Welcome to the Yield Yak Gazette, the newsletter that will fill you up with good vibes, top APY and yak news! DeFi summer started and the season brings gifts and surprises! Yield boosts, extra APY, Arbitrum LTIPP rewards live, Rivo points, LayerZero eligibility, and much more! Can Yield Yak get any better?

The answer is Yes! Yield Yak keeps improving and innovating! Up to 180,000 $ARB and 40 $YAK were awarded to selected strategies, auto-compounding $STG, $USDC and $USDT for triple-rewards madness!

The constant growth was reflected on achieving new milestones, as the Arbitrum TVL reached $5,000,000. As the TVL increases, so does the fees. The $YAK Arbitrum APY stays at a cozy 6%, and the $YAK value keeps growing as the direct result of buybacks!

Before we celebrate my birthday, let me tl;dr Yield Yak to normies! We are talking about the most popular and most used optimizer on Avalanche, due to the great variety of opportunities that it offers. An optimizer is in charge of maximizing the annual percentage of rewards that users can get when farming or staking your cryptocurrencies on other platforms.

The optimizers use the rewards users receive to exchange it for the cryptocurrency or cryptocurrencies you are farming or staking. The next step is to put those cryptocurrencies back into the farm. The compound interest is obtained by using the rewards and reinvesting them in the farm. Sit back and earn!

The Yield Yak dashboard got upgraded for on-chain summer, and the "explore" feature was introduced. The Yak Pack can explore yield strategies and see the highest equivalent APY for the asset across Avalanche, Arbitrum and Mantle. All similar strategies are displayed along their performance, making it easier to compare and highlight the best performing pools.

Yield Yak offers one-click leveraged farming strategies for borrowing and lending markets like Aave, Benqi, and others. These strategies optimize your single-asset deposits, automatically compound your returns, and save you time

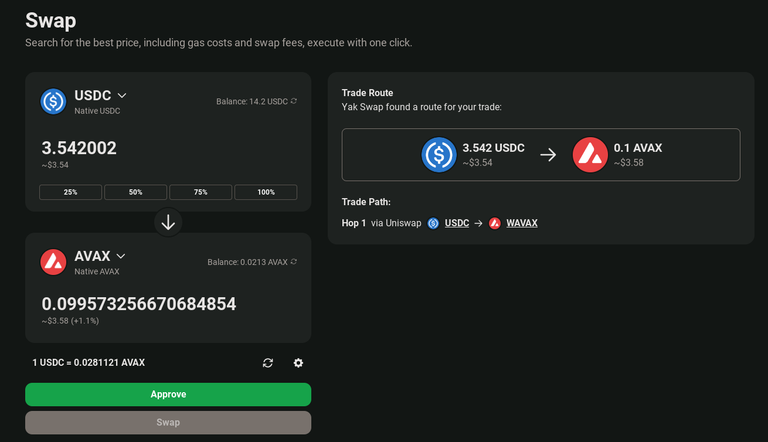

I like long-term strategies, and auto-compounding pools are my favorite pools! I can add crypto and enjoy the full package... optimized yield, no waste on gas, and perpetual earnings. It was easy to understand that $YAK is a gem, and this was the reason why I wanted to be a holder. Set the target to one YAK, and 0.1 each month will do the job.

But a series of events made me accelerate the journey, and reach the goal after half year. I wanted to treat myself of my birthday, and also cashed out the $GNOME - $ETH LP I had on Harvest Finance. The APY went from insane to 1.5% after half year of farming, and I was happy to embraced a 4x return of investments!

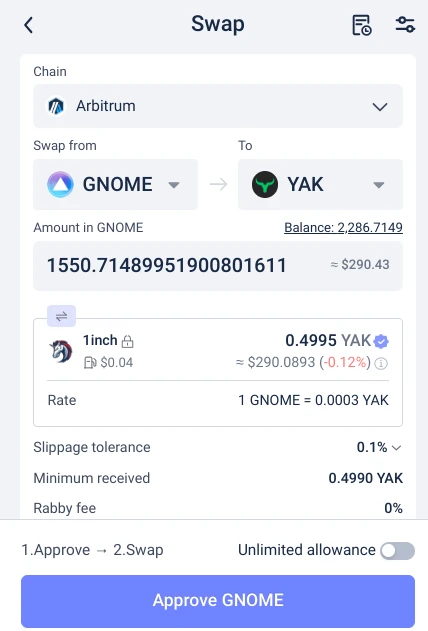

I kept the ETH, as this is essential on any chain, and decided to swap some $GNOME for $YAK! I was singing "Happy Birthday!" when used Rabby Wallet to swap 1550 GNOME for $YAK. I accelerated my plan to hold one full $YAK, and 0.499 was what was needed to extend the celebration!

Gone fast forward and gifted myself an achieved goal for my birthday! It's not much but is honest work! Now I can finally feel like a true member of the YakPack! Onwards and upwards!

Really proud of myself, as my Yak journey continues. I staked now letting the compounding do the work, watching my 1.03 $YAK grow strong! Buzzing for my achievement, also buzzing for all the new YieldYak integrations and partnerships.

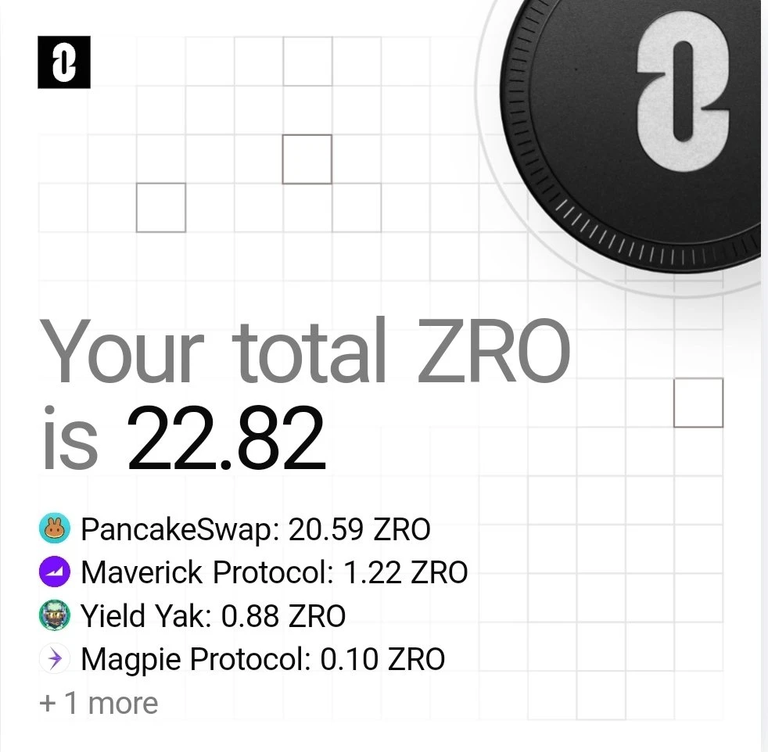

Avvy Domains was integrated this summer, and users can see their custom domain plus avatar when connecting to Yield Yak. The $ZRO airdrop came with good news for Yaks, as the infra-provider that makes $YAK an omnichain token made many eligible for the LayerZero airdrop! Nice to see an extra $ZRO added to my allocation!

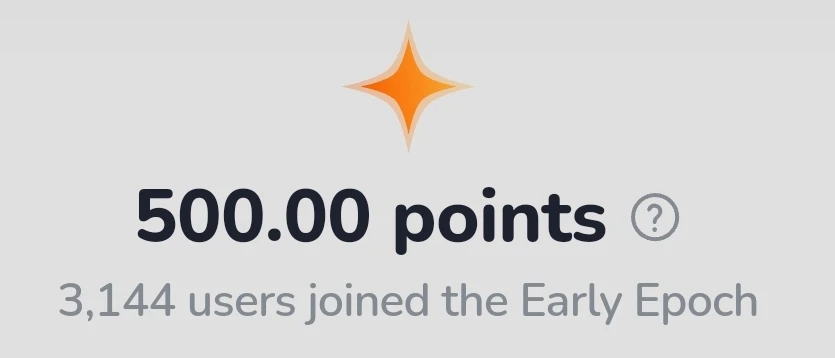

This was the second surprise of the month, after receiving Rivo Points! The early stage of the Rivo points program will also included the launch of a temporary Early points campaign. The campaign was intended as a welcome reward for the users of partner projects, and those that interacted with those smart contracts in the last 12 months were eligible. I was one of those 3,144 users that claimed points, and got 500 Rive points for staking AVAX on YieldYak!

Rivo offers a comprehensive selection of investment strategies aggregated from several reliable protocols, including Pendle Finance, Yearn, Silo, GMX, Velodrome, and several others. Each strategy comes with key metrics such as annual percentage yield (APY), strategy token price, and total value locked (TVL).

Residual Income:

Play2Earn: Upland / Splinterlands / ++Doctor Who++

Cashback Cards: Plutus Card / Crypto.com

Fountains: PipeFlare / GlobalHive ZCash

Creators bundle: Publish0x, Hive & Presearch

PVMihalache The Author - My Amazon Books

GrillApp - New Write2Earn Dapp

Claim Your Mode Network Points