For the last couple of weeks, I have been exploring Defi on other networks like Solana and Sui. I've learned a lot of things and I would like to share also some experiences that were not that positive...

Dealing with transaction fees...

Coming from hive, I'm used to have no fees for transactions. For people who never left hive, you probably don't know how amazing this is. The fees were the reason why I stopped dealing with chains like Ethereum or even Binance. Solana and Sui have much lower transaction fees but there are fees all the same and some fees that are quite surprising...

Testing out Defi

During my exploration, I have worked with many different defi platforms. I did some lending, invested in some vaults and provided liquidity into some pools. In most cases, things worked quite well but I had a very bad experience yesterday...

In order to understand things a bit better, I try out different platforms for providing liquidity. I started with Orca on Solana. When you create a position in a liquidity pool on Orca, you have the option to create a full range or a custom range position. You can decide whether you want to provide liquidity for all prices or just for a segment of the market. This gives a lot of flexibility which is great in my opinion. When you want to create the position, Orca shows you the fees and tells you that some of the fees will come back to you once the position is closed. Its a kind of rent fee.

source: Orca

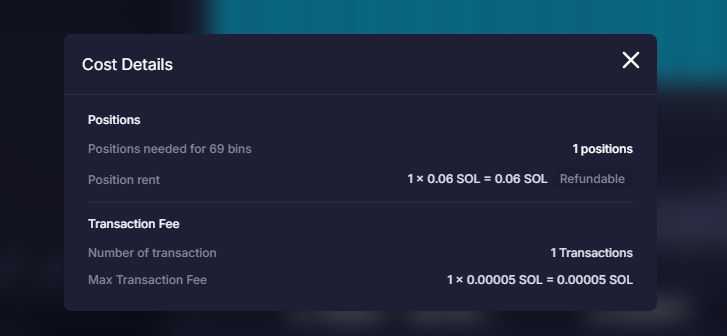

The next platform I meddled with was Meteora. Their DLMM pools are a bit different. According to the number of bins, the pools are more or less concentrated. Again, when you want to create the position you see the fees that you will get back and the ones you won't get back.

source: Meteora

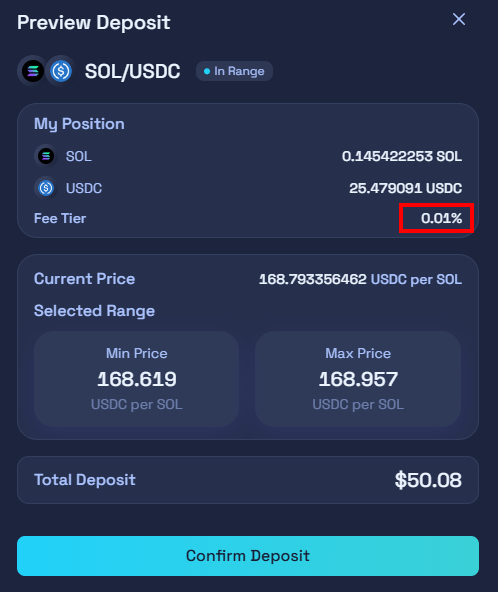

When I tested probably the biggest of the defi platforms on Solana Radiyum and their CLMM pools, I was surprised to see that the fee was pretty low with 0.01%.

source: Radiyum

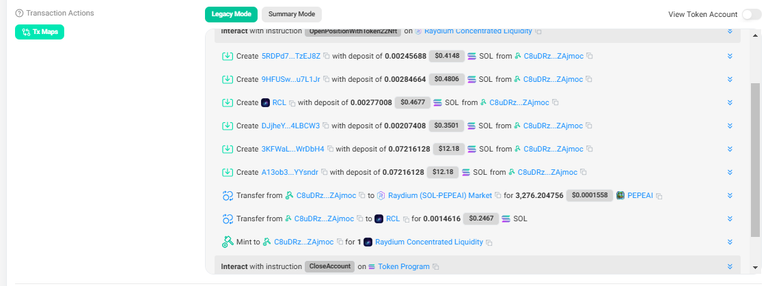

When I created the position, there was suddenly a 0.15 SOL fee added and I thought it was the rent fee that Radiyum will pay back when closing the position... In crypto, you should never think things like that... I actually made the mistake to make the range of my liquidity longer than what is directly offered by Radyium. When you do that, it costs! A lot ! So for creating a position of about 25$, I paid a fee of 0.15 SOL worth 25$ again.

source: Solscan

Since I opened two positions and I did the same in both case, I lost 50$ on fees....

After testing these 3 platforms, I have to say that Orca is by far the best platform in my opinion. The fees are transparent and the flexibility is the best compared with the other platforms. On Meteora and Radyium increasing the size of the range you want to provide liquidity for can be very expensive and on Radyium you don't even see how much it will cost you!

Hope this will help you to avoid making the same mistakes ;-)

With @ph1102, I'm running the @liotes project.

Please consider supporting our Witness nodes: