My new day job as a family fund manager is getting me back into my roots of trading in the stock and options markets. This is giving me the opportunity to trade with a much larger amount of money than I have been in recent past, so it is allowing me get back to trading my favorite options strategy, but on a much bigger scale!

So, this strategy does require you to have a decent amount of funds to start with and may not be for everyone. You have to have enough cash ready to invest to be able to cover at least 100 shares of the stock you are trading. It's all done through a simple options strategy called selling cash covered puts and covered calls. If that sounds like greek to you, well, there is some of that involved too, but I don't get that deep, lol. Let me break it down for you.

Basically a No Lose Strategy

Since this fund is just starting, we are all in cash in this account, which is our active trading account. The profits from this account feed the larger passive income account that is all in monthly paying dividend stocks and ETFs, mainly REITS, bonds, and SPHD which is a low volatility, high dividend paying version of the S&P500.

The way I work this strategy is basically a no lose situation. And before you come at me with this and that, let me explain...

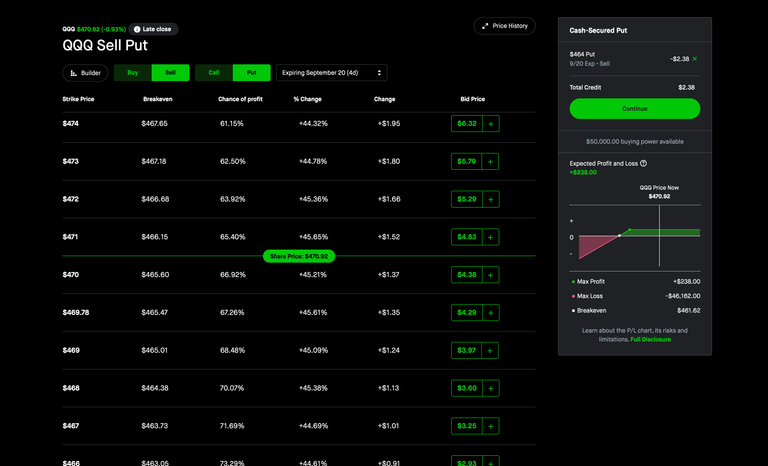

Selling Cash Covered Puts

This options stratey works great when you want to buy the stock. What you do is you have to have the cash on hand in your trading account to be able to purchase 100 shares of the stock or ETF you are trading at the strike price you are selling the contract for.

So for example. I am looking to trade QQQ options. This is a broad market ETF with heavy focus on tech and no financial stocks. The cool thing with this ETF is that you can trade daily options, so if you are on that day trade grind, this is a great fund for you to look at trading. The options premiums are great too! But, you have to have at least 50K in your account to trade this strategy on QQQ...

Anyway, I am looking to buy the 100 shares of the stock as low as I can as with any trade, but instead of just going out and putting in a limit or market order on the market for the shares, I sell a put option at the price I want to buy the stock at. When someone pays me for that contract, they are paying a 'premium'. This means they are looking to sell the stock at that price, or they are just buying a put option which is like shorting a stock or ETF.

So no matter where the price goes, I collect that premium. Which on QQQ can be a couple of hundred dollars profit just for selling that put option! What happens is if the price does not go down to my chosen strike price by the time the contract expires, then I still collect that premium and do it again! If the price does go to the strike price by expiration, well, then I have just purchased 100 shares at the price I wanted and still sitting on that sweet premium.

The only downside to this is if the price keeps going down further than where you bought in. Well, if you know how to play your cards right, and you can do proper analysis on the stock before you put in the order, then you should be in a good place. But this is where the next part of the strategy comes in that can help make up any loss and make you even more money!

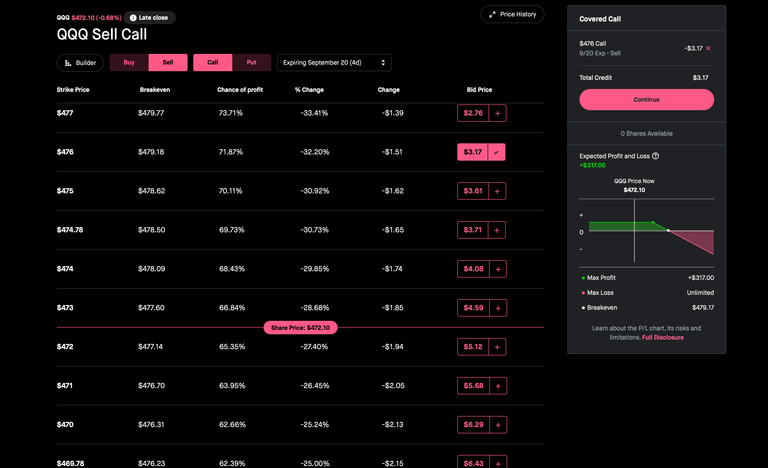

Selling Covered Calls

The flip side to the strategy is when you now own the 100 shares of stock and you want to make some more of that sweet premium and possibly sell the stocks much higher than where you bought it. This is when selling covered call options comes into play.

Okay, so let's say I buy into QQQ at $460 a share. Well now that I own. those shares, I want to now look at the charts and see where the next big resistance level or supply zone is. This is a great place to look at selling a call option. This is where you sell a contract for someone else to buy your stocks at the chosen strike price.

Let's say that our chosen price to sell the contract is at $470 a share. I sell a contract at this strike price and collect the premium from the option buyer. This is someone who is going long on the stock. If the price does not reach $470 by contract expiration, I keep the 100 shares of stock that have hopefully risen in price, and I earn that premium from selling the call option.

And the flip to the put option, with a call, if the price rises to that $470 price by the time the contract expires, then I sell the stock at a $10 per share profit plus the premium! Not a bad trade if you ask me!

The only downside to this part of the strategy is if the price rises higher than $470 by expiration and you still have to sell at $470. But that's no loss at all, you just wait for the boat to come back and do it all over again!

This is my favorite stock and options market strategies to run. It's easy, clean, and just makes money. And now with the fact that I am managing enough money to effectively trade this strategy on some of the best stocks and ETFs in the market, means the Dude is going to make some money for the family and will help my mom retire comfortably while we deal with my dad and all his health issues. So the Dude is doing his part to support the family, property, and eventually inheritance for me and my sister and our families. So I am trying to make as much as possible with as little risk as I can, but of course that is the name of the game!

Anyway, let me know in the comments if you think this is a good strategy, or if you have any questions about it!

Be safe in these markets and always trade logically!

Wanna get on a path to financial freedom?

Join the Logical Trader's Club on Coin Logic!

Trading Education | Personal Coaching | Real-Time Alerts | Market Analysis | Custom Trading Indicator

Additional Blog Locations

Many of my cryptocurrency related articles as well as trading articles can also be found on my crypto research site, Coin Logic.

I also post trading chart ideas on my TradingView Profile.

Trade without KYC on the LogicSWAP Exchange!

Click here to trade on LogicSWAP by Coin Logic

Disclaimer:

The information in this trade journal is for educational purposes only and should not be considered financial advice. Please consult with a qualified financial advisor before making any investment decisions.