Welcome to this weeks update from the @spinvest-leo account. This wallet manages a small portion of the overall @spinvest fund, and sends HIVE back to @spinvest each week to contribute to the pool of funds for dividends. This wallet is managed by @jk6276. The main focus of this account is to generate yield to contribute to the weekly dividends for holders of SPI tokens. 50% of the income generated each week is sent to @spinvest to contribute to the weekly dividend. Primary holdings are positions in SPS liquidity pools, other BeeSwap pools, along with some Hive engine based investments.

Position changes this week:

Some small changes this week. I noticed during the week that the price of BXT dropped significantly. This seems to happen from time to time, and I like to try and boost our position in BXT on these occasions. This time, I pulled some funds out of the SPS/HIVE pool, and added to direct staked BXT. 150 extra BXT staked, which boosts our daily income from staked BXT a little. aside from that everything else is pretty much unchanged. Total income is up from last week, as there were two post payouts this week which makes a difference, and reminds me not to be lazy and make sure I get this update out every week.

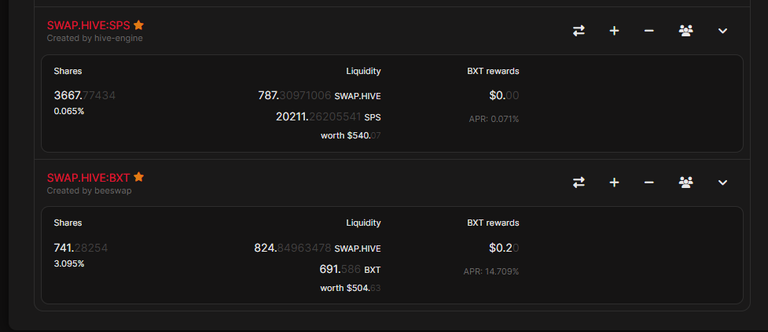

The other thing I'll mention here is that I do not like the way that both Beeswap and Tribaldex value the display the value of the liquidity pool positions. With BXT as an example, it seems to give your value based of the market price (the regular Hive Engine exchange highest bid price) rather than the price in the pool itself. For a token like BXT with a very thin order book, but good pool liquidity it can present a distorted picture.

In the above pic, you can see that The BXT pool is valued at $504, and the SPS pool at $540. However there is more HIVE in the pool. We know that both sides of an LP position must always be equal in value, and the price of HIVE is always clear. So the BXT pool should have a more realistic value of around $575. To work this out, simply take the HIVE portion, multiply by $0.34 (price at the time of this screenshot), multiplied by 2. As you can see, the value is quite different, and this is important for a token like BXT which has a huge spread and not much volume on the orderbook exchange, but a strong LP. The order book price distorts the real value.

Anyway, long story short from now on I will calculate the value of our LP positions based on the actual HIVE position in the pool, rather than use the numbers shown by Beeswap or tribaldex.

Current holdings:

SPS/BNB pool - $808 - up $9

SPS/HIVE pool - $544 - down $56 (funds removed)

SPS/ETH pool - $876 - up $23

SIM/HIVE pool - $542 - up $32

BXT/HIVE pool - $570 - down $5

Staked BXT - $270 - up $38 (funds added) (pool price used)

Staked LEO - $2 - up $1

HIVE Power - $294 - up $23

Miscellaneous - $69 - unchanged

(vexPOLYCUB, liquid ETH & BNB)

Asset exposure

Using the above values, and splitting pool positions into their components, we can calculate the total exposure to each asset for this wallet.

SPS - $1114 - 28%

BNB - $410 - 10%

ETH - $467 - 12%

HIVE - $1122 - 28%

SIM - $271 - 7%

BXT - $555 - 14%

LEO - $2 - 0%

vexPOLYCUB - $34 - 1%

Commentary:

Most of the commentary is up above, regarding BXT and the pool v market pricing. Overall, it has been a positive week, with a big drop in BXT giving an opportunity to bump our position a little. Crypto is feeling less and less like it is in a bear market these days, and it will be nice to see higher values, and more income over time. A decent income week this week, with post payouts helping us along nicely.

Totals and conclusion:

Total asset value last week: $3910

Total asset value this week: $3975

Weekly gain/loss: up $65

Total income generated - 75.794 HIVE (up 17.626 from last week

37.897 HIVE sent to @spinvest for weekly dividends, an increase of 8.813 from last week.

Thanks for taking the time to read our weekly update. If you would like to learn more about @spinvest, and the $SPI token, check out the main account and review the weekly update post.