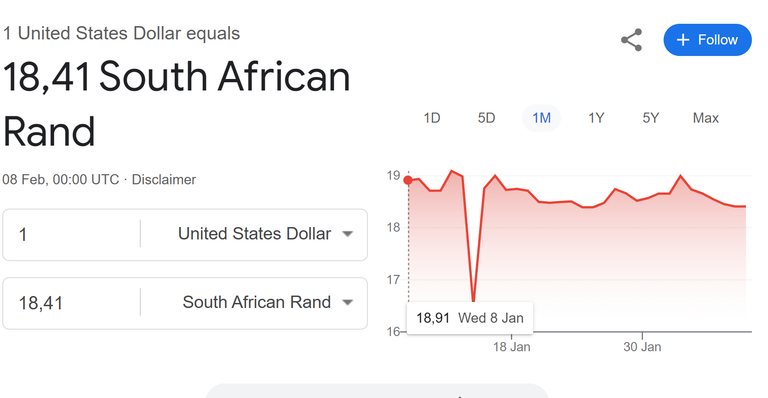

Over the last week we saw the South Africa Rand hit R19 against the $1 which represented a 3% loss due to Trump calling out SA's racial and foreign policies. The next US Ambassador for SA backed this up saying SA needs to realign with race policies and it's stance on Israel and China if it wants to be supported by the US.

R18.41 is better than R19, but it seems like it is on a knife edge and could hit R20 at ay time. Volatility with your currency is not fantastic as it has an impact on everything.

The door is not closed, but the door is definitely not wide open like it was before. If Trump wanted to hit SA hard all he has to do is remove the AGOA trade agreement and SA knows this. If that happens the Rand would go into a downward spiral never seen before and would breach R20 almost immediately. There would be no coming back from that and this is what is at risk.

Thankfully I have kept my UK bank accounts and have kept my funds out of SA besides buying properties which may have risen in value, but in real terms have actually lost money due to the Rand depreciating against every other currency. Maybe not lost money, but basically have stood still which is the same really as you are not making anything. I have to pay attention to the exchange rates more than ever now and move money slowly out by using whatever resources I have and this will not involve banks.

If I had kept my property in the UK which was an option that property value has risen 300% against the breaking even so it shows you that depreciation in currency values is real. This is why you have to pay attention to the values on all levels as your wealth depending on where you live could be eroded away like it has here in SA.

A cheaper Rand makes for cheaper investment options buying up local businesses, but there is huge risk and not necessarily smooth sailing. When your customer pool is so small with unemployment being so high your limitations are real. Labor is not considered cheap for what they offer so a company that was automated would be the obvious decision and then you have electricity supply issues so who would invest under such circumstances? The other downside is you have to have local shareholders which impacts the profitability of the business as you are literally giving 30% away for no return. This is why the likes of Shell departed last year and many others have as well.

The only upside to all of this is for the tourism industry which as the Rand continues to depreciate becomes a serious option for tourists to benefit. Exports will also or should increase but again depends on the tariff structures and if SA is still part of BRICS or if BRICS remains a viable prospect as I do not see this group lasting. If Biden and co had won the election then yes, but under Trump BRICS is dead in the water. Those countries have been warned they will face 100% tariffs if they persist with targeting the Dollar and SA will definitely have to back down.

The next few months will tell us more about where the Rand is heading and if any other companies have decided to leave the shores. The economy is literally shrinking monthly and investors may not see the risk versus the reward which is very high. Emerging economies always carry a risk premium for investment and one could argue SA is not an emerging economy as there is too many real factors going against it.

Posted Using INLEO