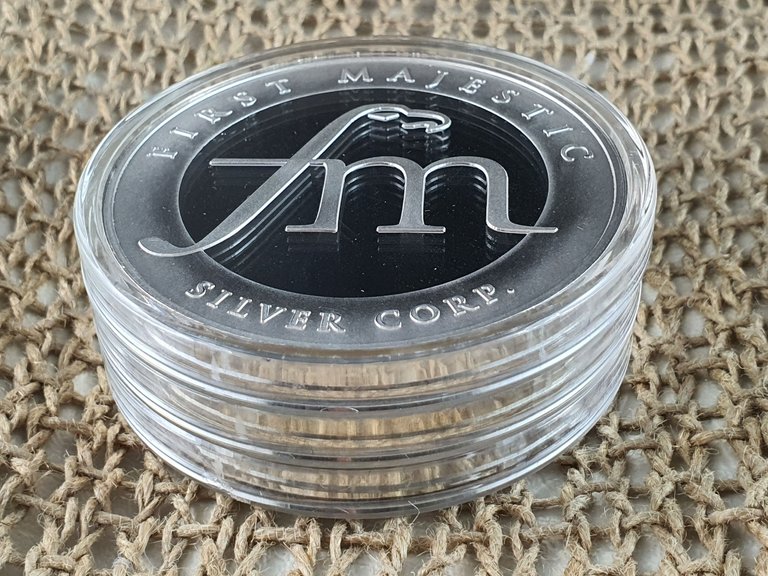

Today's silver post features three 5oz .999 Silver Proof coins struck by First Majestic Silver Corp. First Majestic Silver Corp is a publicly traded mining company focused on silver production in Mexico.

The main mines that are owned and operated by First Majestic Silver Corp are:

- The San Dimas Silver/Gold Mine

- The Santa Elena Silver/Gold Mine

- The La Encantada Silver Mine

These three mines produce millions of ounces of silver every year. Some of the silver that is produced by these three mines is then minted into silver coins like the ones that are featured in this post. The large majority of the silver that is produced from these mines is sold on to large industrial and manufacturing customers.

WallStreetBets

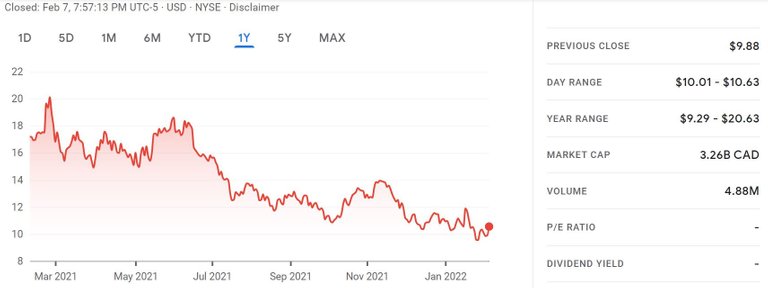

Back in March 2021, roughly one year ago, First Majestic Silver became one of the stocks that got massively hyped up by the WallStreetBets craze. As you can see from the Google Finance chart below, First Majestic Silver (NYSE:AG) was quite heavily pumped and reached a high price over US$20.

Since the peak of the excitement after the WallStreetBets movement moved on, the price of NYSE:AG has had steady decline. Over the past six months the price of the stock has found some support hovering between US$10 - US$12.

source Google Finance

GameStop and AMC to the Moon

I was very interested in the phenomenon that was WallStreetBets when the prices of GameStop and AMC were flying to the moon. As much as the craze interested me, I could not bring myself to invest in stocks that I was not confident had real, sustained, underlying value, so I never did pull the trigger and buy into GameStop or AMC.

First Majestic Silver Pump

When First Majestic Silver Corp got picked up by WallStreetBets, then I did get really excited. I was already interested in First Majestic Silver Corp as a company and had been contemplating whether to invest in NYSE:AG for some time. I knew the underlying fundamentals of the company were strong and I knew the underlying fundamentals of silver were strong too.

Like AMC and GameStop, First Majestic Silver Corp had large short positions against it that seemed to be very aggressive and bordering on manipulation. This was one of the reasons that had previously prevented me from buying into NYSE:AG.

The Short Squeeze

When the WallStreetBets short squeeze began and the price of NYSE:AG began to rise, I got very caught up in the excitement and started to develop a bit of FOMO (fear of missing out), that if I did not make my move I would miss out on the massive gains that people experienced with AMC and GameStop.

For anyone who knows me, you'll know that this FOMO was very out of character for me as I very seldom if ever feel the need to follow the crowds when investing and almost always buy when a stock is coming down in price and do not try to chase a rising stock price.

Stick it to the Man

I often look back at this time and wonder to myself why I got so caught up in it all. One reason I can rationalise in my mind is that we were in the middle of our house renovation and our builder had just alerted us that he had gone into liquidation. As you can imagine there was a lot of anger, fear and worry in our lives at that time and I think a part of me just wanted to 'stick it to the man' by making a quick windfall profit on a pumped up stock price.

Well in the end I let my emotions do the driving, I asked my logical brain to sit this one out and I took a position in NYSE:AG. The problem is I took a position at nearly the peak of the pump. My average price for the NYSE:AG I bought was around US$19, currently NYSE:AG is hovering around US$10 - US$12, so my trade is currently down about 46%.

A long Trade

The five bag or ten bag trade just did not happen, NYSE:AG had a lot more resistance in comparison to GameStop and AMC. Within a week or two the WallStreetBets crew had lost interest in NYSE:AG and they moved on to their next target to pump to the moon.

As the hype faded, so to did the share price, NYSE:AG quickly returned to a price that the market was more willing to support and it has remained within that tight trading range ever since.

Fortunately I am a patient man and I have confidence in First Majestic Silver as a company, so I am happy to remain in this trade for the longer term. Yes it will keep capital tied up that I could invest elsewhere, but it also acts as a good reminder to me not to get caught up in the exuberance of crowds.

The Tortoise, Not the Hare

Throughout my life I have loved the story about the tortoise and the hare. I definitely relate more to the tortoise than the hare, I am definitely more methodical and considered in my decision-making. When I look back at my decision

to purchase NYSE:AG in the rush and frenzy of WallStreetBets, I can see now that it was a hare decision and not a tortoise decision.

There is nothing wrong with hare decisions,certain people have the gift and talent to move quickly and be agile like the hare. I take my hat off to those people and I respect them greatly.

I on the other hand am well aware of my stregnths and shortcomings. Making well researched investment decisions of longer term investments is one of my strengths. However, making quick trades on speculative bets is not a strength of mine, therefore I choose to avoid this form of investing.

Conclusion

We all need to choose our own path in life. I am by no means saying that my investment decisions are the right choice or the only choice. All I am saying is that it is the choice I feel comfortable with and the one that allows me to sleep peacefully at night.

To all the WallStreetBets hares out there, I am so excited for all of you that rode the GameStop and AMC waves and made some real money. You all had a lot more guts and gumption than I did and it paid off for you!!! Congratulations. 😀

Post authored by @strenue