The most lively places on cryptosphere happen outside of the mainstream at very volatile places. Layer 2 projects are going to be extremely important as we go into the best phase of the Altcoin bull market. Layer 2 projects allow the creation of new innovative features or reduction of fees and confirmation times (not that important for HIVE). These Layer 2 activities bring a considerable level of excitement to the community.

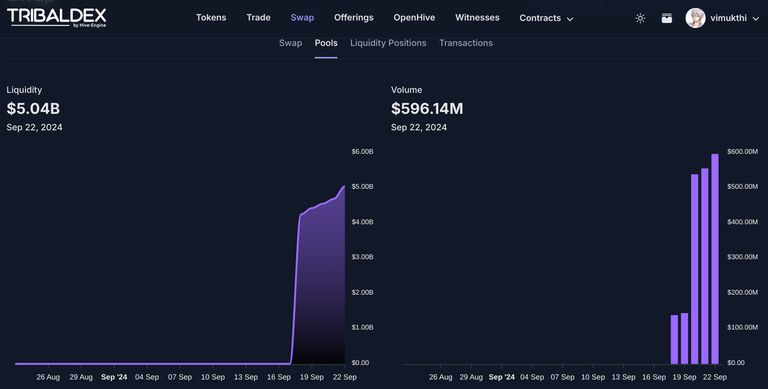

Welcome to $5 Billion TVL

Total Value Locked is an important metric in DeFi that is used to assess the strength of a project. HIVE has three ongoing L2 projects as per my understanding. They are @vsc.network, @dlux-io and HIVE Engine. Most of the DeFi activity is currently happening on HIVE-Engine (the first L2 on HIVE).

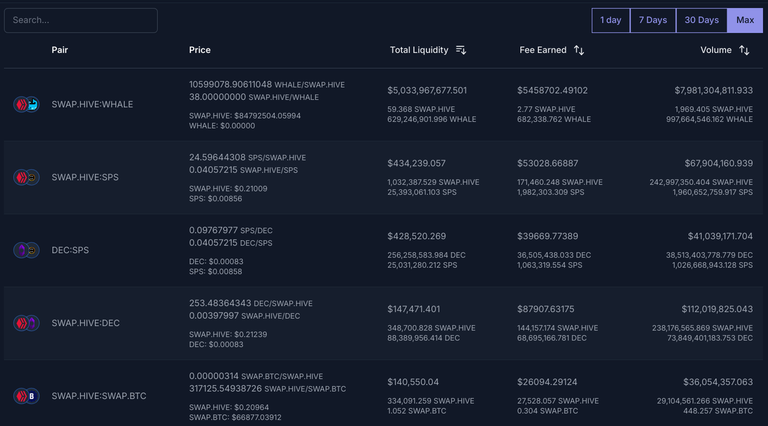

The spike in TVL was caused by a single project having its Token reach massive valuation due to the low trading volume. In short, one could argue that the TVL spike was caused by slippage. Suddenly this WHALE Token had my full attention.

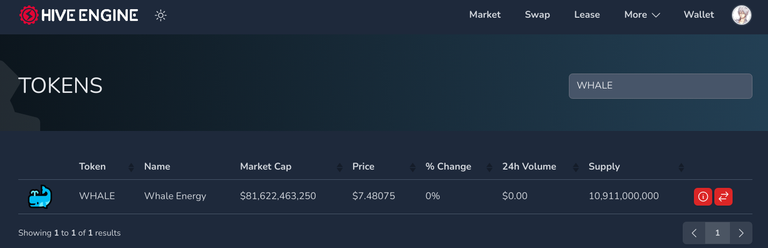

WHALE Was Old and Disappointing

My initial expectation was that Whale Energy is a new project starting out on HIVE. After all, this is a good time to launch a project. In few months there will be too much competition, noise and marketing. The optimal condition for a launch IMO is to be early but not too early.

It turns out that @splinterskins is already defunct. The website is not working and the account on HIVE has not posted any content in 2 years. The account itself was created in April of 2022. Thee project was long dead before it received the attention.

It Was Almost Like a Meme Token

All the utility is dead as per what I can see. The price has gone up exponentially to give it a 82 Billion USD marketcap which would make it dethrone Solana to be the 5th largest cryptocurrency. At the same time there will be massive slippage for any trade in any direction and there is very little chance to make any money out of any of this. Memecoins often end up with similar results. Most investors and speculators do not focus on the failure case studies.

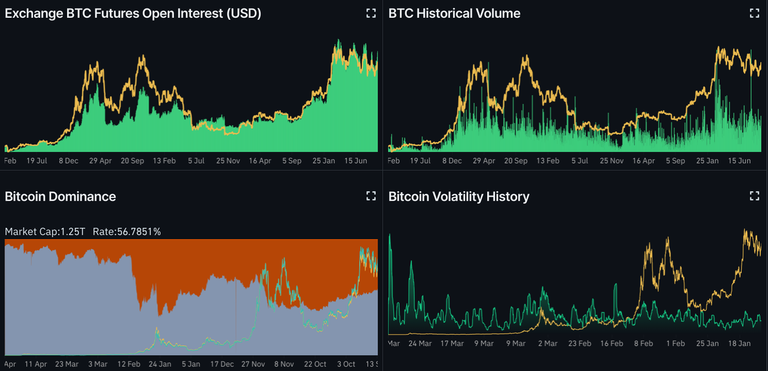

CoinGlass is Underrated

I use the term underrated because of how little investors even know about it. I have seen cryptocurrency traders who did not know of a world outside of Binance. It was one of the most mindblowing experiences in my trading life to discover such people exist. Some of them were even making good money (at least for a while).

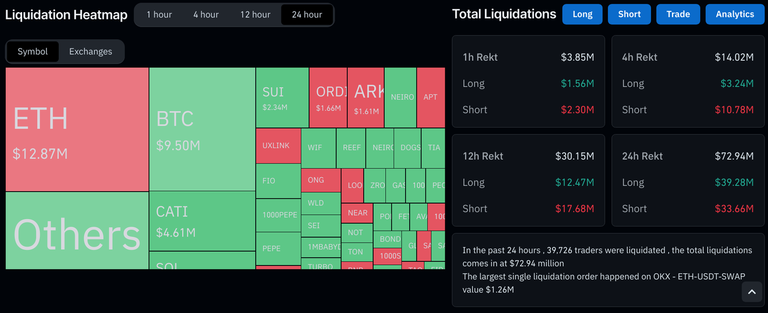

Futures markets on these various centralized exchanges have a large impact on the price of various cryptocurrency. CoinGlass is one of the best places to get statistics about these for free. I am sharing some of the charts that I find useful. Explore on your own to find out what works best for you.

These liquidations (some of which I have gone through) is the reason I recommend against allocating a large portion of your portfolio to these leveraged positions. I won't go to the extreme lengths as some traders and advocate to exclusively trade spot. __The main problem with leveraged trades is that it is not sufficient that you be correct regarding the price. You must get the timing right or else, your position can get REKT.

Keep an Eye on Grayscale

Do not expect to see an ETF for all of these cryptocurrencies. Moreover, we must keep in mind that the point of our decentralized technologies is to replace the traditional centralized systems. We should not beg to be assimilated into them. My distaste towards ETFs does not blind me to the various useful metrics associated with these centralized custodial cryptocurrency holdings.

It is worth paying attention to the premium some investors are willing to pay. ZEN is a very old project I remember from 2017. It was similar to Dash in many ways at the time. Many former Top 100 cryptocurrency have fallen from their rank. HIVE is among them. FIL, SOL, LINK on the other hand are already high marketcap projects. It would be a smart move to keep an eye on these projects. Someday, institutional investors could become our exit liquidity.

Happy Trading!

Posted Using InLeo Alpha