Hello and welcome to this weeks LBI Holdings and Income report. LBI is a pooled investment token based on HIVE with a range of assets backing its token. Each LBI token represents a share of the assets, and the value of that share is published daily on inleo.io as a thread. All you have to do is check our profile page to find the most recent "Asset backed Value" for the token.

LBI came under new management last year, and we are working on raising its profile, converting it into a token that shares a portion of its income each week with token holders, while also selecting investments to maximize growth. LBI's roots are firmly planted in the @spinvest ethos of "get rich slowly". We don't chase amazing returns and massive gains, we look for solid investments, long term growth and the magic of compounding.

It's all been happening here on HIVE, let's see what that has meant for our little fund here.

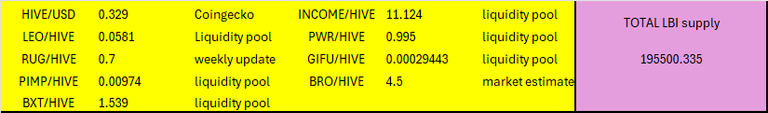

Here is the asset prices at report cutoff time:

Note that since these prices cut off, LEO has popped up a bit, but this report is based on the above prices.

And here is last weeks report for comparison:

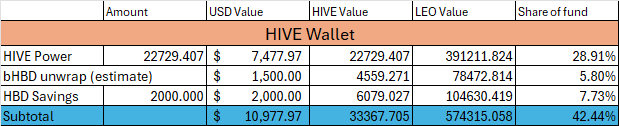

HIVE Wallet

75 HP added this week, which is a bit above our recent average. @no-advice put out some extra content over the last couple of weeks, which has helped a bit. Still no change to the status of our bHBD unwrap. Week 29 and we are still waiting. Hopefully soon ™️

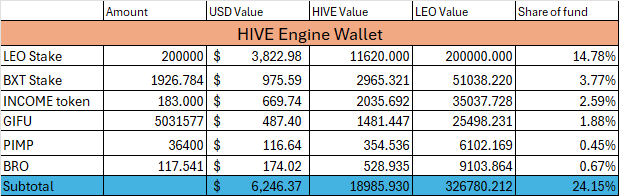

Hive Engine wallet.

I've been pushing to build up our BXT mainly over the last few weeks. If you saw our goals for 2025 update post you would know that we are tracking well on the goal for BXT. I plan to push and hit this target first, and then focus on other goals as the year progresses. Anyway, we added over 100 BXT this week, which is pretty cool. Everything else here is broadly similar to last week.

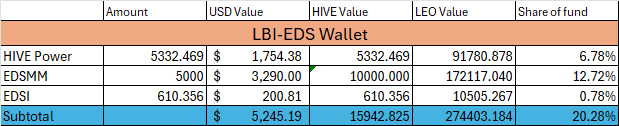

@lbi-eds Wallet.

25 EDSI added for the week, which is spot on with what would be expected. Our most boringly reliable wallet. As we add EDSI each week, our HIVE income increases a little each week also. Nothing new to report, still sitting at 20% of our total fund and doing exactly what it is meant to do.

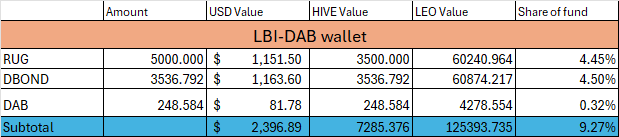

@lbi-dab Wallet.

34 DBOND and 11 DAB added this week, which is a pretty decent week. Our Hive income is steadily growing, and we are up over 0.4 HIVE per day. This wallet is working out as intended. I will need to find funds to buy a bunch of DBONDS to hit our yearly goal - we won't get there from RUG mintage alone. Still, 11 DAB minted for the week is above our recent levels, so overall happy with the progress.

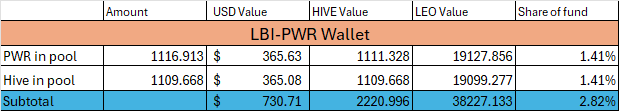

@lbi-pwr Wallet.

There is some news to report this week. I have removed our staked PWR, and added those funds into the pool so we are back to 100% in the pool. We are currently the 5th largest position in the pool and hold 5% of the total LP. The pool is now yielding a great return of 30% APR. We use half of this for income, and the other half gets compounded back in. This wallet is growing nicely and on track for our yearly goals.

@lbi-storage wallet.

Our newest wallet, this is a holding wallet for liquid tokens and so I can play the market a bit. Over the week I sold some GIFU. These were all bought at around 0.00025 each, and the sales I made were all over 0.0003, so a little profit. I've been buying LEO at prices below 0.06 each, and since this report LEO has popped up to 0.064, so we are in profit there as well.

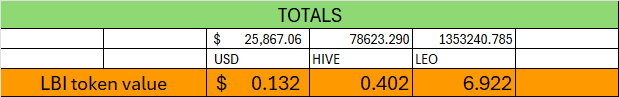

Totals

Overall, we held a USD value for the fund over $25,000 which is nice. To really grow the $$ value, we need a solid LEO recovery. A HIVE pump would do the job also.

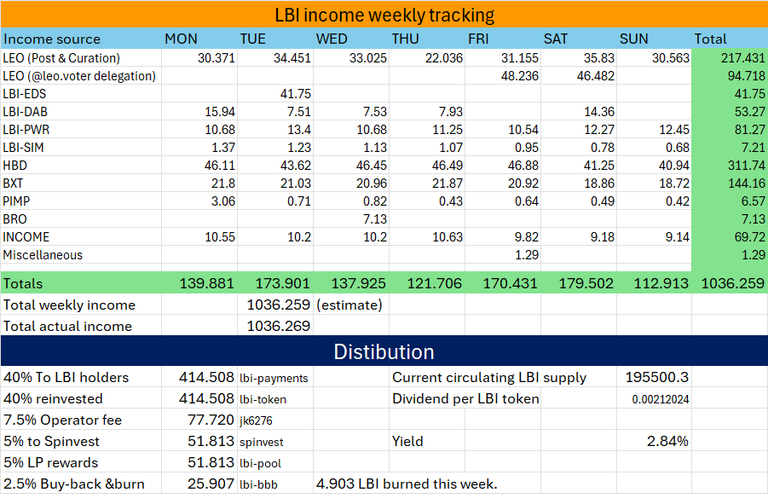

INCOME statement.

Good news and bad news here for the income statement. We did hit the 1000 mark for the second week, which is good. A little less than last week, but still above a thousand. The bad news is that multiple @leo.voter delegation payouts were missed, we only received 2 payments for the week. This means we missed out on over 200 extra LEO in income, which would have meant a 1200 week.

What to do with the leo.voter delegation? Do we pull it? Give it one more week to see if it gets fixed properly? If we do pull it, where to we move to? Let me know your thoughts, diplomatically please.

Summary and thoughts.

Overall, I'm happy with the week we have had. EDSI is doing it's thing, DAB likewise. PWR is strong for us, and we have added a solid amount of BXT over the week. The weak point is the leo.voter delegation - I really am very close to pulling it and moving it somewhere more consistently reliable.

Let me know your thoughts.

Thanks for checking out this weeks update, have a great week everyone.

Cheers,

JK.

Posted Using INLEO