I'm not much of a day trader, so keep that in mind. I follow more of the Warren Buffett long-term approach of pick a good company that you believe in (or a good crypto), buy it, and forget about the price—because if you picked well, even if it dives down, that doesn't matter, it will recover and long-term you will come out ahead.

That said, I do keep up with the news even if I usually don't act on things. I pay attention and try not to let my biases affect how I see things. It's always good to keep an open mind.

There are two things we should be paying attention to. Even if you don't think they matter, or don't think they apply in this case, you should know about them.

MSTR is responsible for the latest Bitcoin pump

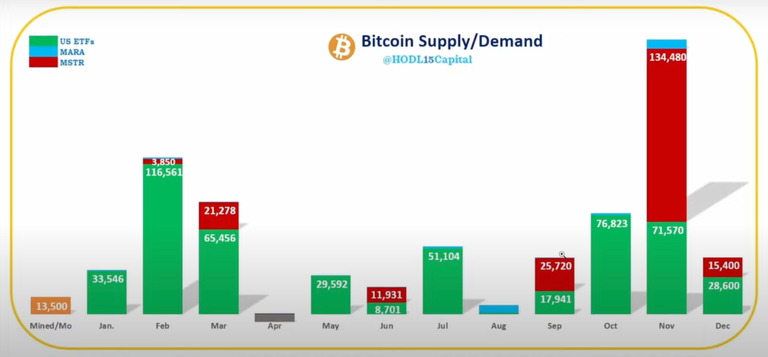

Now that's a bold statement and probably a bit hyperbolical but it is at least partially true. Just look at this graph:

Look at that. Look at how huge the MSTR buy was in November. Now ETF inflows were nothing to ignore, but Michael Saylor's company just put an insane amount of money in. More than anything, that is what pushed BTC up after the US election. And the fact that MSTR Bitcoin buys have been way down so far for December are a large part of why we have been going sideways for the past two weeks.

100k is a significant barrier. Human psychology being what it is, we are seeing a lot of long term holders get out, which is putting a lot of sell pressure on BTC. Unless Saylor comes back very soon and gives us another enormous buy, the bears are probably going to start to win and we fall back down to one of the support levels. The 21day moving average has almost caught up with where we are now, but the 100d is down in the 70-80k range. A pullback to that would be healthy, but it would also be disheartening to many.

Personally I think a correction like this is coming. Again, unless MSTR is able to give us another pump. The smart move here might be to wait for a correction to at least the 80k level before buying in.

The stock market is dangerously bloated

A few days ago @azircon wrote about how crypto is a bubble. I agree. Go read what he said. But let’s take a step back and look at the broader financial landscape, particularly the stock market. This is one that could potentially affect everything.

Look at this chart:

We are right up against a 100 year line of resistance. The last time we came up against this line, we crashed hard. That was the dot com crash. This is a very significant line. This was the line that we approached in 1929. You all know what happened then. You can see on the chart that that crash set the floor of the channel that we are still following. You see for most of the last 100 years we have been near the bottom of the channel, but recently we have been again pushing towards the top.

The big money is already preparing for either a big correction or even a crash. Warren Buffett is selling almost everything he owns and is just sitting on a huge pile of cash, presumably to use for scooping everything back up cheap after a crash. Other investors are following his lead.

On the other hand, the US just elected a very pro-wall street administration. So far, Trump’s promises to the working class seem to have been more about benefiting the wealthy and he is already handing out jobs to his rich friends and is preparing to give even more of the economy to the upper class. In the short term, this probably will mean the bubble keeps going. But eventually the butcher's bill will come due.

Or will it...?

As you can see, recently the bulls pushed through this line. That could either mean we have escaped from the repeating loop of history and are changing to a completely new paradigm, or it could mean the bubble is just getting more bloated, possibly fueled by AI mania now in addition to everything else, meaning the crash will be even more speculator (and painful if we aren't prepared).

There is also the Buffett Indicator. This is the ratio of the US stock market to GDP. The current ratio is right around 208%, suggesting we are very over-valued.

Do these things mean a looming crash? I have no idea. The history here is hard to ignore, but it is also true that there are many new things going on that might be completely changing things. All I can say for certain is that it is prudent to at least be aware of this historic trend and keep it in mind when making plans.

As my #silvergoldstacker buddies would probably point out, starting to put some of your portfolio into precious metals wouldn't be the worst idea in the world.

The first point here might be stronger than the second. The first is pretty clear and easy to see, which may be why so many are calling for it to happen. But the second is not as clear: I'm sure some of you will think that crypto rewrites all the old rules, so this ceiling on the S&P500 no longer applies. You may be right! But I do think it's worth being aware of this.

Anyway, that is all. Let me know your thoughts in the comments.

❦

|

David LaSpina is an American photographer and translator lost in Japan, trying to capture the beauty of this country one photo at a time and searching for the perfect haiku. He blogs here and at laspina.org. Write him on Twitter or Mastodon. |

)

)