All the new people who came to the market after 2020 have seen the market going up and up. But the thing is I have seen the market before 2020 as well and I have seen the ups and downs. Now most of the people say that they can take heavy risk and they are 100% in equity but I think that's not the right way to go forward with your investment.

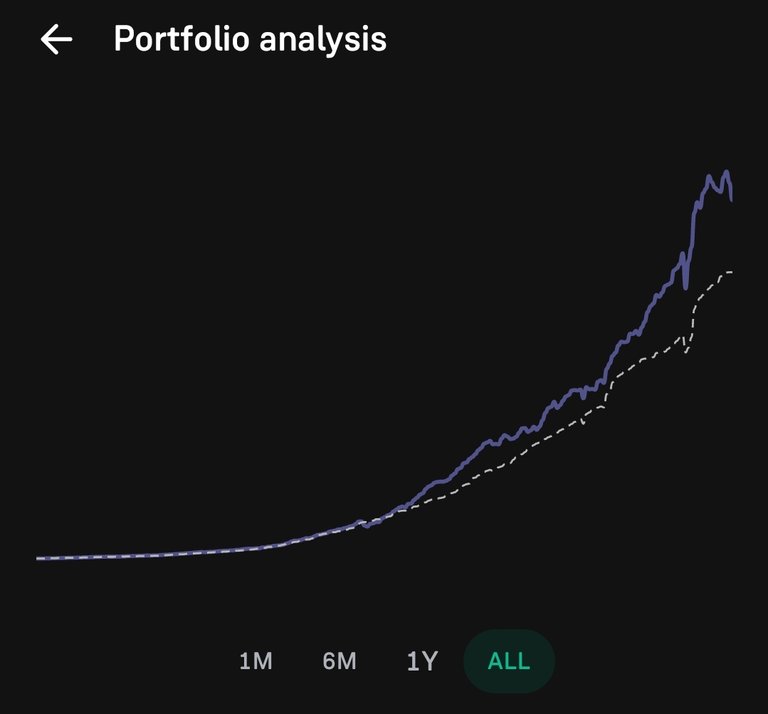

PC: Groww.com

The equity is quite risky where there can be bear market for the prolonged duration. And it can go down my more than 50% and thus if you are 100% in equity your 50% networth will be wiped off. Having the debt fund in your portfolio gives the stability in your portfolio. For example, I always go with 20 to 30% of my portfolio in debt fund. This helps me to move my fund from debt to equity whenever there market goes down.

As a Salaried Individual, we have some funds available every month to invest and we invest it using the Systematic Investment Plan. Now if the market goes down we cannot invest more as our salary is limited. So investing in the debt fund actually helps you to create that kitty to take advantage of the situations like these.

For example, if you have $1000 invested and have 20% i.e. $200 in debt. Now if the equity goes down by more than 20%, do your $800 goes down by $640 but you have $200 in debt. So you can move your $100 in equity from debt so your total down is only some amount. Now if the market goes down more then you can move additional $100 in equity and thus you can take your average quite down.

This is called the rebalancing and if your portfolio goes up you can book the profit and move the fund to the debt fund. And thus the cycle continues with bear and bull market. So even if you can take extra risk, try to keep some amount in the debt to take advantage of the market fluctuations.