Actually, it's a Nano plus but why does SPI store its BTC on a Ledger instead of using it to produce some sort of yield through cefi/defi? On the Ledger, our BTC is earning $0 but this is ok, sometimes it's better to have complete control of your asset. We could stake it to cefi, something like crypto.com and earn 5% in BTC per year completely passively or we could be using it for defi to actively make 10-30% per year in some farm token. Why do I opt to just HODL it old-school?

I have a few reasons. The main reason is that I believe that BTC will be worth $1 million someday and moving it around can be risky. Because SPI is not my money I am always trying to reduce risk.

Internal

The funny thing is Im the biggest risk. I could copy/paste an address and it might be the wrong address, I might miss the first or last character, I might even happy slap the backspace and enter buttons on my keyboard at the same time and send it to an address I dont control. If you hit 2 keys on your keyboard at the same time, it'll type 2 letters so if I hit the backspace and enter at the same time, goodbye BTC. There are lots of things that could go wrong and im not trying to scare you, haha. I have lots of CCPs and procedures in place to ensure the risk is as low as I can get it. An example, I will always check the first and last 3-4 characters of an address and make sure they all match up after pasting and then double-check when asked to confirm the transaction. Do this 50 times and you'll never need to remember to do it again. There are other things I do as well but that's the easiest and best one that everyone should be doing.

There is 1 other person that holds the seed words for SPI's Ledger and that would be the next biggest risk for us internally. I think the risk here is 1 in 1000 as the person has built-in ethics they will never break and I trust them. Also, their stake in SPI is worth more than our BTC holding so less risk of doing us over.

Apart from those 2 things, not alot of risk internally for us. SPI is only 4-5 people doing small work with I guess me taking on the bulk of it so right now at this stage of the game, the focus to reduce risk is external.

Externally

I can write this short or I can write it long but it can all be summed up in a few lines.

The classic, not your keys, not your crypto. I used to like this saying but it's used so often as a warning it's lost all meaning to me and is actually a little annoying. It's turned into the goto lazy reply. So the Ledger is offline and we hold our own keys. We could get rugged on defi through some farm or get a rich drip system. A cefi company could go busto as Celsius did recently.

When money is involved, there's always the chance you could get phished and tricked into giving out sensitive info, this can happen when scammers clone popular defi platforms in order to collect information/passwords/access. You can safeguard against this by never clicking on links in things like chatrooms, forums, blogging, discord, youtube, or Facebook, basically nowhere apart from google and friends you know and trust from my POV. Also if you searching for something, never click on the "Ad" results. Of course, this will apply to crypto/finical platforms. If you are searching for cheesecake recipes, your probally not gonna get scammed.

Next up, we could get hacked. Getting phished and getting hacked could be viewed as the same thing but I think phished is your own doing and getting hacked is you being targeted. If someone breaks your google/Hotmail password, for most people it'll be game over. They look at the browser's saved passwords and then they will wipe out all your liquid cryptos sitting on exchanges and cefi platforms. They will try to gain access to your metamask to wipe that out and then get to work on your LP tokens and other defi investments. Lastly, they will head over to any exchange you have saved cards and deposit the maximum amount they can, transfer it all to BTC and goodbye money in the bank and hello maxed out credit cards. They do this last because it's the first thing that will be flagged up.

Externally, there are a thousand things that could go wrong, more. If Vitalik Buterin where to die today, im sure this would have some sort of negative effect on ETH, at least for the short term. Now think of the size of ETH's ecosystem and everything attached to it and the ripple effect would be massive. Tens of billions of $'s flow through ETH. Thats a random thing that could happen as an example but there could be thousands of things.

$1 million dollar BTC

At some point within most of our lifetimes, this will have to happen or it goes to $0. Markets in general long-term trend north and BTC is the best performing asset of the past decade. There are still 50x gains on BTC to be had if you are willing to wait for it. BTC is $20k today which is 1/50th of $1 million. Buy and just wait. Im not much of the technical guy but I know, I can see from past charts in all asset classes that they increase over long periods of time.

Today, BTC is still a niche investment but give it another 10-20 years for BTC and crypto to be adopted and we'll see where we are at. As one generation replaces another, attitudes on how to and where to invest will change. As younger people that are aware of crypto replace older generations that are not, adoption will take place and im sure in the future, trillions of $'s will flow into crypto and daily trading volumes will be comparable to stocks and maybe even overtake as why hold your stocks with a broker when they can be on a blockchain and in your control. Either way, there are lots of reasons for BTC to worth $1 million someday and I think within the next 10-15 years. 2-3 market cycles will push get us there.

People have been talking about adoption for years already buts we can see that's its happening. Remember dont believe what someone says, believe what you can see.

These are not huge numbers, still over $5 billion but it's a good start and proof that blockchain adoption is actually happening as top companies start to invest. BTC market first hit $5 billion back in 2013, companies that invest into blockchain will invest at a much faster rate than retial investors as its mostly been until now. Goes without saying, only more companies will get involved and only more money will be invested.

The pain of losing BTC

When we know that BTC is going to be $1 million, why risk it? Why risk it to earn a few dollars worth of some shitfarm token or lose it to a company that goes busto?

Most of us will have heard of the guy in the UK that threw out a HDD that contained 7500 BTC in 2013. He knows where the HDD is roughly, which plot it is in, in the local dump but the Council will not give him access to it as an environmental risk. He has tired everything, he said he would donate half the BTC to the Council of the town he lives in, worth $160 million at the time, late 2017. He has said he suggested using dogs to track it down, drones with arm things to move trash and most recently suggested using remote control robots custom built for the job. He'll never get access to that BTC but today, he's HDD is worth $160 million and it's sitting in a dump somewhere England. He's received $12 million investment money from VC's but wasted money in my POV. I dont know his name and im lazy to google it but dont be this guy.

Dont be this guy, having to wake up and go to a job you hate every day to earn pleb money knowing that are you technically a multi-millionaire and could probally buy your workplace and burn it to the ground with enough left over to live 10 times better than you are now. Dont be the guy that has to watch the price of BTC increase year in and year out. Your life would become a living nightmare and you'd be in forever pain. Over and over in your, head you would think "if i had my BTC, i would"

I would be living in a massive 6 bedroom house with a winning pool, i'd travel the world, I'd help this person, that person, if I had my BTC, I'd do whatever I wanted to do and I'd be much happier than I am now. Dont be that guy, dont lose your BTC for some silly reason like losing your wallet password/seeds or throwing out an HDD that contained near 8k BTC. You dont wanna put yourself through that hell, I've never experienced it and I dont wanna try. I did lose a few BTC with mtGox when I started my BTC journey but even at today's prices, it would not be life-changing for me. I've been working and saving hard since mtGox 8 years ago. At $1 million, it'll hurt but at $1 million, im good at the same time. I rather lose a $1 million winning lotto ticket over 5 BTC over 10 years. 10 years is nothing in the game of life, 20.6% for most people. That's some time i guess but 205 of your life to hold something and do nothing to become financely free? Worth it as you'll still i assume have some time left to do as you please, hobbies and such.

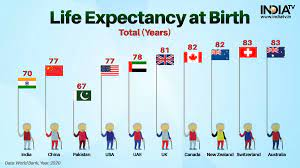

You dont want to have to live through that hell as we are living longer as well. Let's say you held 0.2 BTC on Celsius when it went bust. That is worth like $4000 today, not that much but what when BTC is worth $1 million are even $2 million? Your loss today will not change your life but in 10-15 years, you'll view it as something that could improve your life then if you still had your BTC and then as it continues to increase, you gotta live with that pain and thought in the back of your mind all the time.

So there you have it, folks. This is mostly why I hold SPIs BTC on a Ledger Nano plus. It's already worth $1 million, we're just waiting for the price of catch-up. Also should say that even if I were to lose the Ledger nano, I can simply buy a new one and regain access with the seed words. The seed words are whats most important.

Hope you enjoyed this post today, have good one and stay safe.