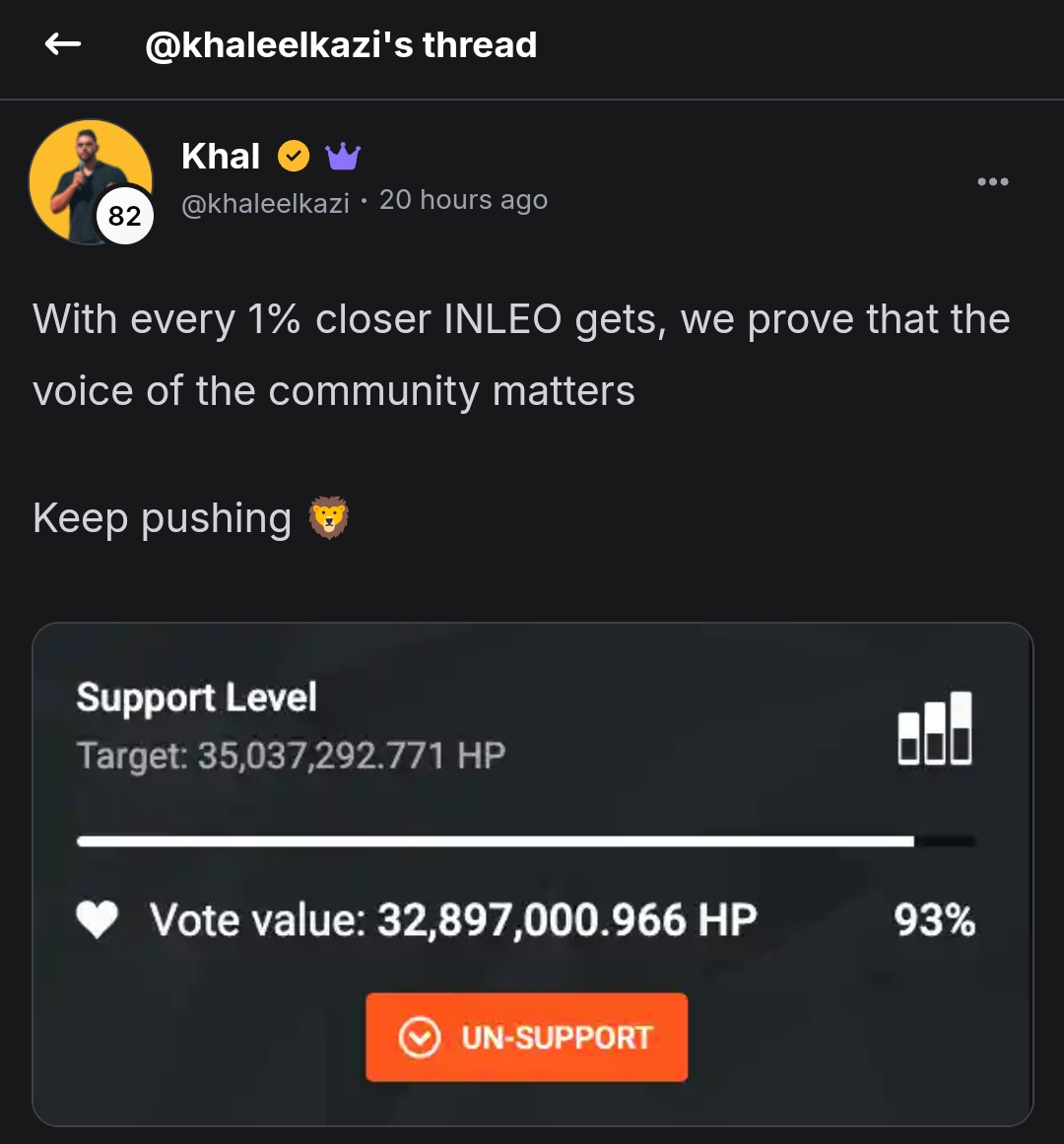

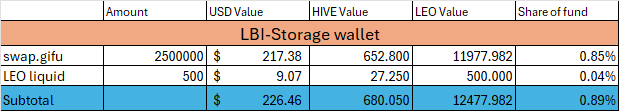

Introducing - @lbi-storage wallet

The purpose of this wallet will be to accumulate some liquid tokens, to play the market a bit. LEO is real cheap at the moment, so I'd like to buy a chunk, but hold it liquid. When (if) LEO recovers from its current levels around 0.0545 HIVE each to 0.1-0.2, I would sell the liquid stash I build up for profits. So far, I only have a little LEO here, plus a portion of our swap.gifu. As I said above, we will hold 5 million GIFU for the long run in our main wallet. But if I wake up one day and GIFU had pumped big time, It'll be good to have some in a wallet that I can quickly sell to lock in profits. Anyway, that is the purpose of this wallet, so we shall see how it goes.

The other goal is to build up some liquid funds, so that if something new comes along that we really want to build a big position in quickly, we have a stash of funds available to do that without having to sell long term assets.. That's the plan anyway, lets see what happens.

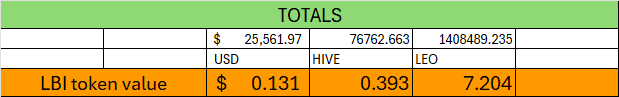

Totals.

Overall, the fund went down in value by around $4,000 this week. The HIVE value dropped a bit, and the LEO value is really high as our other assets are worth more in terms of LEO at these prices.

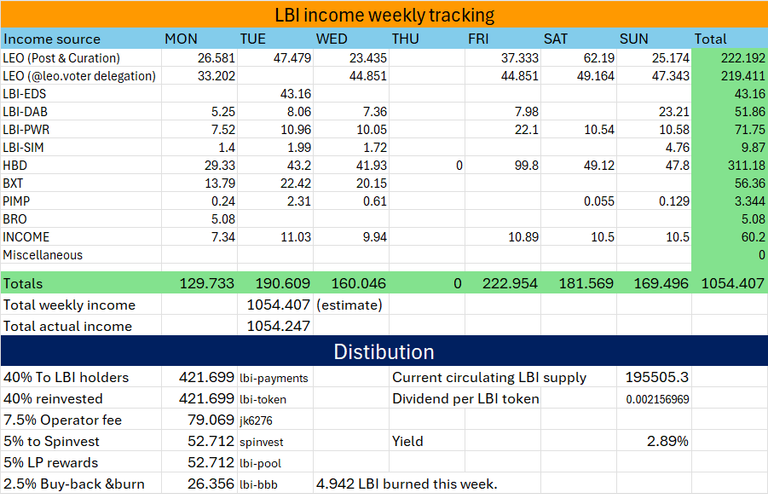

Income Statement.

We smashed through the 1000 LEO mark for the week, despite Hive Engines issues. Many of our investments were impacted with delayed payouts or missed days of income. However, the low price of LEO meant that we still hit a record income in terms of LEO for the week. One indicator I'm watching is the Yield number, and it's pleasing to see it trending upwards. This shows that our plans to build layers of growth into the fund, which eventually flow to income is working.

The EDS wallet is the perfect example of this. We own many EDSMM tokens, which mint EDSI each week. So the asset base is growing, as more EDSI are added to our assets every week. This then flows to higher incomes over time, as the weekly income from a growing stash of EDSI increases every week.

The plan is really starting to work out, and our income yield is growing which is the ultimate goal.

Conclusion.

What a week. LEO is cheap, HE had some major problems, we have a new wallet, and income hits a record high. What a roller-coaster. Lets see what is in store for us next week.

Thanks for checking out this weeks update. See you all soon.

Cheers,

JK.

Posted Using INLEO