One year of staking $UMA and voting on disputes! How was the experience? What about the rewards? Was it worth it? Everything was so smooth, while the rewards were above and beyond the expectation. They don't know I learn 33% APR for solving disputes! Did Trump said Joe more than border? Is "2024" considered a launch date for GTA4?

The fees on Ethereum mainnet were sometimes insane, but not a massive issue on the long run. The fees spent on voting and revealing are reimbursed one a month, in $ETH. In the early days the rebase was in UMA, which had to be swapped in $ETH if needed for voting. I didn't swap any and staked it all back in the pool!

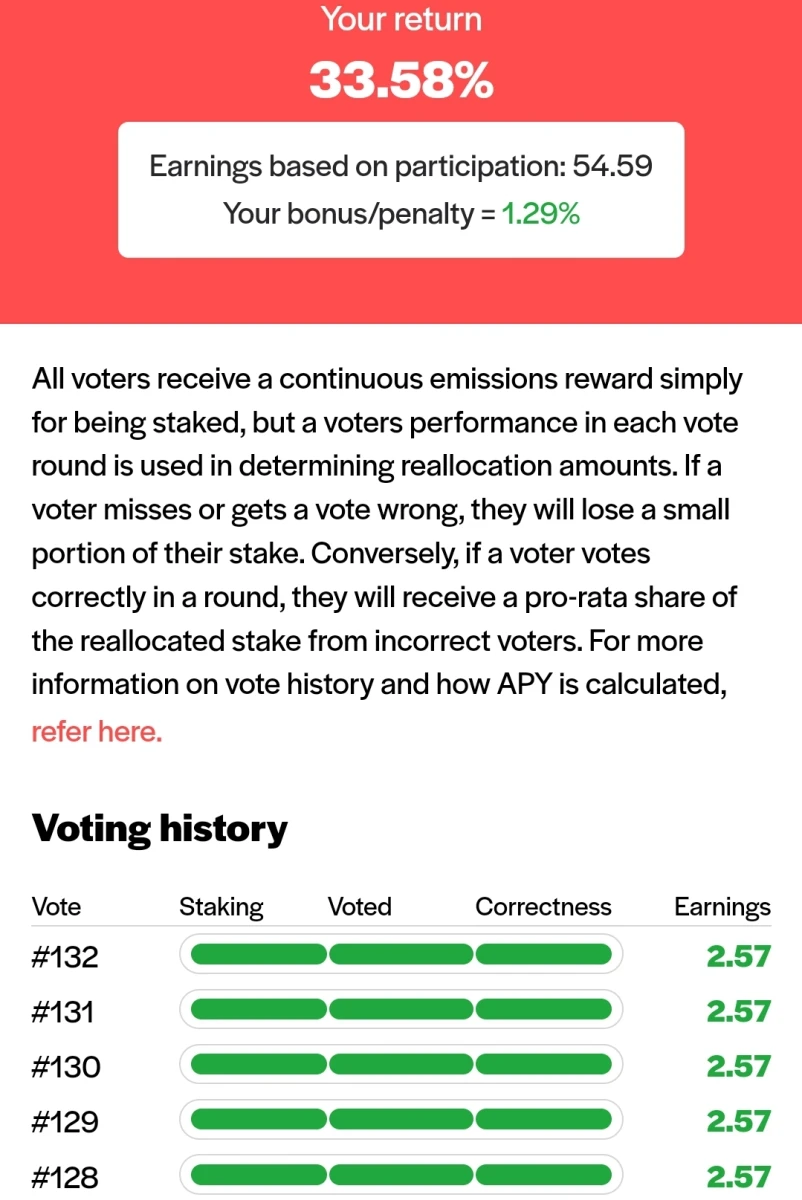

The time to analyze my staking rewards has come, and see how efficient this innovative system was in his first six months of existence. Let's also keep in mind that the UMA holders are also part of something bigger, solving those "gray area" disputes when there is no categorical right or wrong case.

The smart contracts and DeFi applications can now solve grey area disputes and validated information about the world. The OOv3 introduced a new logic pattern for UMA’s optimistic oracle, that of an “assertion pattern". The new system replaced the “question-and-answer" dispute mechanics.

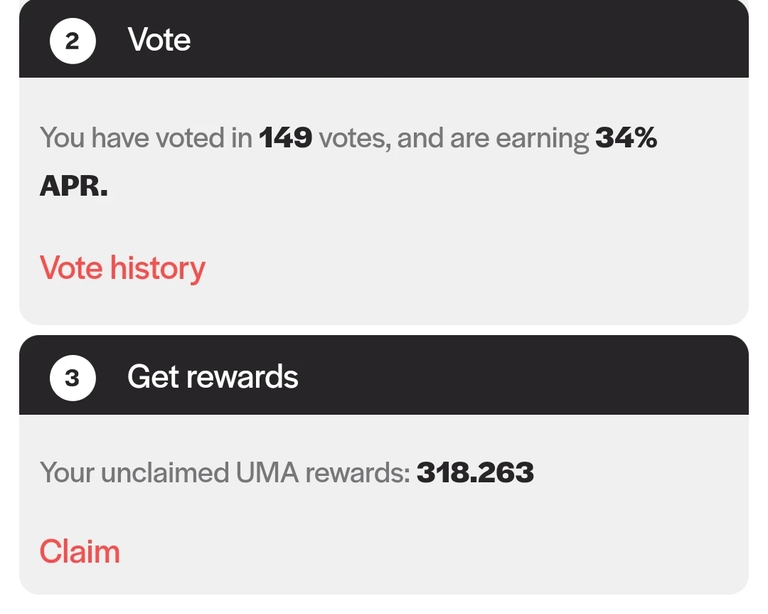

I was able to earn more based on participation and voting performance. My APY went up to 33.58% with the performance bonus, and 54.59 UMA were added after voting correctly in most disputes.

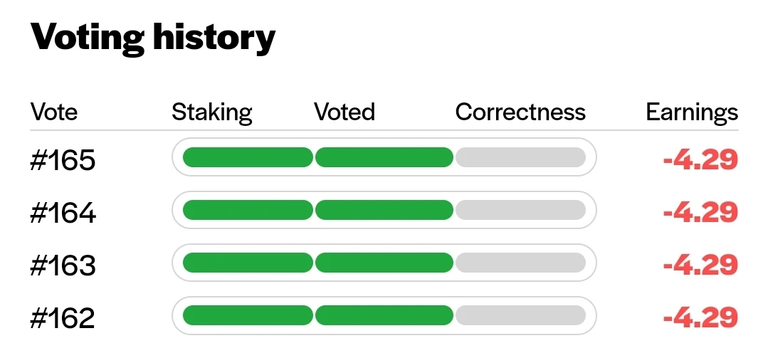

The bonus becomes a penalty if the voter misses or gets wrong too many voters. The slashing is real, at 0.1% of the staked UMA, which will be reallocated to those that voted correctly.

I personally hate poorly written markets, and sometimes that's common on Polymarket. It worth mentioning that I always vote for what I think it's the true, and sometimes I get slashed. This was the case for the disputes regarding the governmental crisis due to lack of funding.

The papers were signed late by Biden, but no governmental organization had to stop their activity due to lack of funding. For two of them I voted NO, and for the other two that were for a future date I went P4-Too Early. All four votes were "incorrect" and I got slashed 13 UMA in one go!

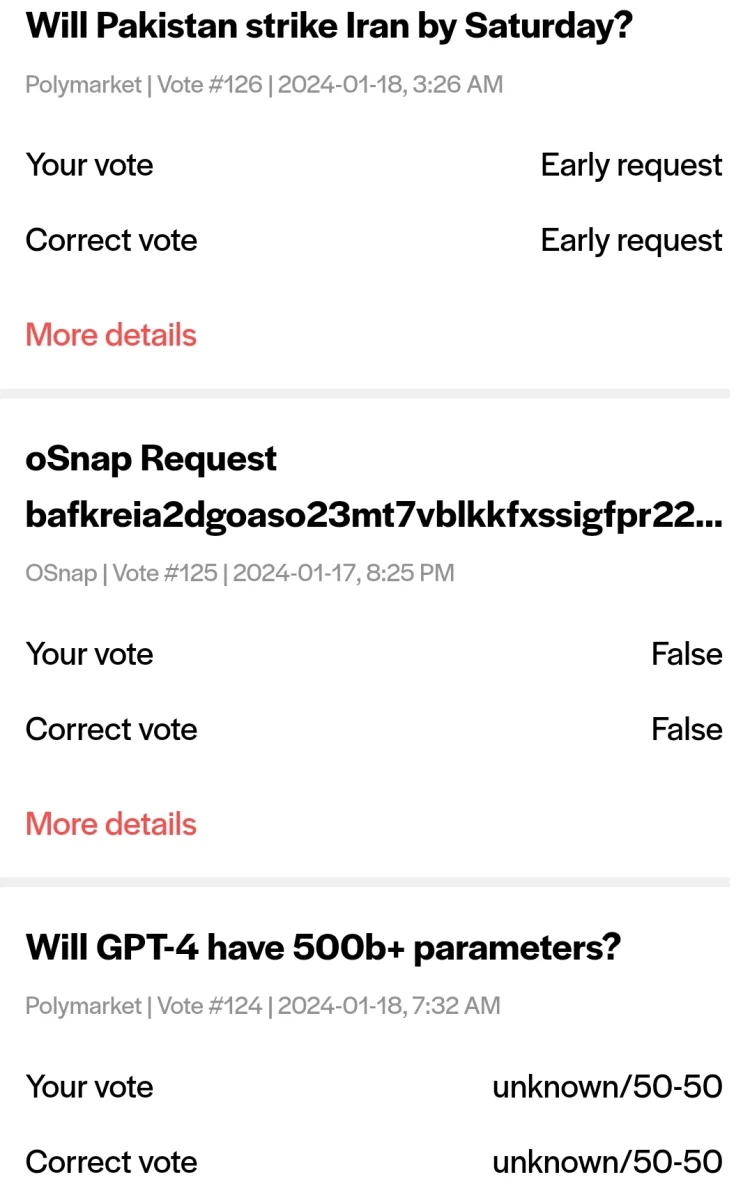

Other markets are ambiguous by nature, while others are just early requests. The YES or NO ones are simple, and false oSnap requests are easily identified on chain.

However, this market was the first ever when the general consensus was 50-50/unknown! Will GPT-4 have 500b+ parameters? No one knows as this was too difficult to verify either on-chain of on-chain. Writing history with the Optimistic Oracle, voting on the first market ever to be solved as 50-50.

Few more disputes in February and March, rising my total to 149 votes. The voting efficiency and engagement raised my APR to 34%, bosting the farming rate and adding nearly 100 UMA for voting correctly.

Farming rewards for the year? I accumulated 318 UMA and celebrated the yearly round-up by pressing the "claim and stake" button. I compounded the rewards for... even better rewards. To be honest I prefer the weeks without disputes, those with plain farming and no headaches. Let's roll for an even better 2024!

Residual Income:

Play2Earn: Upland / Splinterlands / ++Doctor Who++

Cashback Cards: Plutus Card / Crypto.com

Fountains: PipeFlare / GlobalHive ZCash

Creators bundle: Publish0x, Hive & Presearch

PVMihalache The Author - My Amazon Books

GrillApp - New Write2Earn Dapp

Claim Your Mode Network Points