In the next few weeks, all current rewards cards runs will be stopped to usher in a new era of soulbound rewards cards. When the transition happens, these current rewards cards will stop being printed. As a result, the most recent round of rewards cards will be more scarce than the previous round. Prices recently adjusted for the Untamed rewards cards, particularly the commons which recently went out of print. With these changes in mind, I wanted to do a quick evaluation of the scarcity and implied market caps of all Modern rewards cards.

Assumptions made to simplify the analysis:

- I am assuming the print runs stop at the current numbers. In reality we still have about 1-2 weeks of printing

- I am using current market prices to determine market caps

- To calculate market cap, I am using the 1 BCX price, which will be inflated since multi-BCX listings will typically be lower

- To normalize for scarcity, I am using "max # of maxxed cards" as a proxy

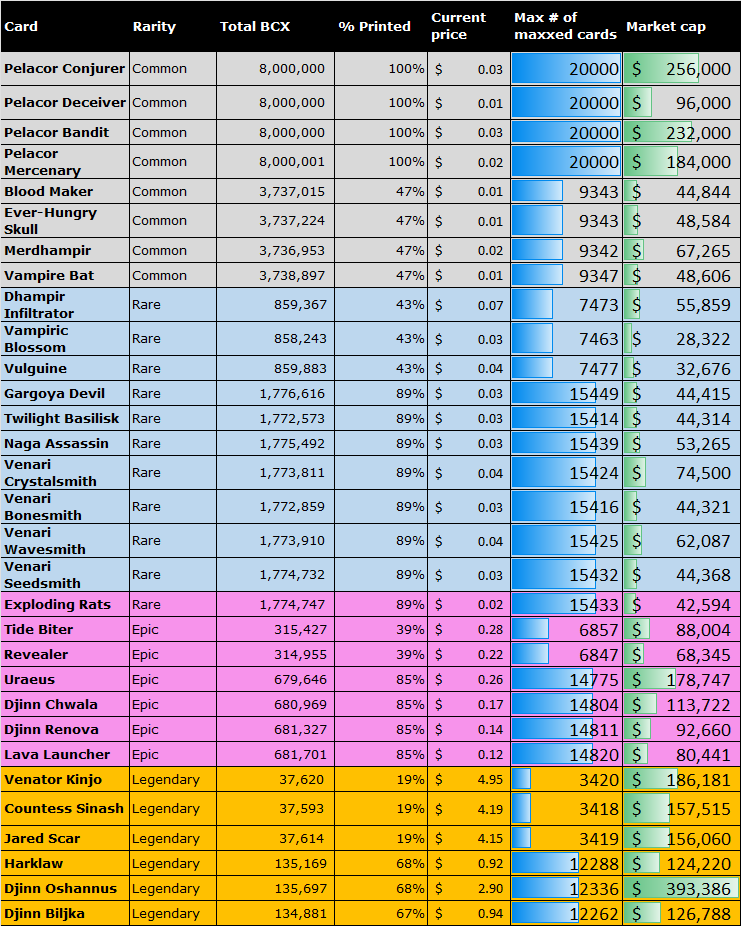

Here's the data:

The data bars in the "max # of maxxed cards" (aka scarcity) and "market cap" columns give you a sense of relative scarcity and valuation across the cards shown in the table.

A few interesting points to take away from the above table:

- All CL rewards cards will be significantly scarcer than Untamed rewards cards; you can see for example that, at maxxed levels, there are only 75% as many CL commons (~9300) than UT legendaries (12k).

- The rarest cards in the series are the CL legendaries, which will only have ~3.5k potential maxxed cards

- The most common in the series are the UT commons, which have 20k potential maxxed cards

- The highest market cap is Djinn Oshannus at $393k, followed by Pelacor Conjurer at $256k and Pelacor Bandit at $232k

- The lowest market cap is Vampiric Blossom at $28k, followed by Vulguine at $33k and Exploding Rats at $43k

- The total MC of UT Common rewards cards is $768k for 32M BCX, while the total MC of CL Common rewards cards is $209k (~70% lower) despite being >50% scarcer (~15M total BCX)

Of course the cards' utility factors into their market caps significantly, which is why we see UT rewards cards like Exploding Rats and Venari Bonesmith with lower market caps than even the cheapest common CL reward cards.

What do you think? Has the market correctly priced these based on scarcity and utility? I think there are some opportunities, so I'm off to the market.