If you sell old equipment or furniture on eBay, Facebook, or even just send money between friends on Venmo you will soon be required to report this to the IRS.

It was recently announced this change will be delayed until 2026, but the requirements for reporting a 1099-K has already changed in 2024.

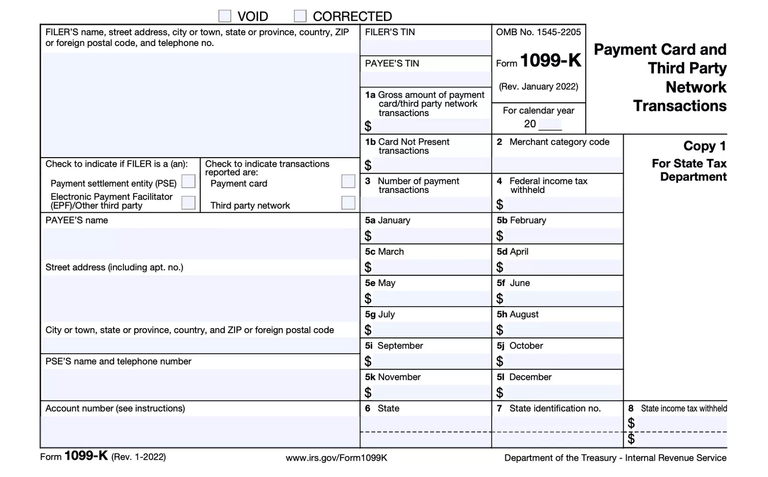

What is a 1099-K?

Most people won't know what a 1099-K is because it is only required when you receive more than $20,000 in a year via a third party network such as PayPal, Cash App, or Venmo. In 2024, this is being reduced to $5,000 as a temporary transition to the final $600 amount now set for 2026. 2025 the threshold is currently planned to be $2,500 unless there are further delays.

It is up to the payment services you use to file a 1099-K and provide you a copy. If you receive this, you will need to file it with your taxes and zero out the reported income if it is a category that should be taxed. Example categories would be receiving money to cover a friends share of ski rental, money received selling used goods that come out to less than what you initially paid, using a service like Venmo to split dinner costs.

This change is to go after the "dirty cheats" trying to steal from the US government but will affect many who are doing nothing wrong. If you sell used gear on eBay at a loss, you are not required to file taxes as you did not make a profit. Under this new law however, the IRS will receive a 1099-K with all transactions you received through these services. You will now be required to defend yourself if questioned and potentially show proof that you did not profit from the transaction(s).

This means that 7 year old used computer you sold for $200 bucks will look like a profit to the IRS unless you provide receipts. There is a good chance most people won't be bothered and this won't be a major problem, but it is now something you need to be prepared for.

I believe they are mostly targeting those who are doing business on eBay or through Venmo selling services or new products. Although these type of people are either are very unsuccessful or are already being reported for making over $20,000.

This isn't a new reporting requirement, it is just the threshold has been drastically reduced. You may be familiar with the $600 threshold as that is the same amount the Biden administration has been trying get put in place for reporting all crypto transactions as well.

If you are doing nothing wrong, you have nothing to worry about but you do have additional responsibility now to report and document this transactions going forward. Although it is highly unlikely most people will run into a problem.

Posted Using InLeo Alpha