Without a doubt, the lose idea is ordinarily utilized in financial matters and game hypothesis, especially with regards to exchanging and exchanges. In exchanging situations, a lose situation suggests that the all out gains and misfortunes in an exchange are adjusted; what one party gains, the other party loses.

Image Credit

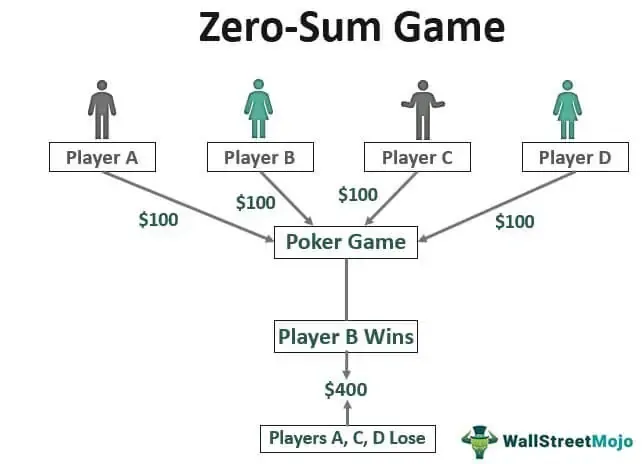

A zero-sum game refers to a competitive situation wherein the profit of one equals the loss of another and vice-versa, thereby nullifying the net change in wealth for participants involved. The number of participants can be anything but one. It is a type of game theory and often applies in economic and political situations.

For example, in monetary business sectors, when an individual purchases a stock and sells it at a more exorbitant cost, they gain a benefit. In this situation, the increase made by the purchaser is equivalent to the misfortune caused by the vender, bringing about a lose result. The aggregate sum of cash in the exchange stays steady.

In any case, it's essential to take note of that while explicit exchanges can be lose, the more extensive financial framework isn't really a lose situation. Financial development, mechanical headways, and by and large flourishing can prompt a positive-total circumstance, where the complete riches and worth in an economy can increment, helping different gatherings at the same time. Lose thinking doesn't catch the intricacy and elements of long haul monetary development and improvement.