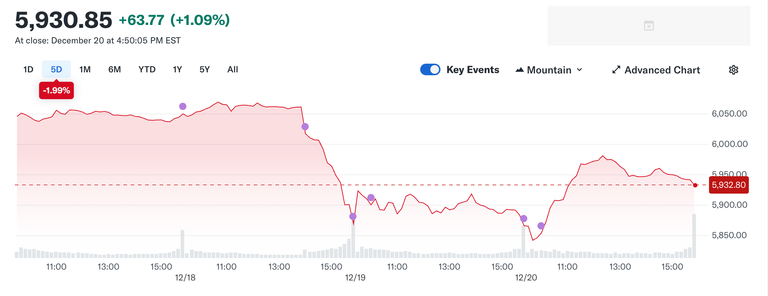

Obviously the recent FED decision to make fewer interest rate cuts in 2025 had an immediate negative effect on the BTC price (unless you missed that!)

However if you check the S and P 500 price trend it's pretty similar....

I mean obviously the BTC price swings are more dramatic, but the trend is broadly the same...

Lots of analysis pointing to a convergence.....

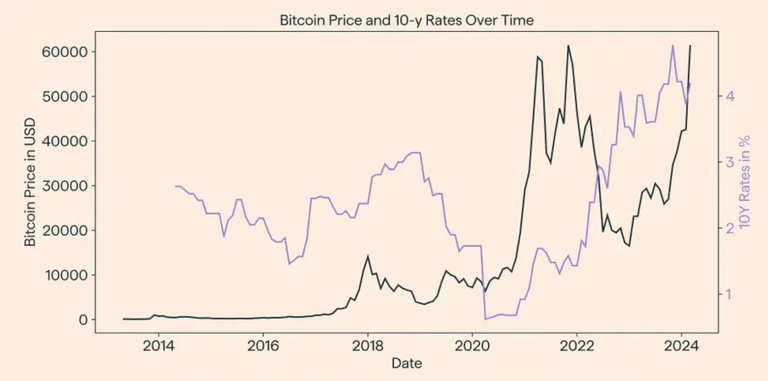

That's a convergence between the BTC price and stocks, for example. According to this article there has been something of a negative correlation between interest rates and BTC for some years...

Although obviously it's not perfect, as BTC held level during much of 2023 while interest rates remained high.

This raises the interesting prospect that we might have a situation going forward in which lower interest rates mean bTC trending higher, and then higher interest rates result in BTC going sideways.

Probably with the occasional huge sell-off thrown into the mix, you know how it is!

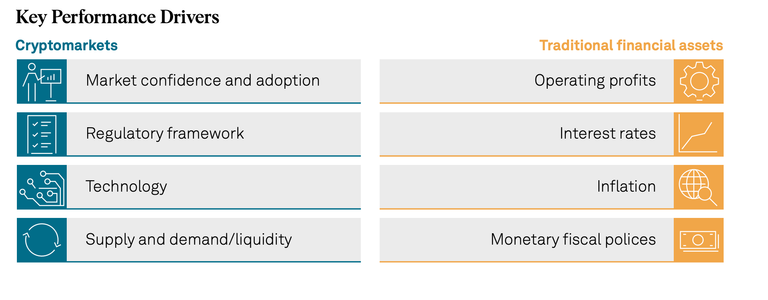

But BTC's influenced by a broader range of factors...

I think this analysis, although done over a year ago still holds true, but with BTC moving acting more like traditional assets than it suggested...

It breaks down the influencing factors as follows:

Obviously all of the stuff influence X mainstream asset, but then the BTC (and other crypto) prices are influenced by all of these and then confidence, regulation, tech developments and ofc liquidity, which goes a long way to explaining the greater volatility of BTC compared to stocks.

However now we're entering a situation in which more people are adopting and we've got probably clearer regulation coming at least for another 3-4 years (and then more uncertainty when we enter the next US election cycle), I think there's maybe less scope for BTC to fluctuate so widely.

Conclusions

I have this strange feeling that the BTC is just going to mirror that of the S and P trend more closely, but probably with more upside potential with greater adoption and decreased supply.

At the end of the day BTC is now established and there's NOT A LOT of it to go around!

Posted Using InLeo Alpha