I invested a great deal of my portfolio into $CUB and $POLYCUB and I must have lost over $60,000 on these trades. I went all in on both these Tokens and staked them for the longest time possible. It turned out to be the biggest investment loss in my life. Despite all these things, I managed to stay in good spirit. I had built enough resilience since 2017 to the point that I could experience the biggest investment in my portfolio crash and still be okay and sleep well.

Having seen how mentally unstable some people get over smaller losses (percentage wise), I could even call the entire experience an alternative education with the price tag of a college degree. There is no point worrying about the past and I will move forward as a better investor. LeoDEX has already accomplished far more than CubFinance and PolyCUB combined. It is the foundations of those past failures that gave birth to LeoDEX. There are even more positive things that came from those "failures".

Abandoned Liquidity on Binance Smart Chain and Polygon

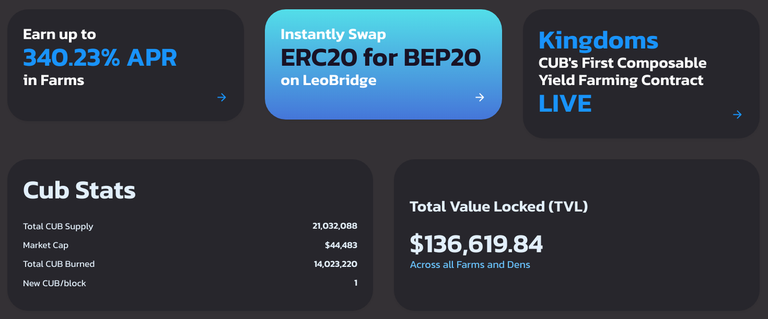

@leofinance moved everything under LEO umbrella to $LEO and the two projects are more of less abandoned. There $247,291.88 combined liquidty and these create some amazing marketcap to TVL ratios. The only investors who are already locked in are the ones that staked in CUB Kingdom for the long term. I don't think there will be many who are incapable of following the instructions to get $LEO which is going to appreciate in value. The likely scenarios are,

- Investors who missed the announcement about conversion to $LEO.

- Investors with too small of an investment left after $CUB and $POLYCUB prices crashed.

- Those who unfortunately lost access to their wallets.

- Those who quit during hard times.

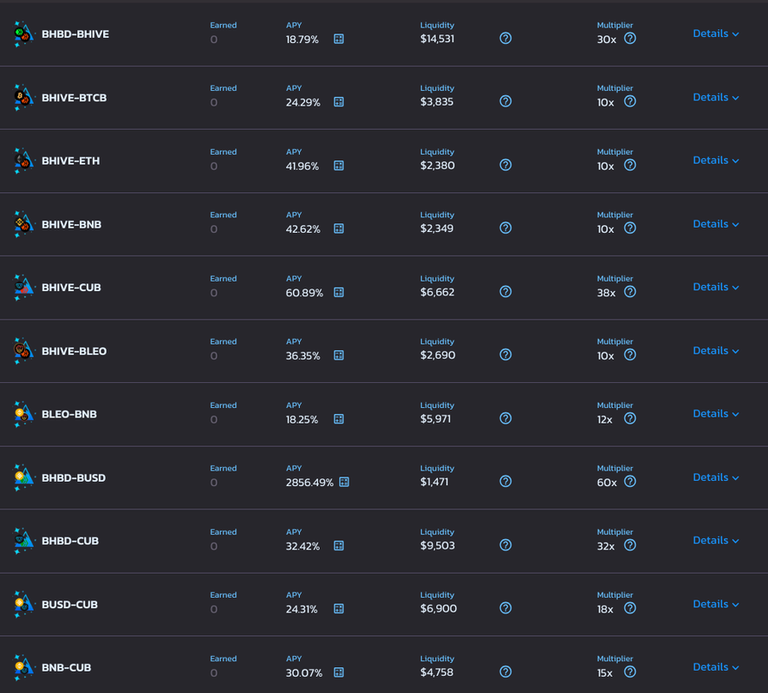

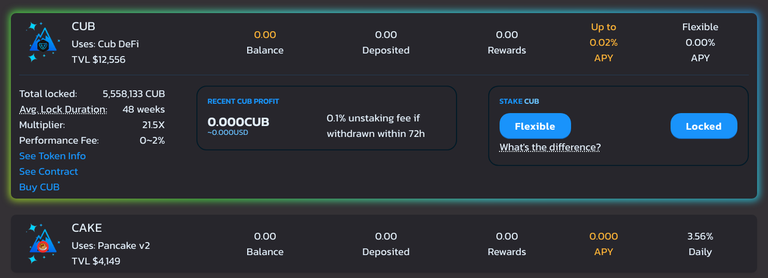

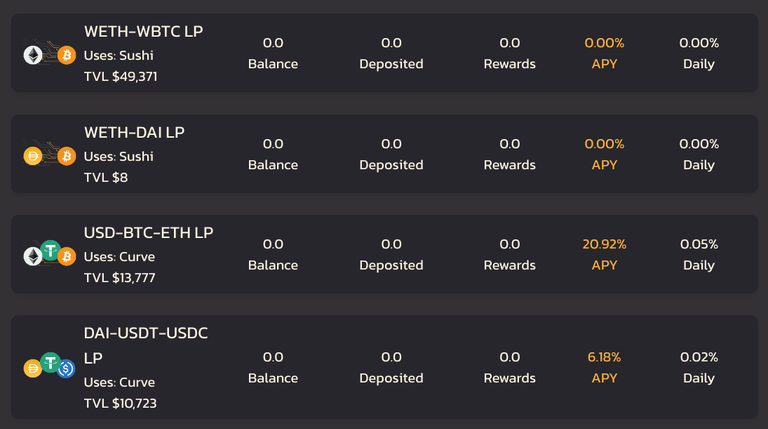

The Value Locked On CubFinance

I think the APY numbers are not accurate. There should not be any rewards given for providing liquidity or staking IIRC. There are probably some rewards to be gained from trading fees. Having some liquidity available on these popular blockchains is a great thing. LEO Bridges are ones of the best things to come out of the DeFi ventures LEO community had.

Presence in 4 EVM Chains

- wLEO

- bLEO

- bHIVE

- bHBD

- pLEO

- pHIVE

- pHBD

- pSPS

- aLEO

We have Ethereum, Binance Smart Chain, Polygon and Arbitrum covered so far. aLEO is what connect us to Maya Protocol (which then connect us to a great many more). The best success we have had is not on a blockchain we developed a DAPP for. Cryptosphere is full of open source collaborations. This is one of the greatest strengths we have over TradFi.

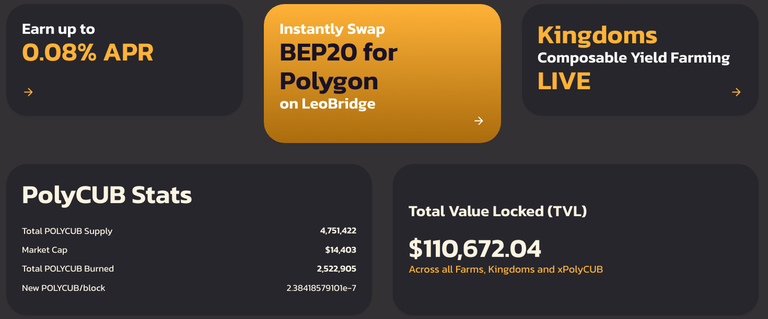

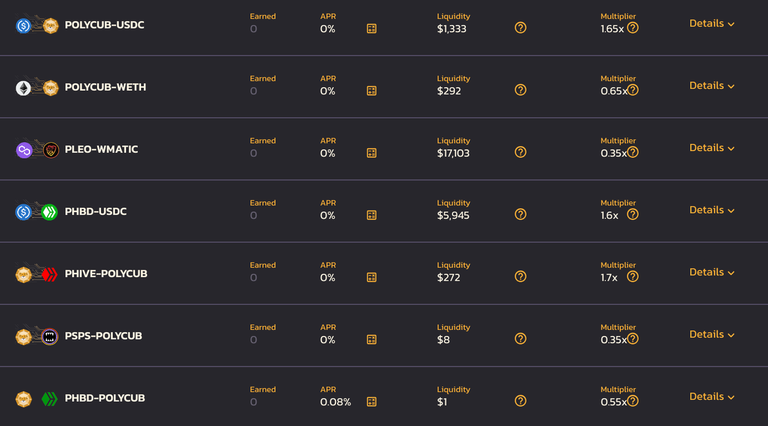

The Value Locked On PolyCUB

At least PolyCUB investors have been better at pulling out their liquidity. 4 of the Farms + 1 Kingdom have been drained. We may get the benefit of free liquidity in the case of other Farms/Kingdoms. xPOLYCUB and vexPOLYCUB are the most useless at the moment. These assets are not providing utility to anybody.

Were We Overpaying for Liquidity Providers?

This is a complicated situation. If the rewards are not good enough, those who come are the ones who either don't care about rewards or those who are speculating on the future price of rewards. Then we have all the lost access to wallets and people throwing away cryptocurrency. James Howells threw away a hard drive containing 7,500 Bitcoins in 2013 which could end up being worth more than a billion dollars during this bull market.

Due to smart contracts and DeFi, these inaccessible assets get to contribute to the decentralized ecosystems we are building. Even without rewards, there is a quarter million dollars worth assents locked up on blockchains. Stopping rewards or adding rewards will not make a big difference. It is unlikely these wallets will get active anytime soon. One could argue that we were unnecessarily paying rewards to this quarter million in assets.

- CubFinance Marketcap to TVL = 0.325596926

- PolyCUB Marketcap to TVL = 0.130141271

I Don't Buy LEO

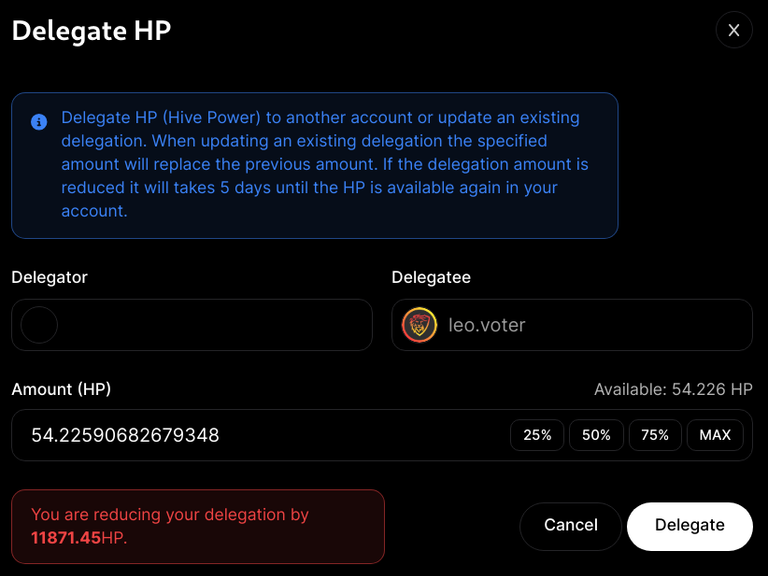

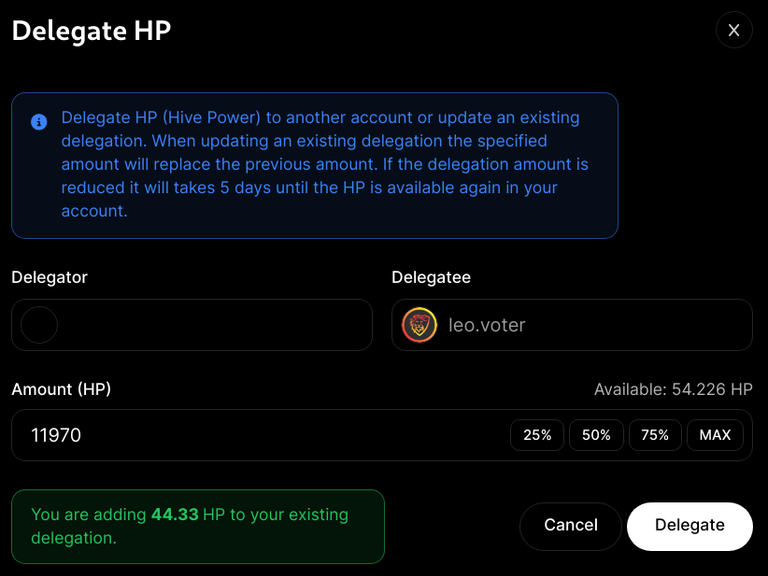

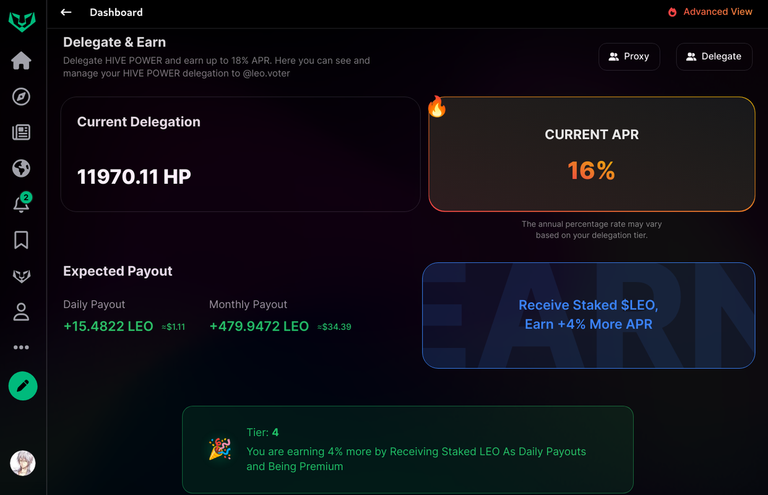

I earned most of my $LEO and this will continue to be the case for foreseeable future. This is one of the best things about LEO and it drastically reduce the risk an investor is taking. The most consistent way to do this is by delegating to @leo.voter

@gadrian recently faced some trouble when using the delegation feature. If other front ends adopts a similar warning text, we could have far less messy situations with delegations in the future.

80% of My HIVE Power Goes to @leo.voter

I maintain the bear minimum HIVE Power I need for my daily activities and delegate the rest to earn various Tokes as passive income. $HIVE itself has a 3.26% APR at the moment of writing and I get the Tokens on top of the HIVE rewards.

Consistent APR Upto 18%

I may have to eventually take the rewards in the liquid form. There have been many cases where I missed out on good trades due to a lack of liquid funds. I have been missing out on LPUD for some time due to the same reason. I wish there was a more clear showcase of what each Tier is. These are small changes that will get improved over time.

Happy Trading! Happy Investing!

Posted Using InLeo Alpha