Day 3 - Time to look for opportunities

Account Overview

Good morning to all of you beautiful people out there. I hope you are doing well. Myself? I'm tired and had quite a late start to the day Nothing wrong with that though. Just means I'm gonna be a bit late with my post.

Anyway moving on to the account. I decided to sell some of my cards from splinterlands today to help raise some initial capital for the day but I should be getting more over the next week or so as this was only 15 USD to help kick-start the account.

We will be using this as the base to see how far we can take it before I deposit more.

Since we are starting with such a small capital there's no point in using spot as that would take way too long, especially in this market which is still trending down in the long term. Margin on bybit offers up to 5x margin but I find it to be needlessly complicated so the only option is derivatives and leverage.

Of course, this is a double-edged sword as it increases our risk exponentially so we will be using tight stop losses, lower leverage and aiming for asymmetric opportunities. The goal here is to make enough money to start using a bit of margin and stable farming as well (the aim will simply be to store the money rather than to earn interest)

Market Overview

Before we start looking at crypto it is always a smart move to see what is happening with a few key markets outside as they will give us ideas about general market sentiment. I like to look at the SPY to get a feel for the overall US economy, the DXY in connection with that and finally Gold as a leading indicator for obvious reasons.

SPY500

Taking a look at the SPDR on the 30-minute time frame we can see that the MACD is starting to turn bullish. The RSI has room to grow and is also looking bullish, however, it looks like we're rejecting at the middle EMA and if we continue this bearish momentum into the open we might be moving down, we'll know more after looking at the DXY. We also have a hammer as the previous candle so perhaps we have a 30-minute pullback before moving higher.

DXY

Taking a look at the DXY 30-minute chart, it is not looking good. A super bullish push up to the middle BB is in process with the RSI crossing through its moving average. The MACD is looking like it's about to have a super bullish cross too. So the overall sentiment is that the Doller wants to move higher and begin a rebound after the CPI data came out. This tells us that this rally won't go on for long and we can assume that the SPY will continue its downward move. This bullish momentum of the dollar is due to the recent news of a missile strike in Poland.

Gold

Taking a look at gold we seem to be slowing down with both the RSI and MACD showing a potential reversal. If this is the case then we can assume the dollar has bottomed.

For me, all in all, this shows me that was about to start moving down in the traditional financial markets but what is BTC saying about the crypto markets?

Trades

Now then let's start looking at what potential trades we can make today now that we've taken a look at the overall market. I will be choosing a few different tokens that I like to trade and will be focusing on them so as to not get overly distracted or pulled thinner than I need to be.

We will consistently trade these coins but I won't go over all of them each day.

BTC

Now let's take a look at BTC on the 4h. Since yesterday we've rejected off the constricting upper BB and also made a lower high and a higher low. We are currently at the middle EMA but I don't think it will hold. The RSI and the MACD are bullish but starting to slow down. Like I said yesterday if we reject off the upper BB then we will have our lower high. However, we don't want to be too hasty in making a trade as there is no clear direction simply consolidation.

ETH

Taking a look at ETH we see that it is currently just on the trend line with the MACD just about to cross. The RSI is below the EMA as well. This for me looks like a much nicer short opportunity to me however we need confirmation. If it has a 4h candle close below this trend line and retests it then I will be looking for a short entry especially if BTC starts to move down.

FTM

FTM on the other hand seems a bit more bullish to me. The MACD and RSI seem more bullish than BTC and the middle EMA of the BB connects with the trend that was broken through, however, due to the overall bearish sentiment I won't be trading FTM today. If I was to guess though I say it pulls back to the middle BB before consolidating slowly

AVAX

When looking at AVAX we can begin to see that most of the alts are looking more bullish than BTC and ETH but it wouldn't surprise me if it pulls back to that lower trend line/ support region.

ATOM

We have a similar situation as AVAX with ATOM.

Final Thoughts

To finish off my overall feeling is bearish for the market so I will be looking for shorts rather than longs and as such the clear option is ETH. So I will be placing an order using 50% of my capital to open a 7x short at around 1230. Once that triggers I will see what is happening with the market. Based on what's happening ill set an appropriate TP and SL. If I have confirmation that we are moving down then I will deploy the other 50%.

See all of you tomorrow

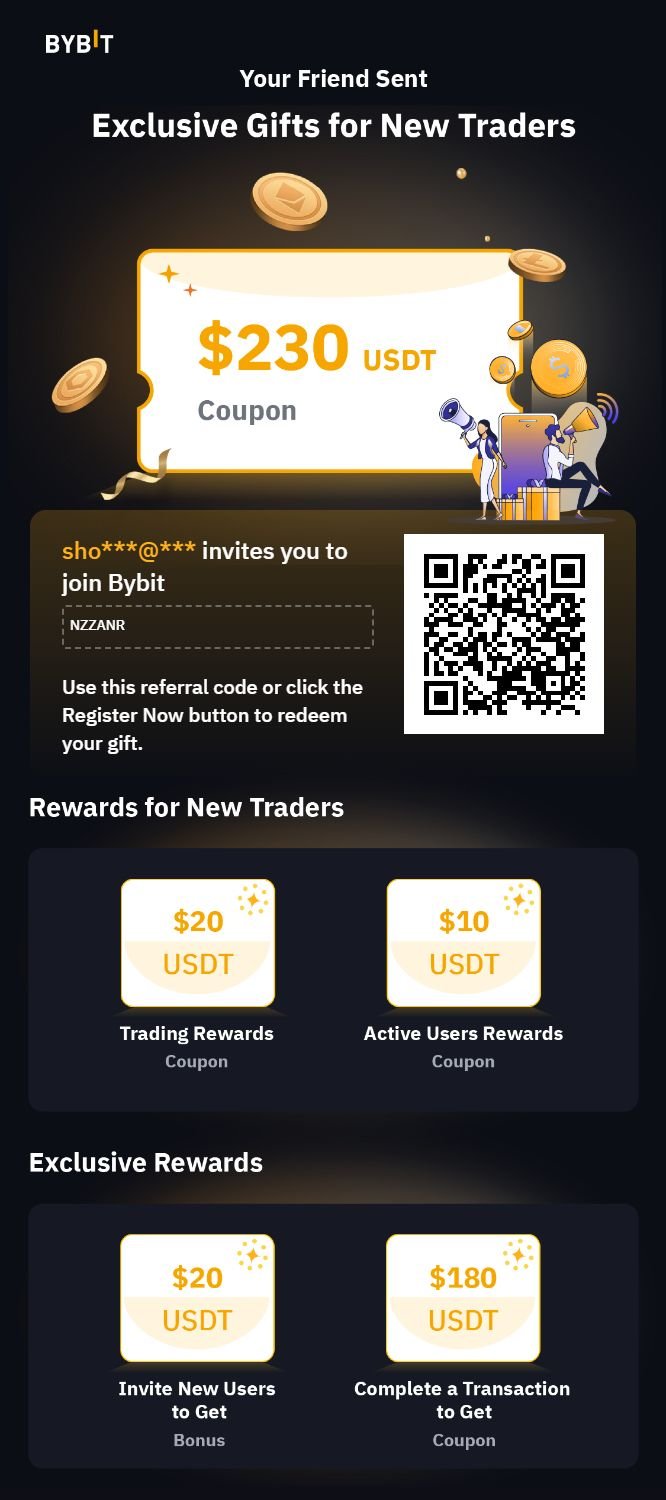

Please use my Bybit link if you are planning to sign up as it would hugely help with what I'm trying to do here.