With an ever rising inflation and terrible economic policies from different government administrations that have never benefited the common man, millions of Nigerians continue to remain in poverty.

The supposed middle class Nigerian no longer exist and have also moved to the lower class that is perpetually in a state of poverty.

The Unwanted Savior

Many people are left without options and have turned to various loan sharks as their only hope to save them from financial embarrassment.

Some take loans to do negative risky activities like funding a betting lifestyle, others get financial assistance from these loan operators to support their small business enterprises or even just to feed for the week.

What ever is the reason for taking these loans, there is a common denominator which is “Outrageously high interest rates on loans”.

blockquote Loan sharks thrive on the desperation of borrowers who have no other options.

I have once been a victim of one of these loan operators with such high interest rates when I was in a serious financial mess.

To paint a true picture of what these high rates can be. You borrow ₦10000 ( about $12 at current official rate), and you are expected to pay back 30% to 40% interest rates, within a week or two!

This is just outrageous and exploitative. The deadline is also too short! The fact that people are desperate to make ends meet does not mean they should be exploited!

Ease of Access to Loan Operators

One may ask if conventional banks exist, why are Nigerians running to these evil loan operators?

The answer rests on the fact that the conventional banks have criteria that the average Nigerian can not meet to obtain loans with fair interest rate.

People have to resort to loan operators that are just a click away on their mobile phones. Lots of them are found on playstore, other popular evil loan operators not on mobile are LAPO, Soko Loan and others.

Besides, running to conventional banks to ask for small loans for things like personal feeding is a waste of time.

“Smart Nigerians” Escaping the Jaws of Debt

Despite the gloomy tales of loan operators and their victims, there are also the tales of people who somehow believe they have found a way around avoiding being trapped by these loan operators.

There have been instances of people borrowing from Loan App A to repay Loan App B and then Loan App C. This is silly as it messes up your credit history. However, I doubt if credit history is being relied upon to grant loans in the first place, else, how will one be able to jump from Loan App A to Loan App C.

There are other instances of people who believe revoking access to the Loan App to their mobile phones will help them escape from these digital money lenders. However, I doubt if there is real proof this has ever worked.

Inhumane Loan Recovery Tactics

While loan defaulters devised a means to avoid the loan operators, the loan sharks themselves have devised inhuman techniques to recover their loans. Two can play the game!

These loan sharks somehow obtain their victim's personal information and send embarrassing short messaging service (SMS) and WhatsApp messages to the contacts of the loan defaulters with the purpose of shaming and embarrassing the defaulters.

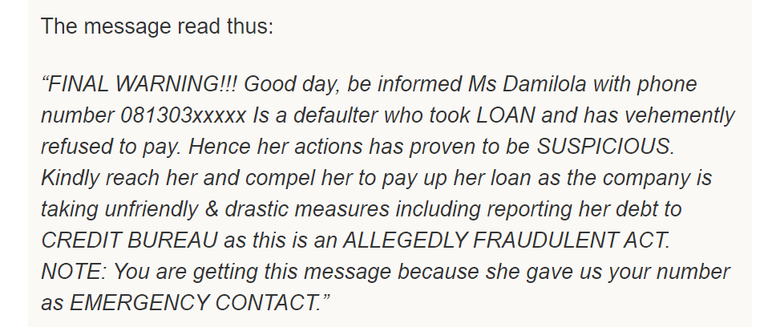

Below is one of such messages:

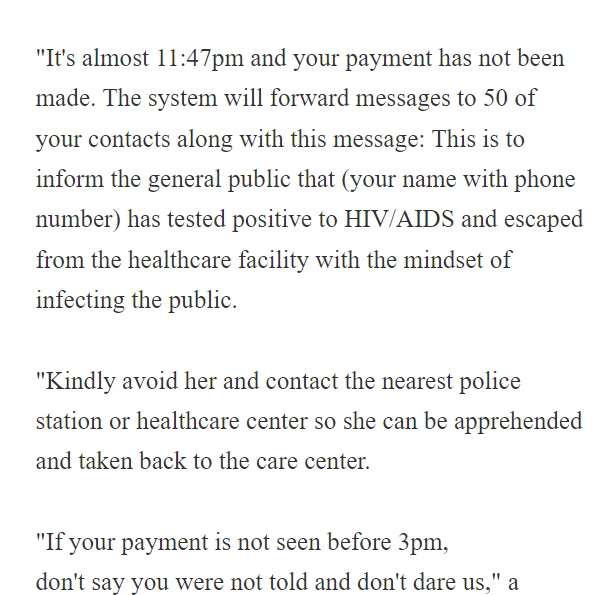

Again, the shaming message in the picture below is even way worse than the previous one.

These type of messages can be quite depressing. I am pretty sure I will be depressed if someone close to me receives such a message with the intention of shaming me. How will they now see me? How will I be regarded?

This is just me anyway because I doubt if these shameful messages are even having results. Many people are broke anyway! What is the probability of the loan operators sending a shameful message, intended to embarrass a victim, to another defaulter who happens to be a close contact? With current economic realities, I’d say 100%.

A Glimmer of Hope

Amidst the battle between loan operators and their victims, there is some form of relief for poor people who are at the mercy of being exploited by these loan operators, particularly, the digital money lenders.

Google updated its April 2023 policy to restrict loan app operators from accessing user contacts and pictures. Also, many of the evil money loan apps have been removed from the Google Play Store.

While this might be a reprieve from receiving shameful messages, there is still the fact that people are still broke, people still need money to run their daily activities. As long as the poverty of millions of Nigerians exists, these loan sharks are not going anywhere. The reality is they are still among us!

Posted Using LeoFinance Alpha